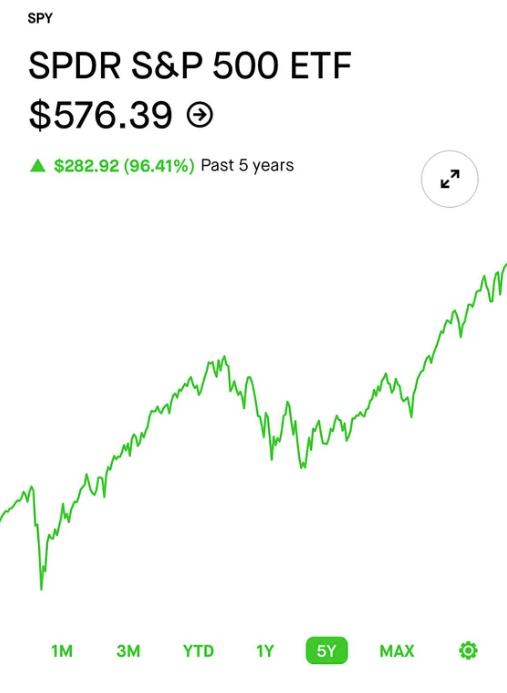

I’ve noticed that the SPY500 has nearly doubled over the last 5 years, while the GDP hasn’t risen anywhere close to that level. The post-pandemic crash made sense, and so did the subsequent rise due to quantitative easing. But now, the continued upward trend doesn’t seem to align with actual economic growth.

If you factor in modest future GDP growth, one might expect the stock market to be where it was pre-pandemic, or perhaps slightly higher due to normal yearly increases. But doubling? That seems disconnected from reality.

What’s driving this surge? Is it just inflation, low interest rates, or something else? Curious to hear your thoughts!

How many people feel like this guy?

I think a lot.

I hear the same stuff yet ATH’s daily in stocks. pic.twitter.com/DflnUBUUgb

— QE Infinity (@StealthQE4) October 10, 2024

2/ In Sept 2007, the Fed cut rates by 50 bps

This cut was in response to increasing signs of economic weakness pic.twitter.com/f5F5I3yegc

— Bravos Research (@bravosresearch) October 10, 2024

4/ However, a key difference between now and 2007 is oil price

Back then, oil surged to new all-time highs

Which played a big role in accelerating the economic downturn pic.twitter.com/CYZOzLaPXe

— Bravos Research (@bravosresearch) October 10, 2024

6/ Another key difference is the internal market strength

For a major breakout to hold, broad participation is necessary

Wherein, lots of stocks move higher to support the rally

— Bravos Research (@bravosresearch) October 10, 2024

h/t ccooddeerr

Views: 105