No, this isn’t a John Kerry/Greta Thunberg hysterical warning about climate change. But a storm created by 1) Biden/Congress spending splurge and 2) excessive monetary stimulypto by The Federal (Feral) Reserve. Now that The Fed is withdrawing the excess stimulus, we are seeing a world of pain for commercial real estate. A financial climate change!

“We’re in a Category 5 hurricane,” Sternlicht said in an interview on June 28 taped for a July 25 release in an upcoming episode of Bloomberg Wealth with David Rubenstein.

Sternlicht warned, “It’s sort of a blackout hovering over the entire industry until we get some relief or some understanding of what the Fed’s going to do over the longer term.”

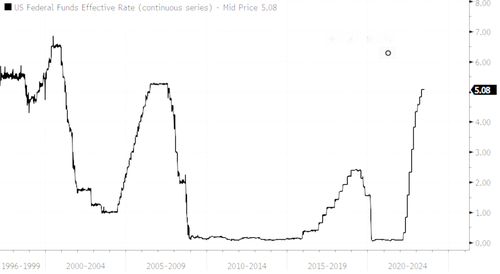

He explained the CRE downturn was sparked by the Federal Reserve’s sixteen months of aggressive interest rate hikes to tame inflation — and unlike past downturns — not due to reckless speculation.

In early March, during the regional bank meltdown, we penned a note that accurately pointed out stress would materialize in the CRE space, mainly in offices and malls. The note was titled Why Small Banks Are In Big Trouble: As Hedge Funds Pile Into The New “Big Short,” The Next’ Credit Event’ Emerges. And since, we have penned countless CRE notes (some of which are here & here & here) about the unfolding crisis.

Tighter credit conditions following the regional bank crisis in March have made refinancing existing buildings exceptionally hard for landlords and come as vacancies rise.

Sternlicht recalled that his firm tried to obtain a bank loan for a small property not too long ago. He said his staff reached out to 33 banks, and only two came back with offers.

According to Morgan Stanley, the elephant in the room is a massive debt maturity wall of CRE loans that totals $500 billion in 2024 and $2.5 trillion over the next five years.

As we’ve seen in San Francisco, the inability to refinance as some properties sustain rising vacancies will pressure landlords to sell properties or walk away from them.

Sternlicht said there’s a very real possibility of a “second RTC” event playing out, referring to Resolution Trust Corp., the government entity that led the effort to liquidate assets of the savings and loan associations that failed three decades ago.

“You could see 400 or 500 banks that could fail,” he said. “And they will have to sell. It also will be a great opportunity.”

Sternlicht launched his real estate firm during the era of RTC, purchasing multi-family units and flipping them to billionaire Sam Zell 18 months later for triple the price.

Sternlicht said the Federal Deposit Insurance Corp would likely begin offloading CRE loans on Signature Bank’s books, which failed in March. He said, “The government’s going to prop up the value of that portfolio by providing very cheap financing to it.”

* * *

Transcript of the interview:

David Rubenstein:

Sometimes people are saying that the best investment opportunity now is distressed real estate debt — that you can buy the debt from banks at a discount. But do you think it’s too early for that?

Barry Sternlicht:

You know, we were gonna give back an office building. And they said, “Well, not so fast. If you want to, we’ll restructure the loan. And we’ll cut the loan in half. And you put the money in here. And we’ll take this as a junior note.” Because the banks don’t want the assets back. They’re not set up to carry these assets. It’s not their business.

So you’re beginning to see stuff. We’re going to see this big trade of the [Signature] Bank portfolio. That’s going to be a benchmark for market.

David Rubenstein:

A lot of fortunes were made in the real estate world in’ 07-’08 when people bought distressed real estate. The late ’80s too, when the RTC was here. Do you see funds being formed to buy these assets? But you think they won’t be available for a year or two?

Barry Sternlicht:

Right now you have an unusual situation in the real estate markets because everyone’s sort of looking at the yield curve. And it says rates will be lower later. Everyone says, “You know, survive till ’25. Hold onto your assets.” So transaction volumes have plummeted.

Unless you have to sell something today, nobody wants to sell anything today. They think tomorrow will be rosier. So for the most part, everybody’s pushing any sales back. But what you’re seeing is when a loan is maturing and a borrower can’t cover the current debt service. Something’s gotta give. Unfortunately, we’re also a lender.

