The US Fiscal position is very bad and the US is beginning to look like a third world economy. And with Biden and Democrat AGs filing indictments against Biden primary Presidential oppoonent, that country is Venezeula! Like skyrocketing interest on the Federal debt to pay for green energy hustlers and the Ukraine war.

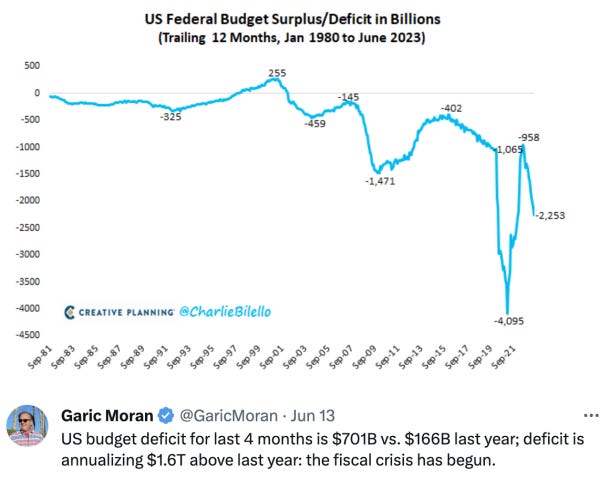

The US Federal Deficit continues to grow as seen in the charts below. A $2.25 Trillion dollar run rate deficit is significantly worse than the $1.3 Trillion that was recorded in Fiscal 2022. This level of deficit is unprecedented in an economy with low unemployment and theoretically no recession. Naturally, we ask just how big the deficit will be if we have either a recession or a crisis? In the dotcom bust, the GFC and the COVID shock, the deficit expanded massively.

Taking Garic’s math one step further, the US incurred a deficit of $1.3T in Fiscal 2022 (September). If the current run rate is sustained that would imply an annualized deficit of $2.9 Trillion.

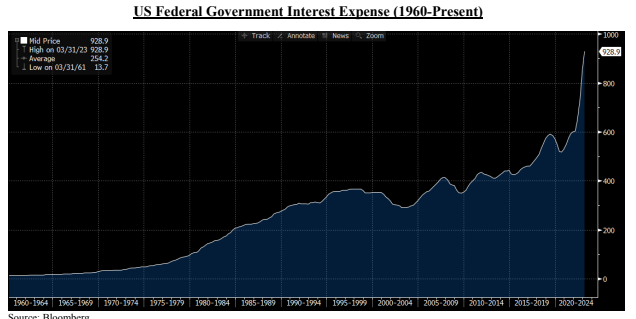

Of course, one big driver of this deficit is the interest cost incurred by the Government itself. It is rapidly approaching a $1 Trillion dollar run rate which means the Government is spending more in interest than on national defense. As you can see in the schedule below, the Fed’s rate hiking campaign has been very expensive for the US Government since a large portion of the federal debt is in shorter maturities which currently pay ~ 5.3% in interest. As recently as September of 2021, many of these same securities had much lower interest cost – as low as only 10-30 basis points.

Looking at the chart above, we wonder: is there anything about this that looks remotely sustainable? We are at that point in the movie where raising interest rates to fight inflation actually makes things (including inflation) worse. Worse because deficits swell and will need to be monetized.

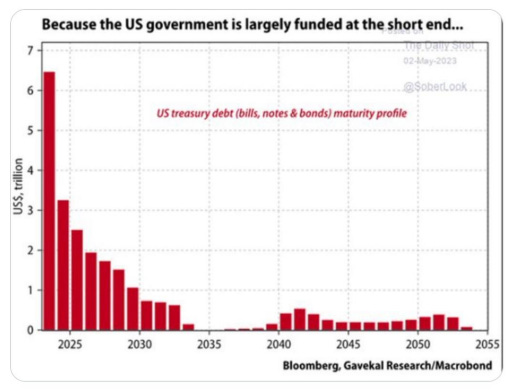

Furthermore, the issue is acute because the US Government uses the short-term bond market to Fund most of its debt. As the chart below from Gavekal Research/Macrobond shows, the Government needs to roll over $6 Trillion of maturing notes in 2023 and $3 Trillion of notes in 2024. This does not take into account any of the roughly $1.2 Trillion of bonds and notes that will be sold into the market by the Fed if Quantitative Tightening continues. Nor does it account for the ever increasing US Federal Deficit which will easily exceed $2.2 Trillion this year.

In short, the US Government has some serious funding challenges particularly when we consider that foreigners have been net sellers of our bonds since 2014.

IT’S THE DEBT, STUPID

On January 19, 2023 the US Federal Government hit its debt ceiling of $31.4 Trillion. Extraordinary spending measures kicked in which allowed the Government to keep operating. This lasted until June when Treasury Secretary Yellen informed Congress that a debt default was imminent if the ceiling was not raised.

After the usual political posturing, Congress did two things: (i) they agreed to place a two year cap on spending increases for a small portion of the budget that amounted to only 7% of the total budget. (like placing a band aid on a gaping wound); and (ii) they agreed to suspend the debt limit and to not replace it with another figure until January of 2025. We do not think they have ever.

Put it differently, let’s call this “Government Gone Wild!”

Views: 81