As someone who’s been diving into the world of cryptocurrencies, I can’t help but draw parallels between Bitcoin’s wild ride and the infamous Madoff Ponzi scheme. Both promise astronomical returns, and both have an army of believers who swear by their success. But let’s break it down a bit.

Bitcoin’s Rollercoaster Ride If you’ve been following Bitcoin, you know it’s a rollercoaster of epic proportions. One day it’s soaring to record highs, and the next, it’s plummeting. The fluctuation is enough to give even the most seasoned investor a headache. Yet, despite these drastic ups and downs, there’s a steadfast group of investors who believe in Bitcoin’s potential to revolutionize the financial system.

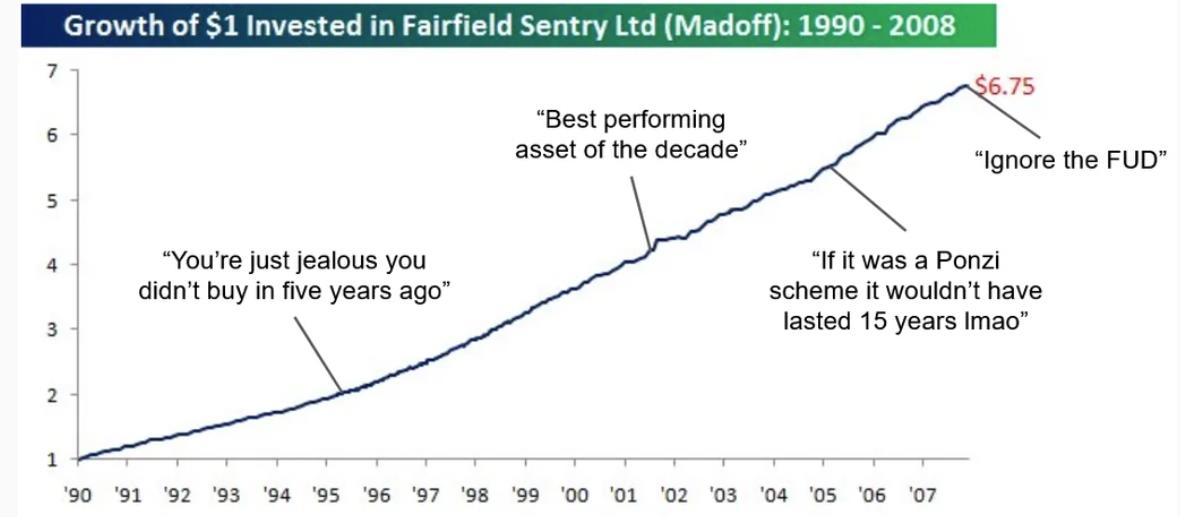

Madoff’s Mirage Remember Bernie Madoff? He had investors convinced for years that they were making incredible gains. The returns were steady, predictable, and too good to be true—because they were. Madoff’s scheme eventually collapsed, leaving many in financial ruin and questioning how they could have been so blind.

The Eerie Similarity Here’s where it gets interesting. Bitcoin’s dramatic fluctuations and the fervent belief of its investors can seem eerily similar to Madoff’s Ponzi scheme. There’s this cycle of unsustainable growth and hype that’s hard to ignore. Sure, Bitcoin has a technological backbone with blockchain, but the speculative frenzy around it can feel just as deceptive.

The Bottom Line Now, I’m not saying Bitcoin is a Ponzi scheme. It has its legitimate uses and has brought about significant innovation. However, the hype and the blind faith some investors place in it remind me of the blind faith people had in Madoff. As with any investment, it’s crucial to do your homework and understand the risks involved. Don’t just get swept up in the hype—dig deeper and make informed decisions.