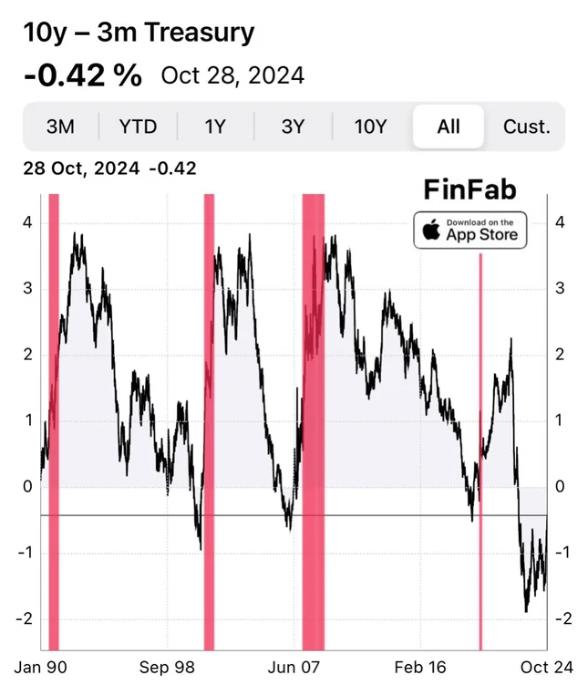

Last time we had this combination, it wasn’t good for equities:

1- % YC un-inverting after reaching extreme levels

2- Monthly RSI > 70

Additionally, some valuation metrics are worse than they were in 2008.

But maybe this time is different..

Last time we had this combination, it wasn't good for equities:

1- % YC un-inverting after reaching extreme levels

2- Monthly RSI > 70Additionally, some valuation metrics are worse than they were in 2008.

But maybe this time is different.. pic.twitter.com/obvCA8WZZy

— Guilherme Tavares (@i3_invest) October 29, 2024

h/t ChampionshipUsed9855

Views: 61