Biden/Harris will be remembered for many things, mostly BAD. Uncontrolled immigration, crime out of control, endless wars, grossly incompetent government administrators, 200k+ missing immigrant children, etc. But wreckless inflation coming from insane government spending takes the cake. And it is heating up again, with the help of The Feral Reserve. Yes, The FERAL Reserve.

Under Biden/Harris, prices are WAY up, real weekly earnings are WAY down.

Gas: +38.2%

Electricity: +31.3%

Fuel oil: +37.4%

Airfare: +24.5%

Hotels: +42.4%

Groceries: +22.1%

Eggs: +69.2%

Baby food: +31%

K-12 food: +69.7%

Rent: +22.9%

Transportation: +31.1%

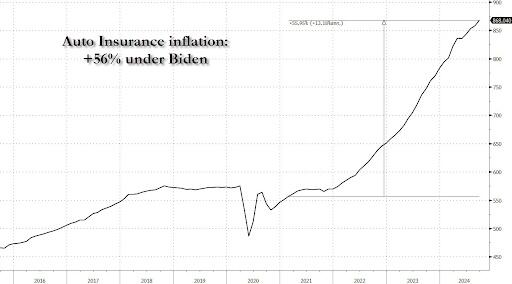

Car insurance: +56.5%

Real average weekly earnings: -3.4%

For the 52nd straight month, core consumer prices rose on a MoM basis in September (+0.3% MoM – hotter than the 0.2% expected) – the strongest since March. That left Core CPI YoY up 3.3%, hotter than the 3.2% expected…

Source: Bloomberg

The headline CPI also printed hotter than expected (+0.2% MoM vs +0.1% MoM exp), with the YoY CPI up 2.4% (hotter than the 2.3% expected but lowest since Feb 2021)…

Source: Bloomberg

Core Services and Food costs surged in September…

Source: Bloomberg

Overall, headline consumer prices are up over 20% (5.1% p.a.) since the Biden-Harris admin took over, which compares to around 8% (1.97% p.a) during Trump’s first term…

Source: Bloomberg

The so-called SuperCore CPI also increased on a YoY basis to +4.6%…

Source: Bloomberg

A surge in Transportation Services costs (record high auto insurance) and Medical Care Supplies lifted Super Core…

Source: Bloomberg

Why is the cost of auto insurance up 56% since Biden and Harris took over?

Source: Bloomberg

Real wages are down since the start of the Biden-Harris administration…

Source: Bloomberg

Finally, we note that money supply is resurgent once again, suggesting The Fed’s confidence in CPI’s decline may be misplaced…

Source: Bloomberg

Could we really replay the ’70s once again?

Source: Bloomberg

Will that really be Powell’s legacy? Or will the timing of this resurgence in inflation be perfectly timed to coincide with Trump’s election victory… and offer a perfect patsy for who is to blame?

Views: 97