As the cost of living continues to rise faster than wages, Americans are grappling with financial challenges that strain their budgets. Four key signs illustrate the ongoing struggles many face in this shifting economic landscape: rising paycheck-to-paycheck households, growing retirement concerns, inflation outpacing earnings, and changing family dynamics. These trends reveal a stark reality—financial stability is increasingly elusive for many.

The first sign is the rise in paycheck-to-paycheck households. Since 2019, more Americans across all income brackets have been living paycheck to paycheck. A staggering 82% of American workers believe it’s harder to achieve a comfortable retirement today compared to previous generations. This growing concern is reflected in a recent survey by CNBC, which shows widespread anxiety over financial security in retirement. With rising living costs, healthcare expenses, and the decline of traditional pension plans, many Americans are unsure how they will be able to retire comfortably, if at all.

Retirement concerns are also reaching new heights. A CNBC survey found that 82% of American workers believe it’s harder to achieve a comfortable retirement today than it was for previous generations. This reflects widespread anxiety about financial security in retirement. The pressure to save while managing daily expenses leaves many Americans feeling unsure about their future, unable to build the nest egg needed for a secure and comfortable retirement.

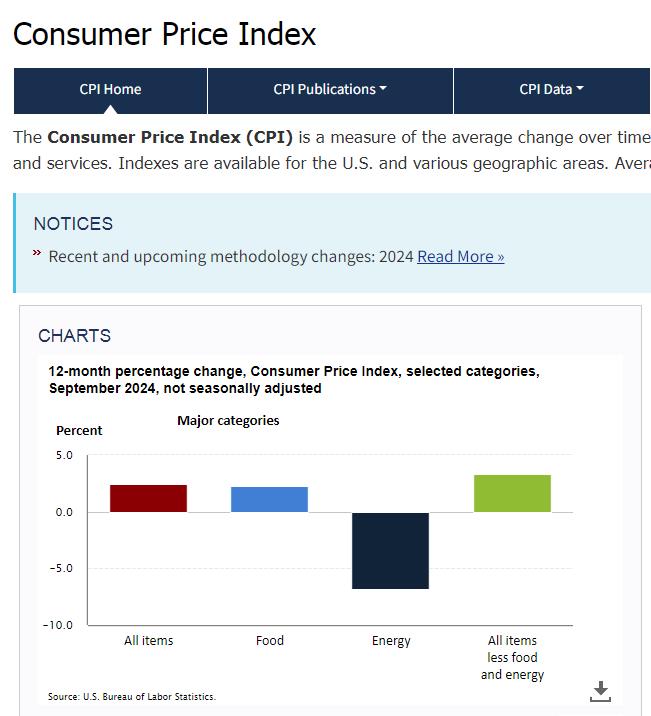

The third sign is the stark inflation-earnings gap. Over the past four years, inflation has surged by 21%, while average earnings have increased by only 19%. This means real wages have not kept pace with the rising cost of living. Basic goods and services have become more expensive, but many workers find themselves earning just slightly more than they did before, resulting in a sense of financial strain that is felt across the country.

‼️US CONSUMERS HAVE BEEN CRASHED BY INFLATION‼️

Average US prices have risen by 21% over the last 4 years.

At the same time, earnings have increased by only 19% on average.

Meanwhile, 59% of Americans believe that the economy is in a recession.

Average consumer is struggling. pic.twitter.com/RMantyv7tG

— Global Markets Investor (@GlobalMktObserv) November 11, 2024

Finally, changing family dynamics add to the stress. The trend of smaller families and fewer grandchildren has profound implications, particularly when it comes to elderly care. As birth rates decline and families shrink, fewer younger adults are left to care for aging relatives. In some families, a single grandchild may be responsible for supporting multiple aging grandparents, creating a heavy emotional and financial burden.

What happens to elderly care when the ratio of young people to elderly people in an extended family is closer to 1:1 instead of 3:1? What happens when the sole grandchild in a family has four aging grandparents counting on him or her for comfort and memories?

— Robert Sterling (@RobertMSterling) November 12, 2024

These four trends—more Americans living paycheck to paycheck, rising retirement worries, inflation outpacing wage growth, and evolving family structures—reveal a financial landscape that’s increasingly challenging to navigate. With economic pressures building, financial stability is slipping further from reach for many.

The reality is that the median American is broke as fuck with their largest asset being something they live inside.

— Darth Powell (@VladTheInflator) November 12, 2024

Sources:

Views: 150