David Rubenstein:

Are we going to change the way office buildings are really valued in the future because tenants aren’t going to need as much space? Or do you think eventually the tenants will come back and the employees will come back?

Barry Sternlicht:

The work-from-home phenomenon is a US phenomenon. If you go to England or Germany, rents are up, and vacancy rates in the top German property markets — Berlin, Frankfort, Munich, Hamburg — are less than 5%. People are back in the office. You and I go to the Middle East, they’re full. We have offices in Asia, they’re full. So this is a US situation.

In the US you have two markets. The nice buildings will stay rented and my guess is at pretty good rates. And the B and C stuff is going to be — maybe fields of grain or something. It’ll be very pretty. We’ll have all these little mid-block parks in New York City because there won’t be anything else to do with those buildings.

The other thing about office is AI. AI is going to hit a couple of these industries that have been big users of office space. So that’s sort of a big question mark in the investment equation.

David Rubenstein:

Let’s suppose I’m an average person. Where should I put my money as an investor in real estate?

Barry Sternlicht:

High interest rates are depressing the number of single-family home units that have been built so now you’re having an ever-increasing scarcity of residential. Given the cost of construction, the whole residential complex — including single-families for rent, multi-family, the housing market, even residential land — I think they make interesting investment opportunities today.

David Rubenstein:

Is it a good thing for people to now invest in a real REIT?

Barry Sternlicht:

I think real estate has a nice place in the balance sheet of any individual. In the pandemic, we raised a special-situations fund and bought 15 names in the REIT business, and we were up, like 70% at one point. We’re going to do that again. And if you take a long-term view, some of these are good companies with the wrong interest-rate environment. I wouldn’t even say they have the wrong balance sheet, but they are so out of favor. There are some really good buys out there. So if you’re clever, you could buy some public REITs.

David Rubenstein:

What kind of return should an average REIT investor expect?

Barry Sternlicht:

In the mortgage REIT, Starwood Property Trust, we’re paying a 10% dividend. So you get that and any appreciation in the stock, and the stock’s currently trading below book value. It usually trades above book value. It used to trade at 1.23 times and now it’s trading at .9. So if it reverts, you’ll get a 15% return. We’ve averaged 11.3% over 10 years.

David Rubenstein:

Why should somebody want a career in real estate? Why is that a good business to be in?

Barry Sternlicht:

You’ve got to find niches, and there are a lot of niches in real estate. And it’s very micro, block by block. If I didn’t have my firm today, could I buy — even in a city like New York — and redo apartments and housing. I could make money doing that. I have a friend of a friend who’s bought 300 homes. He turned living rooms into bedrooms, put them all on Airbnb. He’s earning a fortune and using Airbnb as his distribution set. It’s a giant industry. There’s always something to do.

David Rubenstein:

You were based in the northeast part of the US for much of your career. You grew up in Connecticut, you were born in Long Island. But you picked up and moved to Miami. Why did you do that a few years ago? And any regrets about moving to Miami?

Barry Sternlicht:

Well, my mom’s down there. And I got divorced. That was one reason. Change your life, start over. There was obviously a tax benefit to doing so. And I had sold an interest in my firm at the time. I was based in Connecticut. I was based in Greenwich, our headquarters was there. I looked at my travel calendar in a normal year and I was only home for about a third of it. So I didn’t think it’d be that hard to move and make that my base of operations. It turned I caught the wave perfectly.

I was an early settler into Miami. And, you know, the home prices probably tripled there. I should have bought everything with my house. I would have had the best-performing real estate fund in the world.

David Rubenstein:

If your mother came to you and said, “I have $100,000. I need to invest it somewhere. Where should I invest it?” You would say where, real estate?

Barry Sternlicht:

Today if you look at my portfolio, I have a significant amount of cash that I never had before because I’m getting 5% for the cash. Pretty soon I’m going to just start deploying that capital when I can see the sun coming through the clouds of the Fed’s movement. When the Fed basically tells you they’re done, I think real estate will catch a very firm bid.

Greta Kerry? John Thunberg?? They are the same repeater, and non thinker.

Here the real (financial) climate terrorists!! Yellen and Powell.

Views: 290