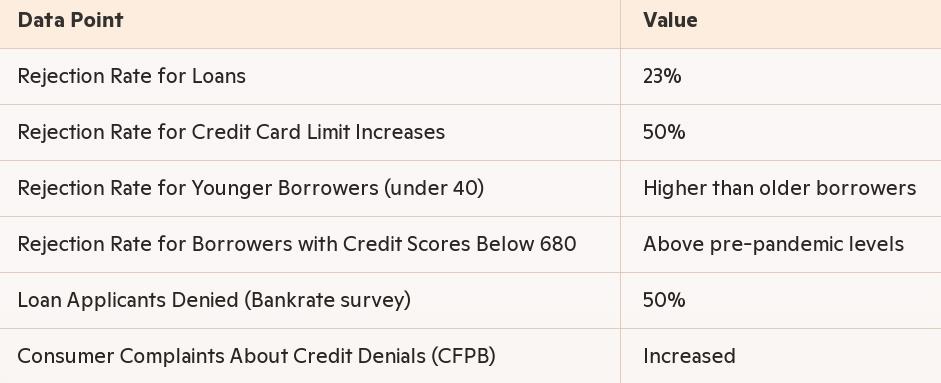

The landscape of American credit has taken a stark turn for the worse, with rejection rates for various forms of credit reaching levels not seen since the financial turmoil of a decade ago. According to the latest data from the Federal Reserve Bank of New York, rejection rates for loans, including credit cards, mortgages, and auto loans, have spiked to 23%. This figure marks the highest recorded since the depths of the financial crisis, signaling a significant contraction in credit availability.

Moreover, the rejection rate for credit card limit increases has reached nearly 50%, indicating that even those with existing credit lines are facing unprecedented hurdles in expanding their credit. This surge in rejection rates is not merely a statistical anomaly but reflects a systemic shift in how financial institutions are managing risk in an increasingly uncertain economic environment.

A detailed analysis by the New York Fed’s Credit Access Survey shows that this trend has been particularly harsh on younger borrowers and those with lower credit scores. For instance, individuals under 40 have seen application rejection rates exceed those of their older counterparts, highlighting a generational gap in credit access. Additionally, those with credit scores below 680 are facing rejection rates well above pre-pandemic levels, with auto loan rejections hitting an all-time high since the survey’s inception in 2013.

The ramifications of this credit crunch are far-reaching. For many Americans, the ability to finance significant life events or manage daily expenses through credit has become more challenging. A Bankrate survey reveals that 50% of loan applicants have been denied since the Federal Reserve began raising interest rates, impacting their financial stability and major life decisions like buying a home or a car.

Economic analysts attribute this tightening to a combination of factors: rising interest rates have made borrowing more costly, inflation has squeezed household budgets, and banks, still cautious from previous economic shocks, are more selective in their lending. This environment has led to a situation where, as noted by Forbes, even small businesses are increasingly relying on high-cost financing options like credit cards, with many unable to pay off these balances monthly.

Furthermore, the Consumer Financial Protection Bureau (CFPB) has noted an increase in consumer complaints regarding credit denials, suggesting not just a quantitative but also a qualitative shift in how credit is being accessed and managed. This was echoed in social media and financial forums where users report longer waits for approval decisions and more stringent credit checks.

As credit becomes scarcer, consumers are forced into more conservative financial behaviors, potentially slowing economic activity. This scenario might require a recalibration of personal financial strategies, with an emphasis on saving rather than borrowing. For financial institutions, the challenge lies in maintaining a balance between risk management and supporting economic growth.

Sources:

https://x.com/GlobalMktObserv/status/1877739680369684618

https://www.newyorkfed.org/newsevents/news/research/2024/20241118

https://www.bankrate.com/credit-cards/news/credit-denials-survey/

https://www.forbes.com/advisor/business/software/people-twice-likely-spend-using-card-than-cash/

https://www.consumerfinance.gov/complaint/

65 views