by Cautious_Kamakazi

The largest banks in the US are reportedly taking big hits to their bottom line as borrowers default on billions of dollars worth of loans.

Citing data compiled by Bloomberg, the Financial Times says that JPMorgan Chase, Bank of America (BofA), Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley appear to have written off a combined $5 billion worth of loans in Q2 of this year as consumers feel the negative impacts of inflation and higher interest rates.

The banking giants point to credit card debt as the primary source of their multibillion-dollar write-offs.

JPMorgan Chase alone absorbed losses of $1.1 billion in bad credit card debt last quarter, an increase of over 66% on a year-over-year basis.

Meanwhile, BofA’s credit card loans account for around 25% of the lender’s unrecoverable debt.

Another pain point for the six banks is the struggling commercial real estate sector, which is witnessing a significant decline in demand as large swathes of the workforce telecommute for several days a week.

Wells Fargo, an institution that reportedly holds over $35 billion worth of office loans, is allocating $1 billion to cover possible losses in the embattled sector.

All in all, the six financial titans are expected to earmark an additional $7.6 billion to accommodate loans that could turn sour.

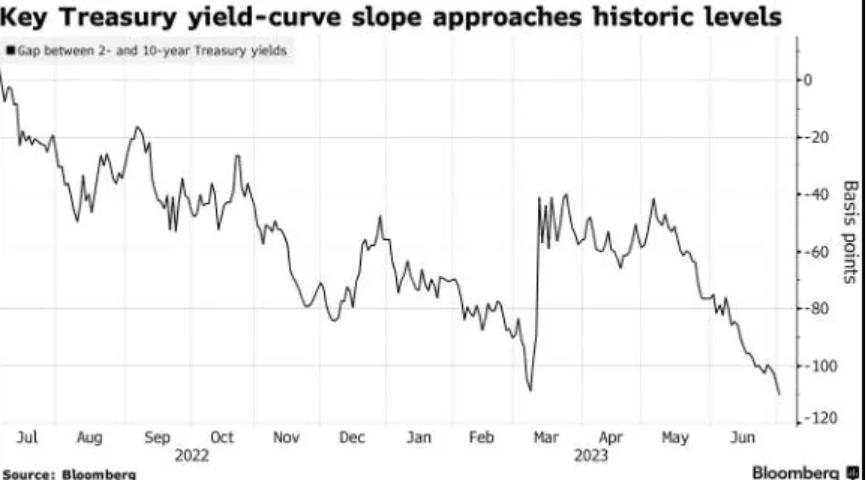

No better, more reliable forecaster of the US business cycle has existed in recent decades than the shape of the US Treasury yield curve, and since last October it’s been signaling another US recession

An inverted curve, which has occurd only eight times over the last six decades and signals a recession with a lag of roughly 10-13 months. Counting from October 2022, a contraction will probably start August to November 2023.

Since the late 1960s US yield-curve inversions have predicted all eight US recessions, beginning roughly a year in advance The yield curve’s forecasting record since 1968 has been perfect: Not only has each inversion been followed by a recession, but no recession has occurred in the absence of a prior yield curve inversion. >>>There’s even a strong correlation between the initial duration and depth of the curve inversion and the subsequent length and depth of the recession. The coming recession will likely be long and deep.

Views: 228