The U.S. debt is currently accruing at more than 119% of GDP, which is an insane record no one in their right mind would have thought possible.

That means the entire economic production of the U.S. isn’t fast enough to keep up with the outgoing expenses. We’re truly in uncharted territory.

But even if you can’t imagine it, things are likely to be more insane when it comes to the debt situation. Here’s why that is…

A recent tweet (or whatever we call them now) from the Kobeissi Letter summarized the absolute insanity regarding the United States debt, and provided a useful graph:

The US National debt is up $1.8 trillion since the debt ceiling “crisis.”

It took the US 209 years to add the first $1.8 trillion in debt.

We just did it in 8 weeks after a “historic” debt ceiling deal.

This is unsustainable. pic.twitter.com/nMVwVDRDg8

— The Kobeissi Letter (@KobeissiLetter) July 31, 2023

Keep in mind that Kobeissi’s math is a little off. The federal government’s total debt “only” spiked $1.2–$1.5 trillion, depending on the starting date you select.

But the rest is accurate.

This trend is both historic and unsustainable.

According to Wolf Richter, it also appears as though the Treasury plans to add trillions more in “fuel” to the debt-fueled fire that is already burning out of control:

For the current quarter: $1.01 trillion in additional debt. This July through September quarter has only two months left. The Treasury jacked up its borrowing plans by $274 billion… up from the $733 billion it had imagined in May, according to its announcement today.

These numbers are absolutely staggering.

First off, the Treasury department underestimated its quarterly cash needs by 38% in a single quarter? What, did Janet Yellen tidy her desk and find a huge stack of overdue invoices? Whose bills go up 38% overnight?

Second, the U.S. government now requires $1 trillion in debt per quarter just to keep the lights on?

The nation endured the U.S. Civil War and TWO world wars – the national debt didn’t hit $1 trillion until 1981. It took over 200 years to rack up the first $1 trillion in IOUs.

Now, we’re hitting $1 trillion every three months.

Has the entire Biden administration lost their minds? Do they understand that people who loan you money expect to be paid back?

Maybe they aren’t completely insane. Somewhere in the basement of the White House there’s probably a cube farm full of Modern Monetary Theory (MMT) economists writing memos to assure them government debt is all imaginary, and that lenders will never ask for their money back.

For those of us who live in the real world, though, borrowing $1 trillion every quarter sounds like a recipe for disaster.

Fitch Ratings, for example, appears to agree…

U.S. federal credit downgraded for the second time in history

You can safely assume the U.S. is moving into dangerous territory when the most popular credit rating system in the world downgrades the nation’s credit rating. (This happened once before, back in 2010 – and was a historic moment in global economics.)

Now, it’s happening again:

Ratings agency Fitch on Tuesday downgraded the United States’ long-term foreign currency ratings to AA+ from AAA, reflecting expected fiscal deterioration over the next three years as well as a high and growing general government debt burden. [emphasis added]

I can’t argue with them – “fiscal deterioration,” by the way, basically means reduced income. I’m sure I don’t need to explain what a “growing general government debt burden” means.

Why now?

Here’s the official explanation, according to a public statement:

In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025…

I would translate “a steady deterioration in standards of governance” to mean complete dysfunction in the federal government. Not just over the debt ceiling, not just the $1 trillion deficit in just three months. No, I think it’s more than that.

Imagine, for a moment, the greatest debtor in world history, a track record of wasteful and irresponsible spending and a complete and utter lack of any plan to make good on all that debt.

Would YOU lend them money?

Me, either – and increasingly the rest of the world is catching on:

The dollar moved lower against a basket of major currencies after the announcement.

Surprise! The value of a dollar is based on supply and demand, too – and if demand doesn’t grow at the same rate as debt ($1 trillion a quarter!), well, the dollar’s value suffers.

There are a few other important consequences to keep in mind…

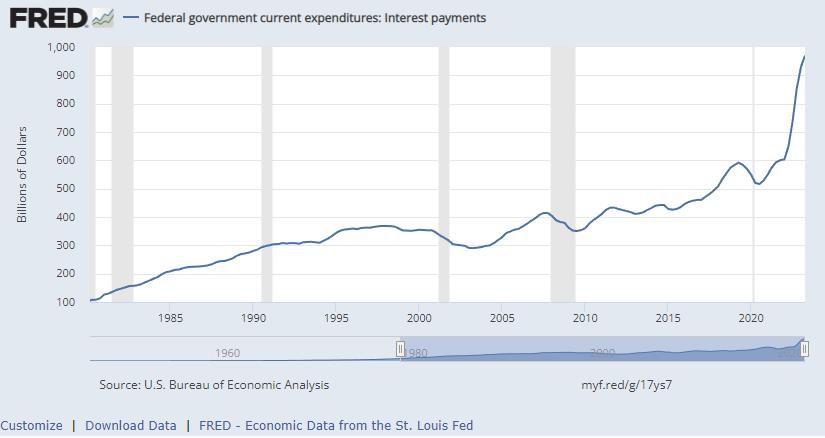

First: The government’s debt-service payments are likely to rise even further (they’re already at all-time highs). The current trajectory isn’t at all comforting.

Second: Any nation looking to join the de-dollarization movement now has a convenient cover story to explain their decision. (For example, the BRICS nations which are set to meet on August 22 of this year.)

We already covered how the debt and debt servicing payments compare with the GDP and tax revenue collected last week (and why that’s expensive).

How much longer will the rest of the world tolerate the economic insanity of lending even more money to the greatest debtor in world history?

Does your financial future rely on the dollar’s future?

The more I think about the last few years, the more I realize the global de-dollarization trend may be a matter of economic survival. Or, as Janet Yellen put it, “a natural desire to diversify” with less problematic assets.

For our daily transactional needs, buying gas or groceries, we’re pretty much stuck with the dollar. But that doesn’t mean your financial future has to be. You can unchain your savings from the dollar disaster by diversifying with universally-valued, safe-haven assets like physical precious metals (especially gold and silver). They’re some of the only financial assets that exist in the real world – not just entries on a spreadsheet in a bank’s database – and can’t be inflated away or hacked.

Knowledge is power. You can get all the information you need about both gold and silver for free to make an informed decision right here.

Don’t delay, though – because, as Matthew Lynn wrote for The Telegraph:

The message is finally getting through that the West can’t keep its debt-fuelled spending spree going forever…

At some point we will have to stop pretending that we can borrow and spend our way out of every crisis, or that “green investment” somehow magically creates wealth out of nothing. Fitch has reminded us that one day there will be a reckoning – it is just a question of when.

It’s better to be a year too soon than a minute too late.