The Canadian economy faces a looming crisis, heavily influenced by staggering household debt levels. As of 2024, Canadian household debt stands at a staggering 174.6% of gross income, significantly higher than the 75% of GDP in the U.S. This means that Canadians are dedicating a far greater portion of their after-tax income to servicing their debts, raising urgent concerns about financial stability.

The implications are profound. With higher household leverage, Canada is exceptionally sensitive to changes in interest rates. When rates increase, Canadian households grapple with soaring debt servicing costs, which eat into disposable income and curtail consumer spending. This cycle can stifle economic growth, posing a significant threat to the nation’s financial health.

In contrast, the U.S. economy has shown resilience, becoming less susceptible to interest rate fluctuations over the past few decades. As of now, interest rate changes exert a muted effect on employment and overall economic activity in the U.S. However, Canada’s scenario starkly differs, with the total household debt climbing to $2.98 trillion by August 2024, predominantly driven by mortgage debt.

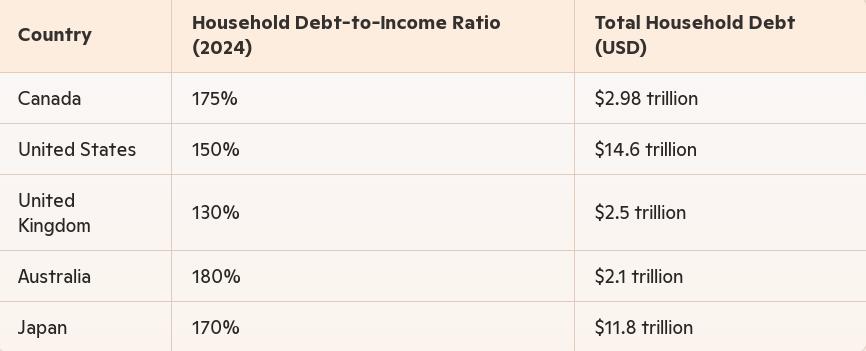

The household debt-to-income ratio of 175% indicates that Canadians owe $1.75 for every dollar they earn. This level of debt not only surpasses many other countries but also raises alarm bells regarding potential risks to economic growth and financial stability. If interest rates rise further or if the housing market experiences a downturn, the consequences could be dire for Canadian households and the broader economy.

Comparatively, here’s how Canada’s household debt stacks up against other countries:

🇨🇦The Canadian economy is more sensitive to interest rates than the US, given its elevated household leverage. pic.twitter.com/Gz6R104YDH

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) October 25, 2024

Sources:

Views: 118