Retail sales growth year-over-year (YoY) has stalled. The Federal Reserve’s data shows a flatline, indicating consumers are spending cautiously. Retail sales drive much of the economy, and their stagnation is a red flag for broader economic health.

fred.stlouisfed.org/graph/?g=1Bp2y

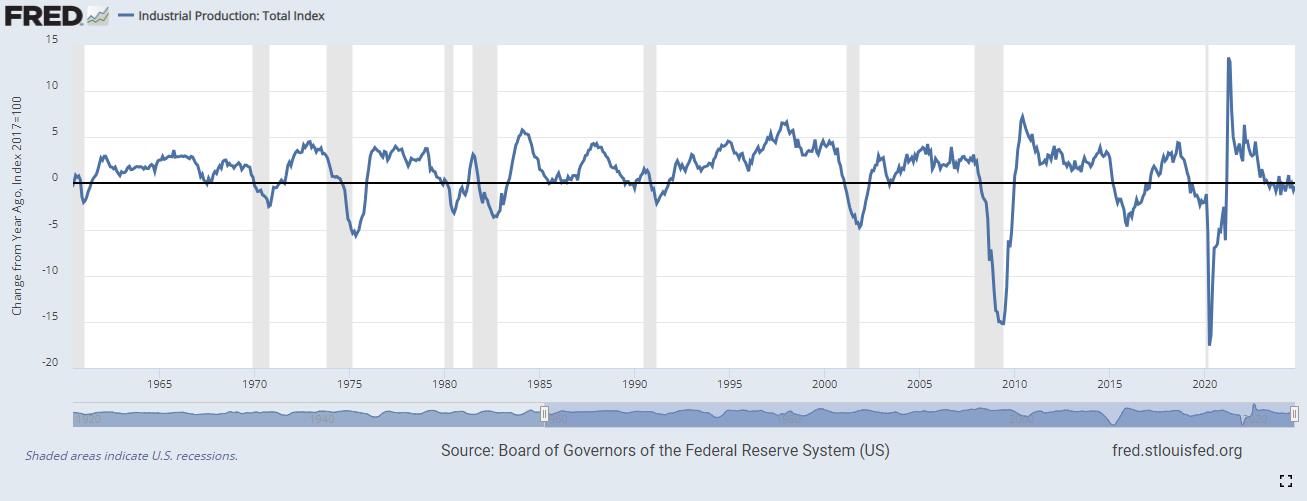

Industrial production YoY is also not growing. This metric tracks the output of factories, mines, and utilities, and its lack of growth reflects a cooling economy. Together with retail sales, these two indicators form the backbone of economic activity, and their combined slowdown often leads to the grey bars of recession on the chart.

fred.stlouisfed.org/graph/?g=1Bp2G

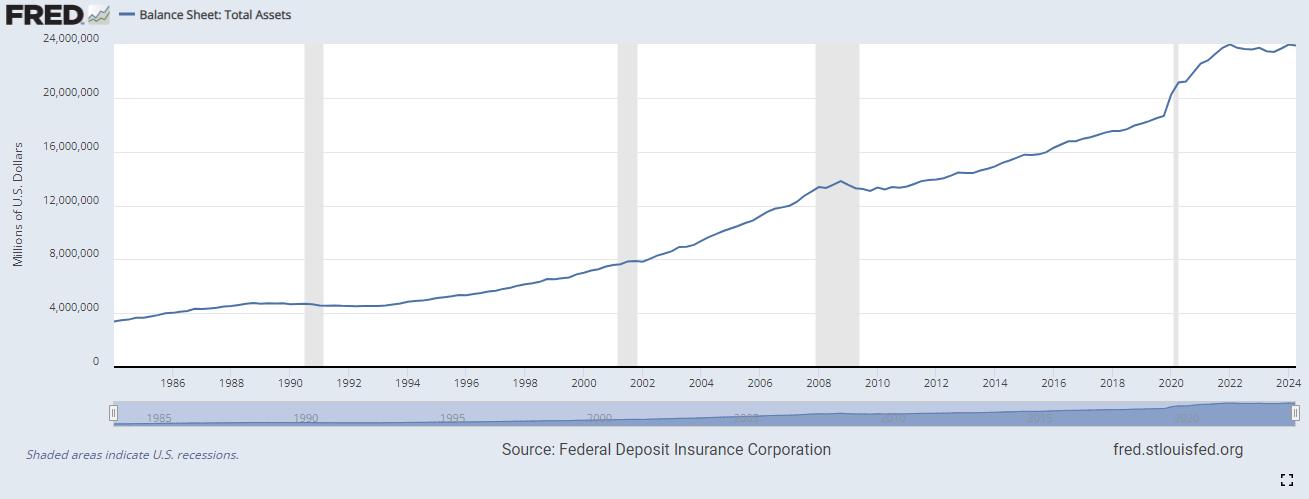

Bank balance sheets have plateaued in recent months. This could mean banks are lending less, borrowers are defaulting, or both. Lending stagnation often signals a lack of confidence in the economy, either from the lenders or the borrowers.

