https://archive.ph/BIDql#selection-5157.0-5165.245

Article:

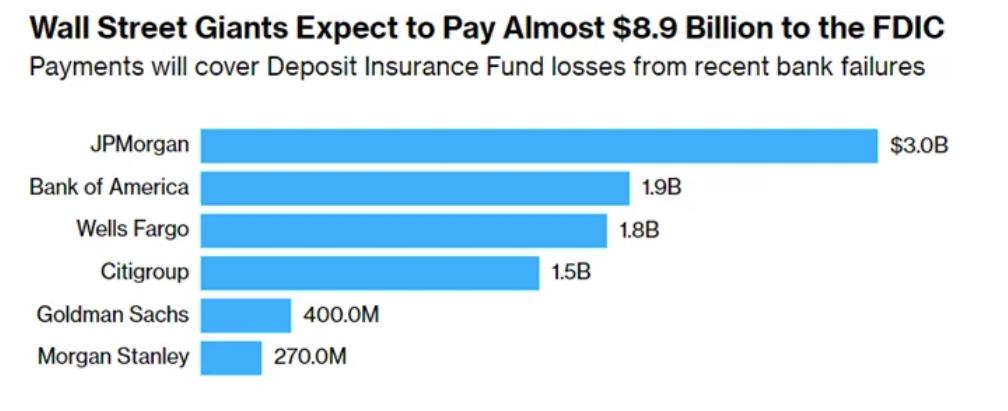

The biggest US lenders expect to pay almost $8.9 billion to help replenish the US government’s bedrock Deposit Insurance Fund after it was tapped to backstop uninsured depositors at Silicon Valley Bank and Signature Bank.

Citigroup Inc. expects to contribute as much as $1.5 billion to the Federal Deposit Insurance Corp.’s pot that was depleted to protect deposits at the two failed lenders, making it the last of the country’s biggest banks to disclose the set-asides. In total, the six largest lenders forecast covering 56% of the $15.8 billion it cost the FDIC to protect uninsured depositors. JPMorgan Chase & Co. expects to pay the largest fee, at approximately $3 billion, while Bank of America Corp. and Wells Fargo & Co. will each pay almost $2 billion.

h/t Better-Protection-23