Meh! pic.twitter.com/7mmj6d2LgJ

— Lance Roberts (@LanceRoberts) December 6, 2024

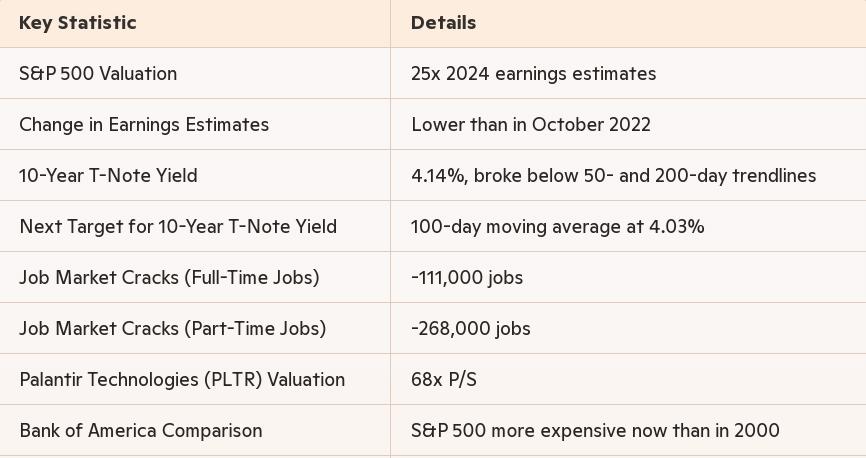

The stock market is sending some worrying signals right now. The S&P 500 is trading at 25 times 2024 earnings estimates, which is quite high. Interestingly, these estimates are actually lower than they were in October 2022, which adds to the concern. This suggests that analysts are becoming more pessimistic about future earnings growth.

The 10-year Treasury note yield has also been on a downward trend, recently breaking below both the 50-day and 200-day moving averages. It’s now approaching the 100-day moving average, which sits at 4.03%. This decline in yields could be a sign that investors are becoming more risk-averse, possibly due to emerging cracks in the job market as seen in the Household survey.

Bank of America has even gone so far as to say that the S&P 500’s valuation is more expensive now than it was in 2000, just before the dot-com bubble burst. This is a stark warning that a market crash could be imminent. Palantir Technologies, for example, is trading at 68 times its sales (P/S ratio), which means that even if it grows earnings by 30% annually for a decade, investors would still see negative returns if the multiple reverts to a more mature level of 20 times earnings.

The job market is also showing signs of trouble, with full-time jobs decreasing by 111,000 and part-time jobs decreasing by 268,000. This is the largest decline in jobs since the Great Depression, which is raising fears of a severe recession.

In historical context, these indicators are reminiscent of the conditions that preceded major market downturns. The combination of high valuations, falling bond yields, and weakening job market data is a recipe for concern. Investors are right to be worried, as these factors could signal a significant market correction or even a crash.

It’s a tense time for the markets, and many are bracing for what could be the worst bear market since 1929. The sentiment is that something is fundamentally wrong with the market, and it’s hard to ignore the feeling that a major correction is on the horizon.

Think the 2008 crash was bad?

The popping of the ‘Everything Bubble’ will make it look like a blip.

Stackers, this is your moment. pic.twitter.com/qH7ZeQj3mt

— GoldSilver HQ (@GoldSilverHQ) December 7, 2024

Sources:

https://www.factset.com/earningsinsight

https://www.bls.gov/news.release/pdf/empsit.pdf

https://lipperalpha.refinitiv.com/2024/11/sp-500-earnings-dashboard-24q3-november-29-2024/