fred.stlouisfed.org/graph/?g=1Bp2Q

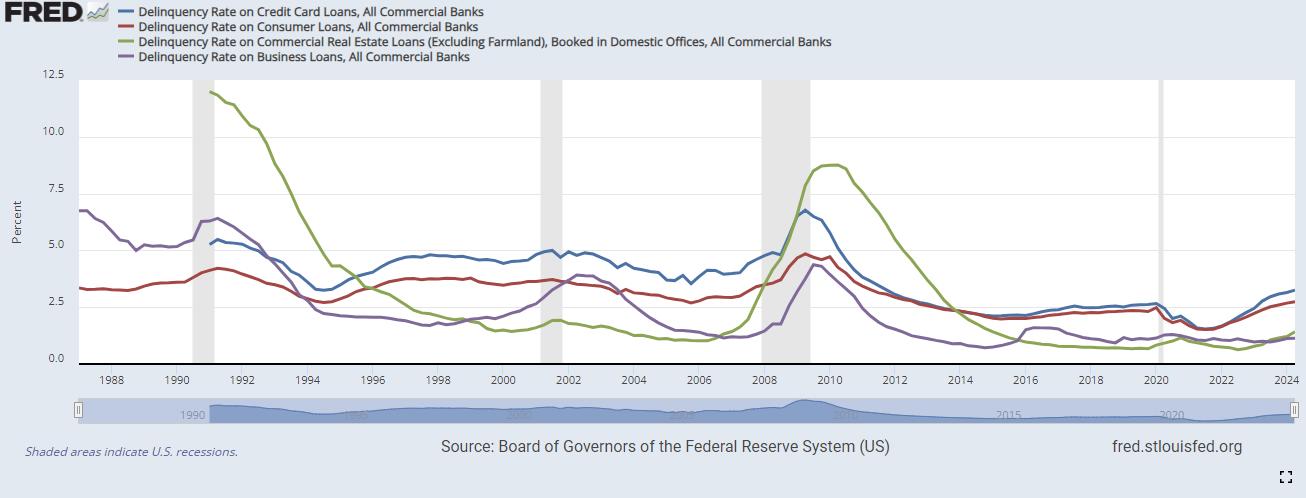

Delinquencies on loans other than business loans are rising. The latest data shows an uptick in defaults, particularly on consumer loans. This hints at growing financial stress among households, which could ripple through the economy if the trend continues.

fred.stlouisfed.org/graph/?g=1Bp2Y

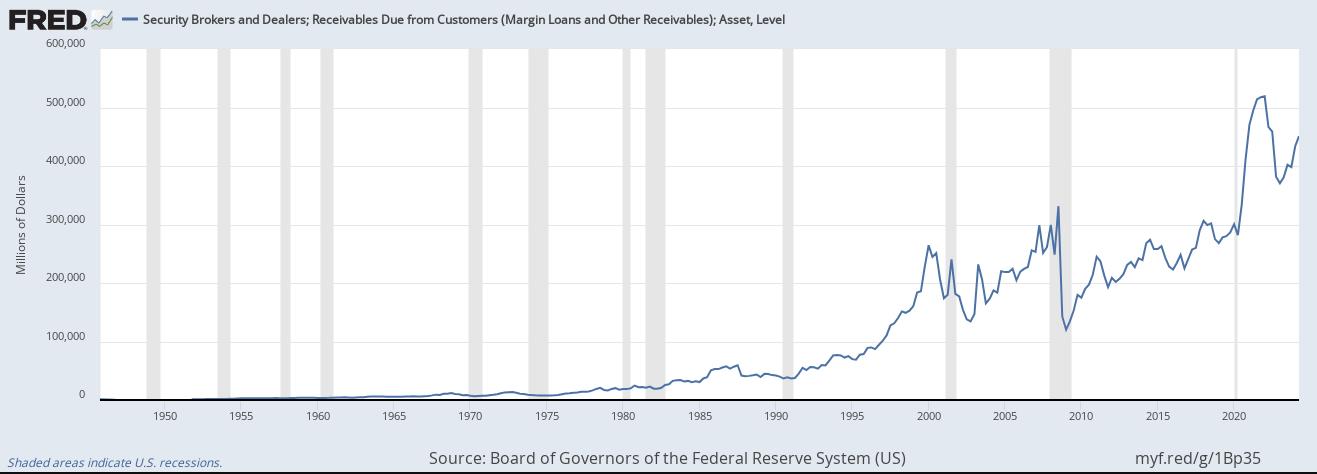

Meanwhile, margin trading is climbing. Investors are borrowing from brokers to buy stocks, fueling what some call the “Trump Pump.” This speculative behavior often marks the late stages of an economic cycle, as optimism drives risky bets even while fundamentals weaken.

fred.stlouisfed.org/graph/fredgraph.png?g=1Bp35

Warren Buffett’s record cash pile seems like a wise move in this environment. I’m following a similar strategy—holding onto my current stocks but avoiding new purchases. With weakening retail and industrial data, rising defaults, and speculative trading at a high, caution feels like the best course.

Views: 114