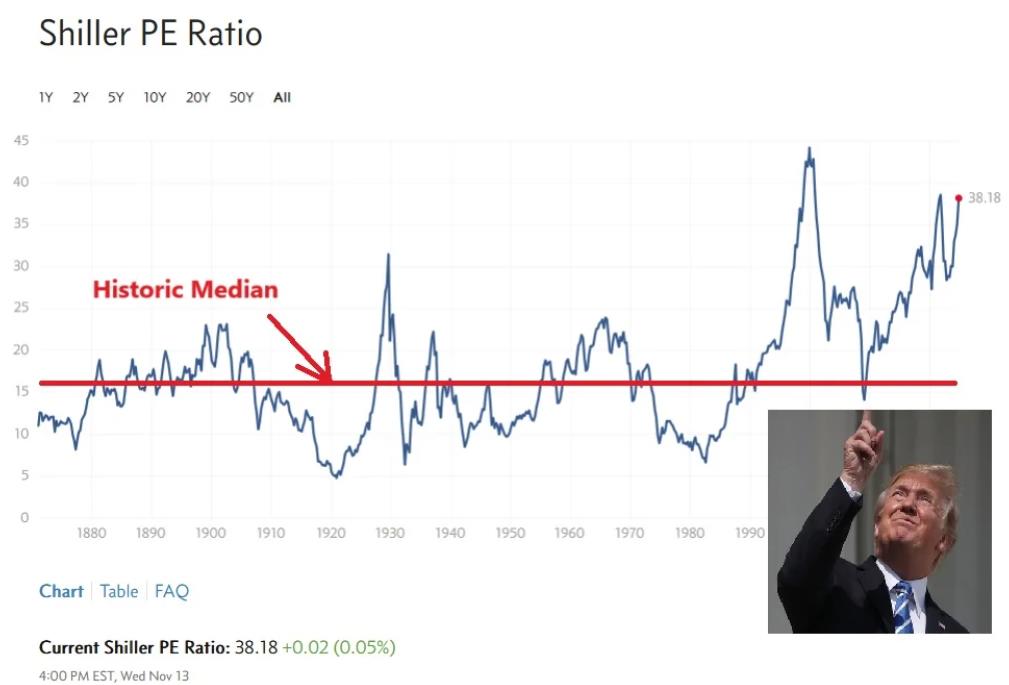

The Shiller P/E Ratio, a trusted gauge of market valuation, has surged to 39.89 as of November 2024. This marks its second-highest level ever, trailing only peaks in 1929 and 2000—years synonymous with catastrophic market crashes.

Developed by Nobel laureate Robert J. Shiller, the ratio measures stock prices relative to average earnings over the past decade, adjusted for inflation. It has been a reliable indicator of market bubbles. The current reading suggests unprecedented overvaluation, with investor enthusiasm driving prices far beyond intrinsic values.

Shiller’s warnings of “irrational exuberance” resonate strongly today. When valuations climb too high, historical patterns show markets eventually “revert to the mean,” correcting to more sustainable levels. The timeline for such reversions remains uncertain, influenced by economic policies and global factors.

twitter.com/MrMikeInvesting/status/1857398512314393036

Sources:

h/t Cells_Inter_linked

Views: 69