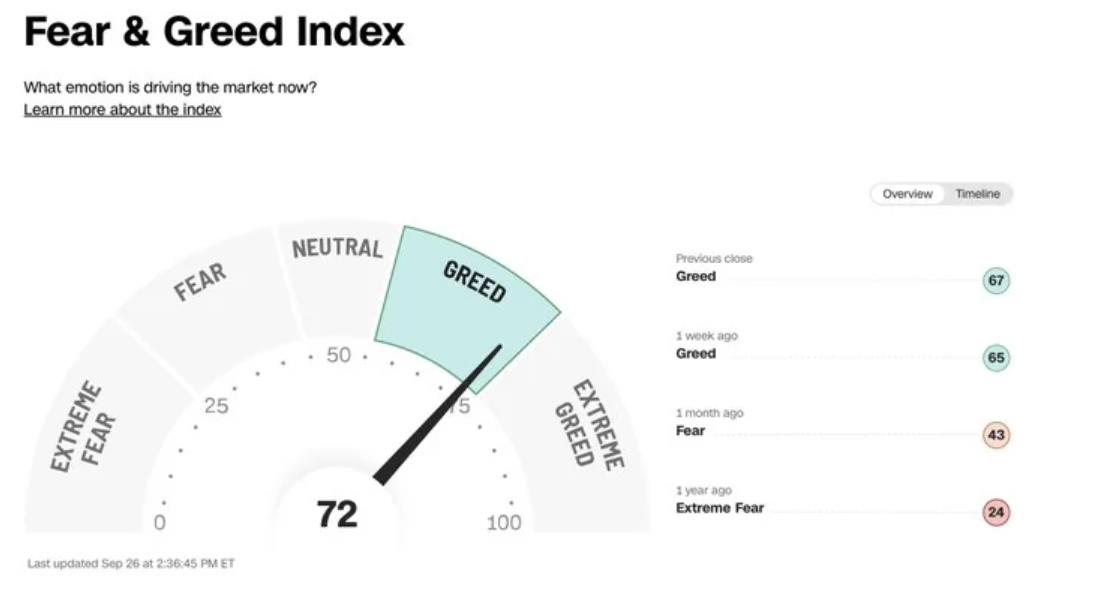

This index measures investor sentiment and is based on seven different indicators:

- Stock Price Momentum: The S&P 500’s current level compared to its 125-day moving average.

- Stock Price Strength: The number of stocks hitting 52-week highs versus those hitting 52-week lows on the NYSE.

- Stock Price Breadth: The McClellan Volume Summation Index, which measures the volume of advancing and declining stocks.

- Put and Call Options: The ratio of put options (bets that stocks will fall) to call options (bets that stocks will rise).

- Market Volatility: The VIX (Volatility Index), which measures expected price fluctuations in the S&P 500.

- Safe Haven Demand: The difference in returns between stocks and Treasury bonds over the past 20 trading days.

- Junk Bond Demand: The spread between yields on investment-grade bonds and junk bonds.

Sources:

www.cnn.com/markets/fear-and-greed

h/t IAmNotAnEconomist

Views: 135