US personal savings are being exhausted as The Fed raises rates to fight inflation. I call this phenomenon “low riding” where consumers are being punished by The Federal Reserve and Biden Administration.

Meanwhile, large bank loan volumes are shrinking. With money-market fund assets hitting new highs, and banks’ usage of The Fed’s emergency funds facility at record highs, we wonder how much longer The Fed can keep the dream of rising deposits alive (after last week’s massive NSA inflows).

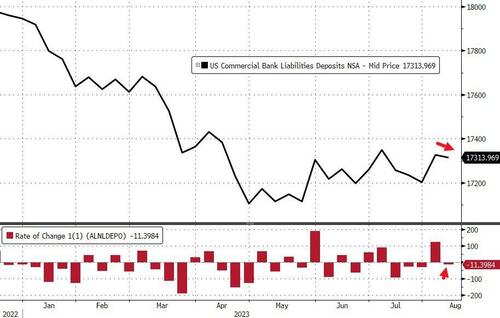

On a seasonally-adjusted basis, The Fed says that total deposits dropped $11BN last week (the first decline in 4 weeks). We also note that the prior week’s inflow was revised higher…

Source: Bloomberg

After last week’s enormous $121BN NSA deposits inflow, last week saw an $11BN outflow (on a non-seasonally-adjusted basis)…

Source: Bloomberg

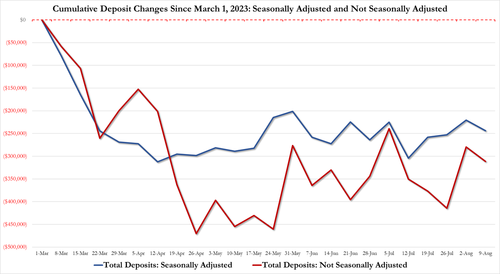

The gap between SA deposits and NSA deposits remains more manageable (until the next time The Fed decides to fiddle)…

The divergence between money-market fund assets and bank deposits remains extreme…

Source: Bloomberg

On a seasonally-adjusted basis, Small Banks saw $5.6BN deposit inflows last week while Large Banks suffered $28.7BN outflows (with foreign bank inflows of $12BN making up the difference)…

Source: Bloomberg

And so, for a nice change, everything is tidy with domestic US banks seeing deposit outflows on an SA and NSA basis…

Source: Bloomberg

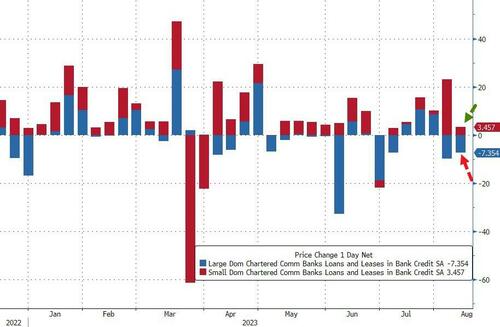

On the other side of the ledger, small banks continued to pump out loans (+$3.56BN, sixth straight week of increases), while large banks saw a $7.4BN contraction in loan volumes…

Source: Bloomberg

So, if The Fed’s data is to be believed, Small banks are ‘winning’ – deposit inflows and making loans; while large banks are leaking – deposit outflows and shrinking loans. All while Treasury prices tumble, stressing small bank balance sheets.

Just remember, the sitting US President Joe Biden goes under several psuedonyms like Robert Peters, Robin Ware, and JRB Ware in his email conversations about Ukraine with his son Hunter. But don’t forget another pseudonym: The Reverend Kane from Poltergeist 2!

Views: 169