The economic news of the day is that stagflation odds took a big jump in the latest NY Fed survey as inflation rose and delinquencies rose, too. This is what I’ve been prognosticating ad nauseam, but now it’s becoming news, and I’m not the only one recognizing it:

In recent weeks, we have discussed on multiple occasions … how in his desire to get Kamala Harris re-elected by rushing out a jumbo cut before November 5, Fed president Jerome Powell may have triggered the second coming of the Arthur Burns “galloping inflation” Fed, and sure enough recent inflationary prints have certainly raised the threat that the Fed is now aggressively easing even as inflation has not only not been defeated, but is once again rising.

So, there it is. Others are seeing the rise come in, too—not in the mainstream press, mind you, which will be last to share that knowledge, but in alternative media. Suddenly, so are investors:

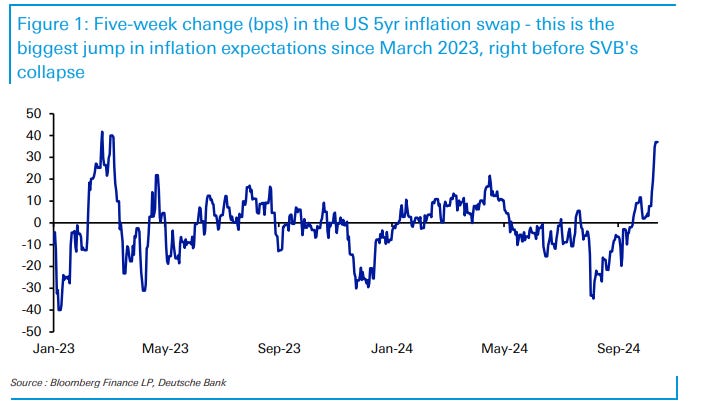

Then overnight, it was Deutsche Bank’s chief credit strategist Jim Reid who observed that US 5yr inflation swaps have seen their “largest 5-week climb since just before SVB’s collapse in March 2023, an event that shifted the narrative away from around 4 more hikes to imminent cuts for a period of time.”

How large?

This large:

What that means is that investors are betting, as Adam Taggart says in a video I’ve posted in the headlines for paying subscribers, “The Fed has jumped the shark.” It has put in its first rate cut too soon.

