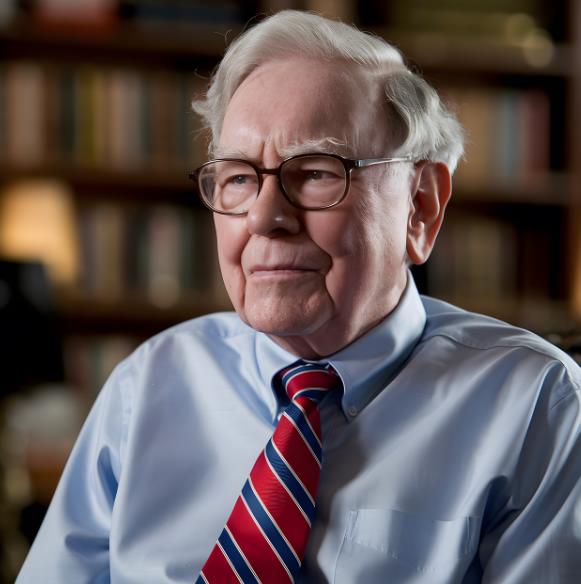

Warren Buffett has some strong feelings about Bitcoin, and he’s not shy about sharing them. He’s known for his preference for real, tangible investments over what he sees as speculative assets. Buffett has said that if you offered him 1% interest in all the farmland in the United States for $25 billion, he would write you a check on the spot. Farmland produces food, and that’s something of real value.

But if you offered him all the Bitcoin in the world for $25, he wouldn’t take it. Why? Because, in his eyes, Bitcoin doesn’t produce anything. It’s not an asset that generates income or has intrinsic value like property or farmland does. He believes in investing in things that you can see, touch, and that produce something tangible.

Buffett’s perspective is rooted in his long-standing investment philosophy: value over speculation. He’s built his legacy on understanding the true value of assets and making decisions based on that. Given his track record as one of the best investors in history, his caution towards Bitcoin certainly gives you something to think about.

Sources:

https://markets.businessinsider.com/news/stocks/warren-buffett-bitcoin-comments-2022-04