The Talking Heads said it best. Bidenomics is burning down the housing market. Bidenomincs (or trying to recover from Yellenomics) is responisble for interest rates rising to flight inflation and the collapse of mortgage lending. And she was … Janet Yellen.

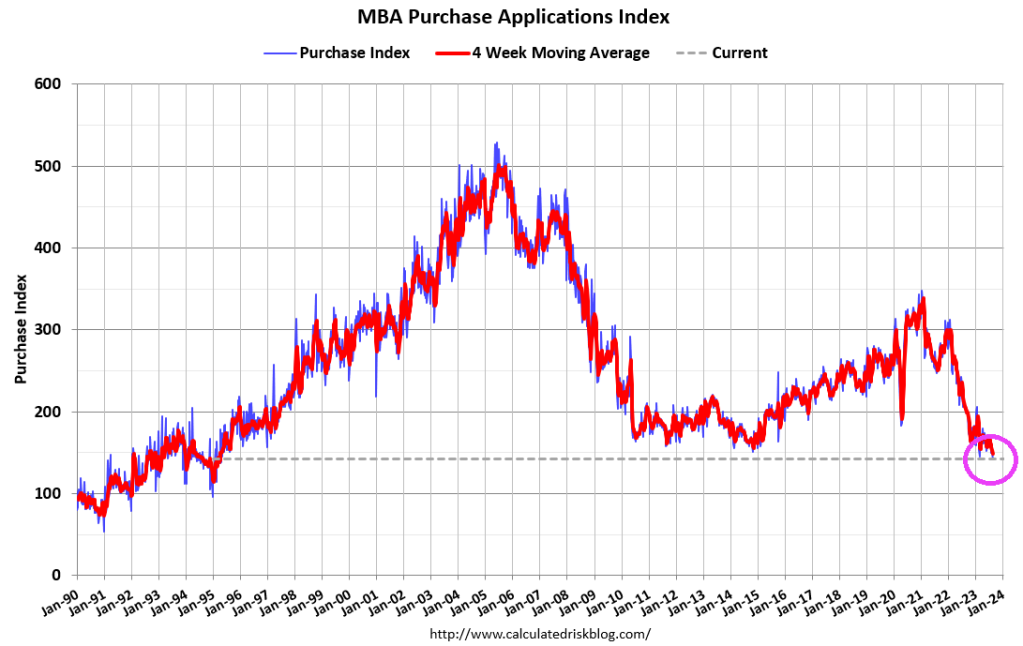

Mortgage demand (applications) decreased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 18, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week and was 35 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 30 percent lower than the same week one year ago.

The spread betweenn Bankrate’s 30 year rate at 7.62% and the effective rate on mortgage debt outstanding at 3.595% has exploded as mortgage rates jump.

Bidenomics (code for making large donors wealthier and the middle class getting the boot) and catch-up for Yellenomics (rates too low for too long), and Powell are helping to burn down the housing market.