by Chris Black

Japanese investors have already begun adjusting investment portfolios away from U.S. bonds in light of rising FX hedging costs (https://archive.is/BGtTQ) and in anticipation of higher JGB yields (https://archive.is/8MWKR).

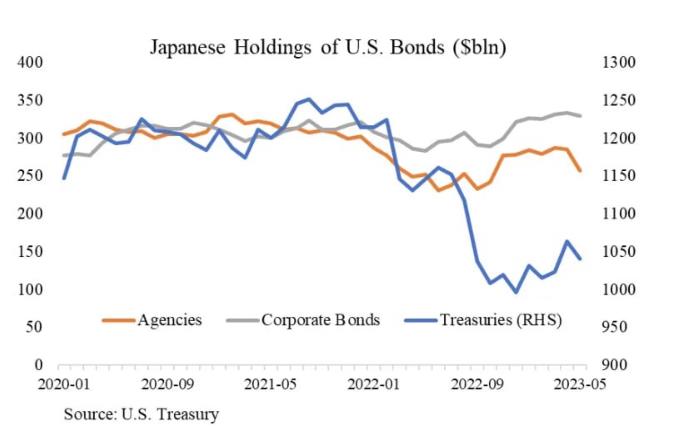

Official sector data (https://ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html) show a notable decline in Japanese holdings of Treasuries, a slight decline in Agency MBS, and a modest increase in corporate bonds.

While these changes are in part due to valuation impacts from rising rates, they also reflect changes in relative value calculations.

Treasury and Agency MBS investments are unattractive on an FX hedged basis, but corporate bonds can still be attractive due to their higher yields even on an FX hedged basis.

A further rise in Japanese yields would further swing this calculation against U.S. bonds.

The BOJ’s low interest policy remains an anchor of global bond yields, but that anchor will soon be raised to a higher level. U.S. bonds will appear even less attractive to Japanese investors, whose exit from the market would allow U.S. bond yields to drift higher.

The eventual but, so far, elusive Fed rate cuts would reduce FX hedging costs and potentially entice some Japanese investors back to the U.S., but until then it looks like one more marginal source of demand for Treasuries is evaporating even as supply is set to increase (https://archive.is/6Ch8H) with the U.S. set to issue over $1 trillion in debt over the next quarter (https://t.me/marketfeed/428788).

This suggests that Treasury yields will continue to drift higher.

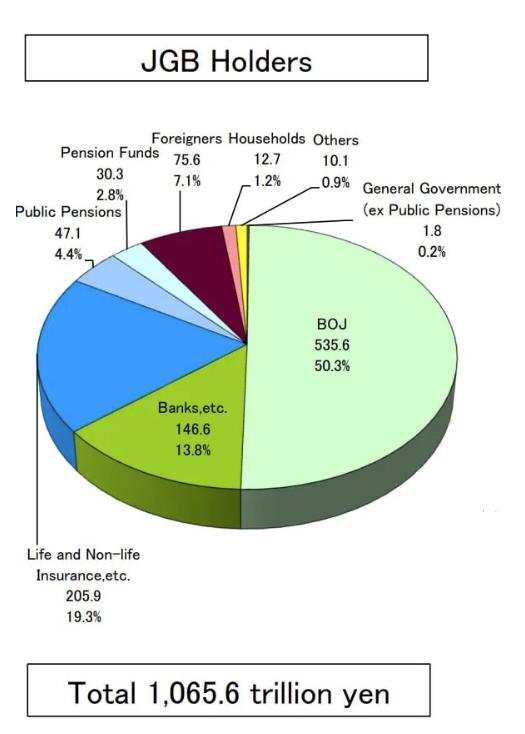

The rise of Japanese yields will likely be smooth as the BOJ is throttling the rate of increase, by “nimbly conducting” bond buying operations above 50 bps, and has largely socialized the mark to market losses.

Japan’s debt to GDP is the highest in the developed world (https://archive.is/DN2k8), so rising yields would impose significant losses on the financial system.

Declines the value of private debt transfers wealth from the lender to the borrower, but declines in value of public debt are net losses to the financial system (https://fedguy.com/fed-cannot-fight-todays-inflation/).

But the BOJ has over time accumulated over half of the outstanding JGBs and thus effectively socialized the mark to market losses from rising yields.

Other investors like Japanese banks should be able to weather the unrealized losses as they remain very liquid from the prior few decades of QE.

The BOJ’s iron grip on their bond market will help investors adjust to losses in a measured manner.

A move from 0.5% to 1% in 10 year JGBs implies a decline in market price of around 5%, which is painful but limited and foreseeable.

This would allow investors to adequately prepare and makes disorderly moves, like those seen recently in the UK gilt market in 2022 (https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2023/an-anatomy-of-the-2022-gilt-market-crisis), unlikely.

Any further tweaks to YCC would also very likely be gradual and well anticipated.

Recently, some large Japanese investors have reportedly (https://archive.is/aXWGz) decreased their holdings as FX hedging costs became prohibitively costly (https://archive.is/BGtTQ), a result of the Fed’s rate hikes making borrowing dollars for hedges on dollar-denominated assets more expensive.

Also, a FX hedged bond investment is mechanically ‘borrowing short and investing long’ (referring to tenor), so it is unprofitable when the yield curve is inverted (https://t.me/DissidentThoughts/2515).

While some FX hedged trades have become unprofitable, Japanese investors are still active in overseas bonds by investing on an unhedged basis or by taking on more credit risk. For example, Japanese life insurers continue to purchase overseas bonds (https://www.boj.or.jp/en/research/brp/fsr/data/fsr230421a.pdf) without fully hedging their FX risks. This saves on hedging costs and is also in part a speculation on Yen depreciation.

Other Japanese investors have reportedly (https://www.boj.or.jp/en/research/brp/fsr/data/fsr230421a.pdf) purchased riskier corporate bonds, which can still be profitable on an FX hedged basis as the high risk premium off-sets hedging costs.