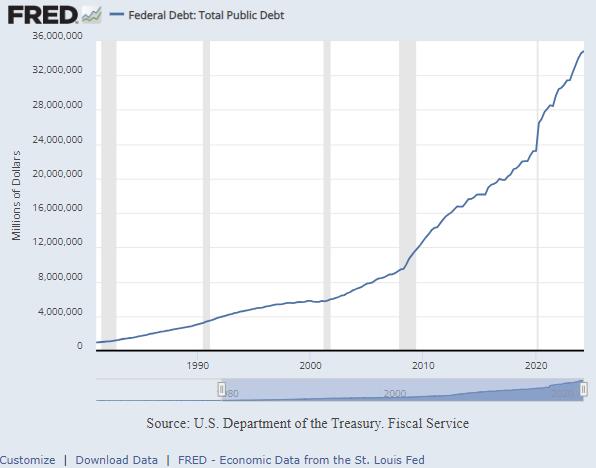

As of Nov. 21, the U.S. national debt broke $36 trillion. It took over 200 years to hit $1 trillion – then just 40 years to shatter $36 trillion. That’s much more than just a massive number. It’s an obligation – and it matters even more than you might think…

By Peter Reagan

The national debt just passed $36 trillion. Trillion.

That is a massive amount of money. Simply mind boggling.

It’s important for you to understand the most likely reason the federal government isn’t especially worried about the debt – and, more importantly, why you should be.

But first, you have to understand just how much $36 trillion really is.

Some perspective on the debt

There are still people out there who act like, and may even say, that the national debt is no big deal. After all, the country is still running, right?

At face value, that seems like a good question to ask. Really, though, it is the type of short-sighted thinking that has our economy in the mess that it is, now, as I’ll explain further down.

Before I do that, though, let’s look at what is really going on with the national debt because there’s a good chance that you may not understand what we’re really looking at in terms of numbers.

So, to start, the national debt is $36 trillion.

To be specific, the exact figure as I’m typing is $36,034,994,586,981.97 (so, it’s higher, now – you can see the latest here). That’s a big number.

And it’s been growing fast. How fast, you ask? Eric Revell at Fox Business writes,

The $36 trillion debt milestone comes just months after the U.S. eclipsed the $35 trillion mark in late July 2024. The national debt has passed other trillion-dollar milestones in the past year, as the $34 trillion mark was reached in early January 2024 and the $33 trillion threshold in September 2023.

You read that right. The national debt increased by nine percent (three trillion dollars) in the last 14 months. That rate would have the already enormous national debt doubling within 13 years.

Imagine if what you owed on your home mortgage doubled within 13 years because you kept borrowing on it and never paying it back.

You’d be in major financial trouble well before you go to the 30 year mark on the average mortgage.

Of course, you can’t do that with your mortgage, but the Federal Reserve enables the Federal government with its crazy spending sprees as if it were someone enabling an alcoholic by buying them more liquor.

To give even more perspective on the debt, though, Revell continues:

By comparison, the national debt hovered around $907 billion just four decades ago.

That’s right, within our lifetimes, the national debt increased by 3,869%.

That’s not a typo.

See for yourself:

It took 200 years to pile up the first $1 trillion – but, as you can see from the chart, it’s getting easier and easier for the number to go up…

That is astronomical. And the rate that the debt is increasing is getting faster.

But the government keeps deficit spending, and you have to ask…

“Why do they keep spending money that they don’t have?”

Now, some who advocate for “modern monetary theory” (MMT) pretend that the government spending money that it doesn’t have won’t affect anything because… the government can print money to pay the debt.

To be fair, advocates of MMT are right that the government can print more money to pay their debts. So, let’s start with that part of their thinking.

Ken Fisher sarcastically explained in the New York Post about why he isn’t concerned about the national debt.

The key point to understand here [when talking about how big the national debt is] is that U.S. debt is issued in U.S. dollars.

That seems to be a pretty uncontroversial statement so far. So what does that have to do with why he thinks that we shouldn’t be concerned about the debt? Fisher continues:

The other key thing to understand is that the value of those dollars has been shrinking drastically, courtesy of a multiyear, pandemic-induced tidal wave of inflation.

There it is. The huge national debt causes inflation which helps the government to “service the debt,” meaning to pay the interest on the debt without ever actually paying it down.

So, MMT advocates think that the national debt is a non-issue. But Fisher understands that deficit spending by the federal government causes inflation. (Funny enough, Biden understands the connection, too, according to his WSJ op-ed.)

Deficit spending is a tax that everyone pays – but it’s a hidden tax, because we pay for it through the loss of our purchasing power.

We’ve been paying it, every day…

Just how much inflation are we talking about?

Again from Fisher:

Since COVID, official inflation rose fully 20%. But you and I know that it was really more than that – maybe 30%.

(I don’t know about you, but double digit inflation hurts every time that I go to the grocery store… I know I’m not alone. I don’t want to belabor the point though.)

But you may be confused as to why Fisher says that inflation helps the Federal government to service the debt, and it’s a great question. He explains the upshot of all this inflation::

…the U.S.’s real [after-inflation] repayment costs on its debt also have shrunk drastically… So, 2020’s $27 trillion national debt got shrunk in real repayment terms by maybe $6-8 trillion.

That’s right, because inflation is actually the devaluation of the dollar, a higher national debt means higher inflation.

Which means that the federal government will actually have to pay back less in real value (assuming that they’re ever so inclined to do that).

But there’s an ugly side that MMT advocates don’t acknowledge when talking about government debt.

While inflation may help the government… it doesn’t help us

And that’s part of the problem with economic central planning at a national level: They forget that what “helps” the government often hurts the people in the country.

How very democratic of those politicians and bureaucrats to reduce our spending power by devaluing our money…

… so that they can keep spending money the nation doesn’t have.

Sounds an awful lot like taxation (taking away our purchasing power) without representation since they never actually put a tax up for a vote…

It’s an ugly system that helps those in government and hurts all of us.

And since they obviously aren’t looking out for you, you have to take responsibility for taking care of and securing your financial future yourself.

I believe that one of the first things that you absolutely must do is to find a way to keep politicians and government bureaucrats from taxing or devaluing your savings into oblivion.

And, really, the only way to create that financial foundation is to find ways to preserve your capital’s value by finding storage methods that are inflation-resistant, that maintain their value by having value in-and-of-themselves.

My best recommendation for that is to consider diversifying your savings with physical precious metals such as gold and silver. That way, your purchasing power is sheltered from inflation – in your hands and in your control. Completely untouchable by deficit spending and dollar devaluation.

Views: 83