Blackstone Real Estate Fund Facing Substantial Redemption Requests – The Registry

Blackstone’s retail real estate fund, valued at $69 billion, experienced a seventh consecutive month of limited investor withdrawals in May, as it faced substantial redemption requests. The fund, known as the Blackstone Real Estate Income Trust or BREIT, disclosed that it received $4.4 billion in redemption requests during May, according to a recent report by Barron’s. It fulfilled 30 percent of these requests, amounting to $1.3 billion, as stated in a notice to its stockholders. The fund restricts monthly redemptions to 2 percent of its net asset value and 5 percent per quarter.

The redemption requests in May were slightly lower than April’s $4.5 billion, relatively unchanged from March, and higher than February’s $3.9 billion. The peak in requests occurred in January, reaching $5.3 billion. In November, Blackstone (BX) initiated limitations on withdrawals from the fund.

Since the gating of the fund began in November, Blackstone has paid out a total of $7.5 billion. However, despite these payouts, BREIT continues to face significant redemption requests that surpass its ability to fulfill them. In June, the maximum amount of redemptions will be further restricted compared to May, allowing for only 1 percent of the fund’s net asset value due to the 5 percent quarterly redemption cap. In May, redemptions were limited to 2 percent of the net asset value.

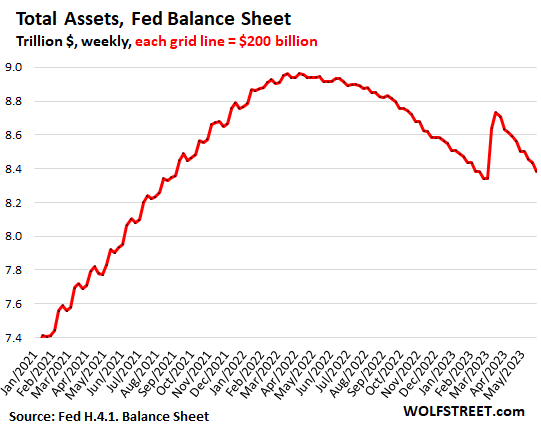

Total assets held by the Fed dropped by $50 billion in the week, to $8.38 trillion, down by $118 billion for the month and by $348 billion in the 10 weeks since peak-bank-crisis. Quantitative Tightening (QT) continued on track, and as the remaining bank liquidity support measures continued to unwind, according to the Fed’s weekly balance sheet today.

From the historic peak of the balance sheet in April 2022, total assets have dropped by $580 billion. This month, total assets will fall below where they’d been before the banking crisis, and will set a new low in this QT cycle.

To see the details of the banking crisis, here are total assets viewed through a magnifying glass:

The banking crisis measures.

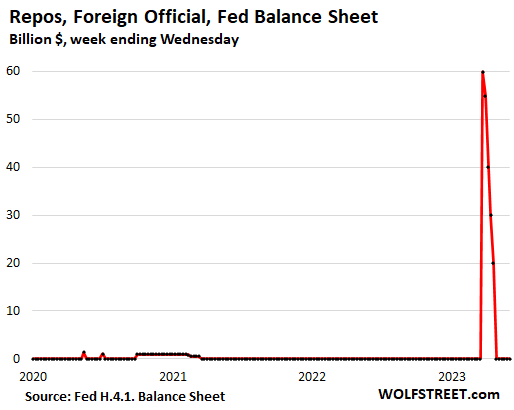

Repos with “foreign official” counterparties: paid off in April. The Swiss National Bank likely used this program to provide dollar-liquidity support for the take-under of Credit Suisse by UBS.

The Treasury is about to dump $170 billion worth of treasury bonds on the market on Monday (June 5th) 😬 t.co/aB3OMdiEa0 pic.twitter.com/7J8CMguJy5

— Financelot (@FinanceLancelot) June 3, 2023

BofA says AI frenzy drives record Inflows into tech pic.twitter.com/J4G1IlvvfO

— Cheddar Flow (@CheddarFlow) June 3, 2023

This is a cyclical bull market within a secular bear market.

Everyone gets to be right.

For a while. pic.twitter.com/aDIeQiLGc2

— Mac10 (@SuburbanDrone) June 3, 2023

Views: 204