All aboard the Bidenomics Crazy Train!

Let’s see. We have inflation that is eroding wage growth so that REAL wage growth is negative. Meanwhile, the Biden Administration and Congress are spending like they can print infinite amounts of cash with no consequences. The result? The Federal government is paying nearly $1 trillion in interest on an annualized basis.

On the corporate side, we are seeing a surge in bankruptcies.

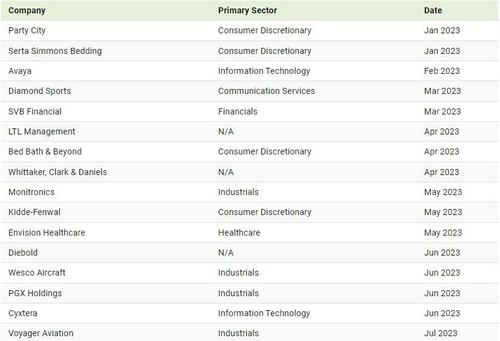

As Visual Capitalist’s Dorothy Neufeld and Sabrina Fortin show in the graphic below, based on data from S&P Global, corporate bankruptcies in 2023 are surging…

U.S. Corporate Bankruptcies Grow

So far in 2023, over 400 corporations have gone under. Corporate bankruptcies are rising at the fastest pace since 2010 (barring the pandemic), and are double the level seen this time last year.

Below, we show trends in corporate casualties with data as of July 31, 2023:

Represents public or private companies with public debt where either assets or liabilities are greater than or equal to $2 million, or private companies where assets or liabilities are greater than or equal to $10 million at time of bankruptcy.

Firms in the consumer discretionary and industrial sectors have seen the most bankruptcies, based on available data. Historically, both sectors carry significant debt on their balance sheets compared to other sectors, putting them at higher risk in a rising rate environment.

Overall, U.S. corporate interest costs have increased 22% annually compared to the first quarter of 2021. These additional costs, combined with higher wages, energy, and materials, among others, mean that companies may be under greater pressure to cut costs, restructure their debt, or in the worst case, fold.

Billion-Dollar Bankruptcies

This year, 16 companies with over $1 billion in liabilities have filed for bankruptcy. Among the most notable are retail chain Bed Bath & Beyond and the parent company of Silicon Valley Bank.

Mattress giant Serta Simmons filed for bankruptcy early this year. It once made up nearly 20% of bedding sales in America. With a vast share of debt coming due this year, the company was unable to make payments due to higher borrowing costs.

What Comes Next?

In many ways, U.S. corporations have been resilient despite the sharp rise in borrowing costs and economic uncertainty.

This can be explained in part by stronger than anticipated profits seen in 2022. While some companies have cut costs, others have hiked prices in an inflationary environment, creating buffers for rising interest payments. Still, S&P 500 earnings have begun to slow this year, falling over 5% in the second quarter compared to last year.

Secondly, the structure of corporate debt is much different than before the global financial crash. Many companies locked in fixed-rate debt over longer periods after the crisis. Today, roughly 72% of rated U.S. corporate debt has fixed rates.

At the same time, banks are getting more creative with their lending structures when companies get into trouble. There has been a record “extend and amend” activity for certain types of corporate bonds. This debt restructuring is enabling companies to keep operating.

The bad news is that corporate debt swelled during the pandemic, and eventually this debt will come due likely at much higher costs and with more severe consequences.

The face of Bidenomics: the top 1% are gleefull (like Billions Biden), the bottom 99% are mournful.