by 5k4_5k4

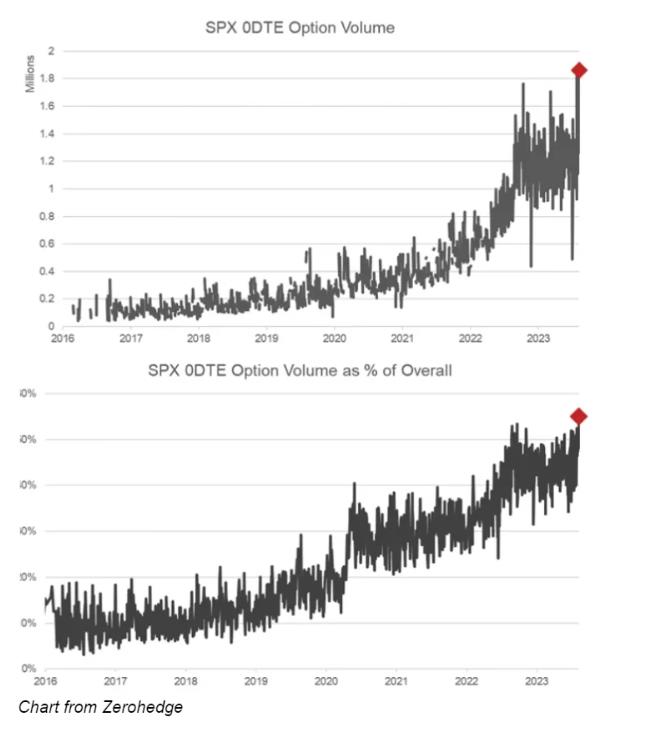

We have all seen that the volume of 0DTE SPX option contracts has been increasing and reaching unseen levels. What does this mean in terms of volatility? Will we have an unexpected flash crash because of this? Not exactly, let me explain.

0DTE option volume on SPX hit another all-time high on Friday.

0DTE options can provide leverage for traders looking to capitalize on short-term volatility in the underlying. Besides being used for leverage, they are a complex instrument that can be traded to hedge against unusual market movements intraday.

According to J.P Morgan’s quant team, only around 5% of the volume on 0DTE SPX options are from retail traders. Using 0DTE options to hedge on SPX is unusual but still used by some institutions. Most of the remaining volume is from dealer hedging.

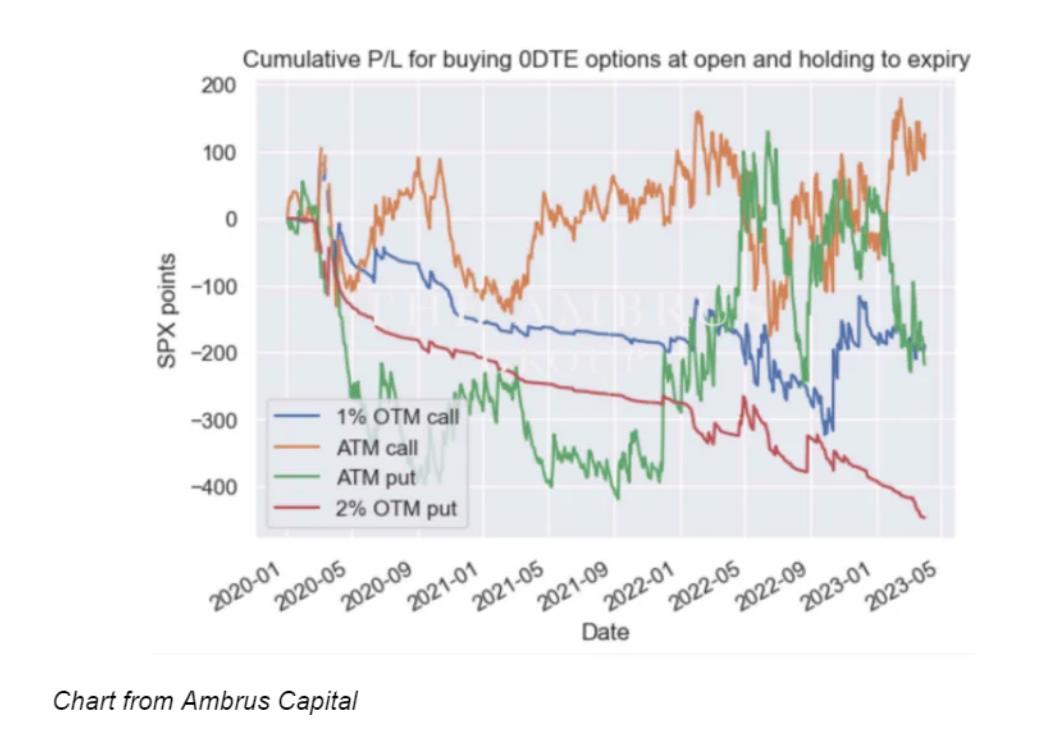

The increasing volume in 0DTE shows us that whoever is trading these is able to do so profitably and is able to scale this. Interestingly enough, purchasing these derivative contracts (using the most common strikes) would lead to subpar returns while selling these options would have been profitable.

So if most of the end users are shorting these option contracts how will this affect volatility on the underlying index?

Dealers must hedge their gamma exposure from selling these 0DTE options, they adjust their position in the underlying to mitigate their risk from the options. This is usually done to reduce the option’s exposure to large swings in the underlying.

SPX 1D

Remember that day almost a year ago in October, a miss on a CPI print caused futures to tank leading to SPX opening at a annual low. In the days leading up to this many traders bought gamma. There was a large imbalance in 0DTE options on the put side. As the market opened and started to move up dealers had to buy back a large amount of delta moving the SPX up over 500bp in a single day. If the market started to move the other way though the dealer’s short gamma position would have fueled an epic crash.

Most of the time however the intraday volatility is actually suppressed by the increasing volume of 0DTE options. “these options are net sold by directional investors, and supply of gamma is likely causing a suppression of realized intraday volatility… if there is a big move when these options get in the money, and sellers cannot support these positions, forced covering would result in very large directional flows.” -JP Morgan

The overall risk of 0DTE options comes when there is a reflexive market, the effect of 0DTE volume on volatility is mostly convex where most of the call and put volume will be balanced. When there is crowding on either side of calls/puts either long or short these contracts, a large movement will cause an increase in volatility and will be fueled by the 0DTE volume.

TLDR: If there is an event(CPI print, FOMC meeting), the market will be expecting and 0DTE options will not cause any change in volatility. If there is a sudden increase in volatility and the 0DTE market is heavily skewed to one side this can cause a huge crash depending on dealer gamma positioning.

TLDR for the TLDR: If there is a Volmagedon 2.0 it is very likely there is no way to reliably predict and it will happen when nobody is expecting anything.

Views: 195