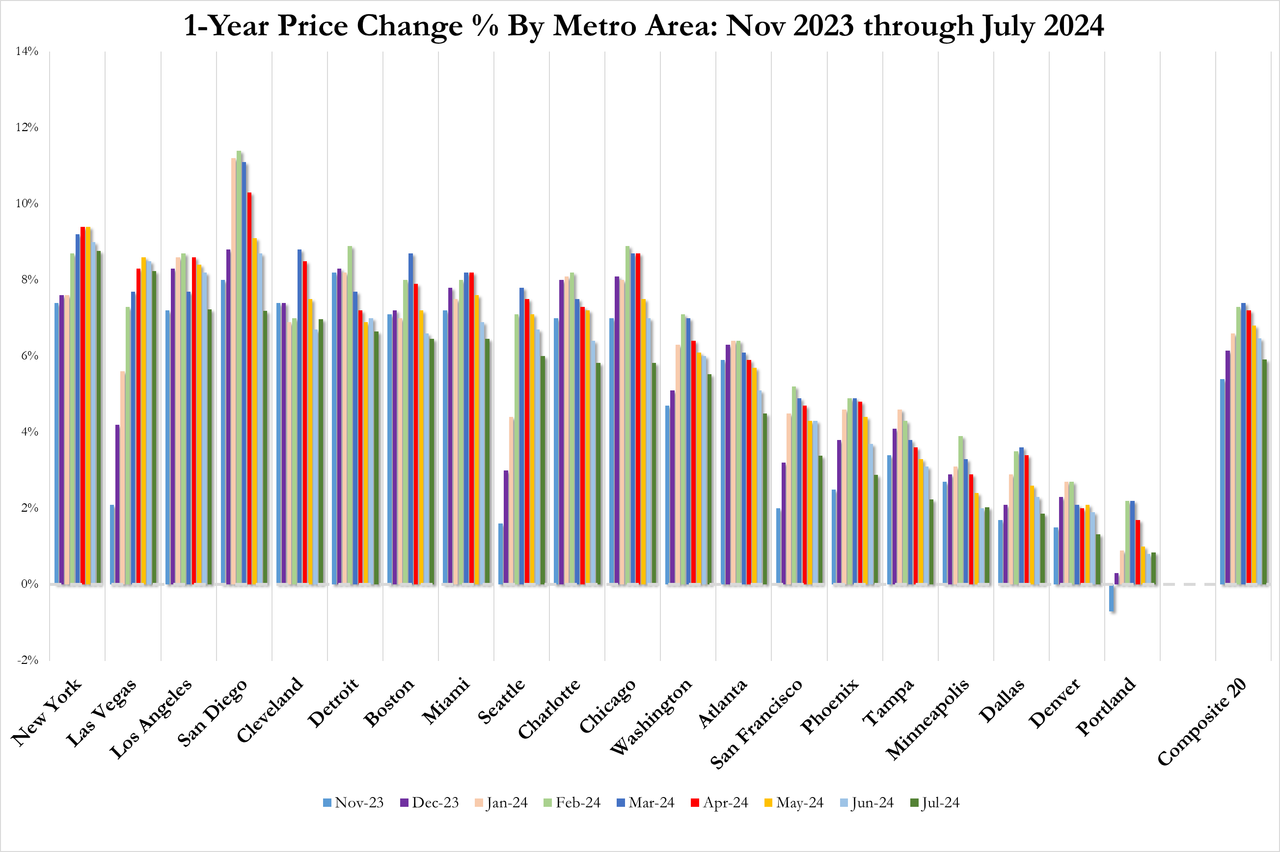

The Fed chose to cut interest rates at a time when housing prices are still soaring:

And when stock prices are at all-time bubblicious highs.

I’ve asked a few times, as the article quoted above (see headlines below for the reference) says, whether or not the Fed’s ambition in cutting rates has anything to do with electioneering. God forbid, but others seem to find the double-size rate cut in a time of soaring home prices, soaring stock prices and evidence that inflation was set to rise again … a bit overwrought in its worries about the economy IF the government is telling the truth about the economy.

If the economy is doing as well as government GDP claims and as the intermittent hot jobs reports (with intermittent corrections and reductions) say, then why is the following happening:

While inflation expectations rose, sentiment about the broader economy deteriorated as perceptions among households that they might become delinquent on debts increased last month to the highest levels since April 2020.

2020, when people were forced en mass onto unemployment, naturally saw a lot of concern about possible delinquencies as no one knew how the self-imposed Covidcrisis would turn out. Were now climbing back toward those levels of concern.

And it’s not just the poor who are concerned about going delinquent:

The anticipated probability of missing a minimum debt payment over the next three months rose to 14.2% in September, marking the fourth straight month of increases; the increase was most pronounced for respondents between ages 40 and 60 and those with annual household incomes above $100k.

There is no government-forced unemployment this time; so if GDP growth really is trundling comfortably along at 3% as the government’s Bureau of Economic Analysis repeatedly claims, and if inflation really is almost over, then what are people so concerned about?

The latest data confirms the view that the US economy is becoming increasingly split as some households do well while others are getting crushed by rising prices, slower growth and higher unemployment. In other words, stagflation.

So, there you have it—the stealth staglfationary recession I’ve been saying we are in. (At least, many are in it.) Those who don’t own stock equities, as I wrote about yesterday, are struggling. They may partially own a home, but mostly they own payments and cannot realize any wealth off their home because they need to live in it; so, for the time being, it is just a cost to many of them.

Fewer consumers are now reporting being better off while more are reporting being worse off than a year ago.

Overall, an ugly, stagflationary survey, and hardly what the Fed may have expected to see several weeks into the first easing cycle since the global economy was shut down by a genetically engineered flu virus in 2020.

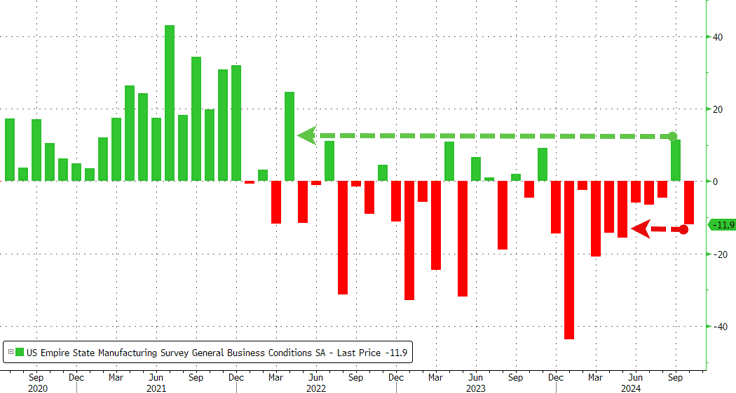

Manufacturing clearly in recession

Meanwhile, the Empire Fed Manufacturing Survey sounded all rosy in last month’s report; but that was a head fake because look at what it has crashed back to:

A sea of red.

We’ve had almost a full year of decline manufacturing, following two years that mostly saw decline. Other regions have reported similar results. September was a nice little kiss for the Biden-Harris admin, but we’re right back in the perilous red sea, and it’s not looking better down at the horizon because new orders plunged twenty points. Prices paid by manufacturers for materials, however, increased to a six-month high.

Can anyway say “stagflation?”

Views: 235