Authored by Charles Hugh-Smith via oftwominds,

Is an economy based on the wealth effect generated by front-running the front-runners really that stable?

So the entire economy depends on the stock market going up as punters front-run the Fed–and this is not only fine, it’s optimal, the best arrangement the world has ever seen. On which ethereal plane is this considered sane, much less optimal?

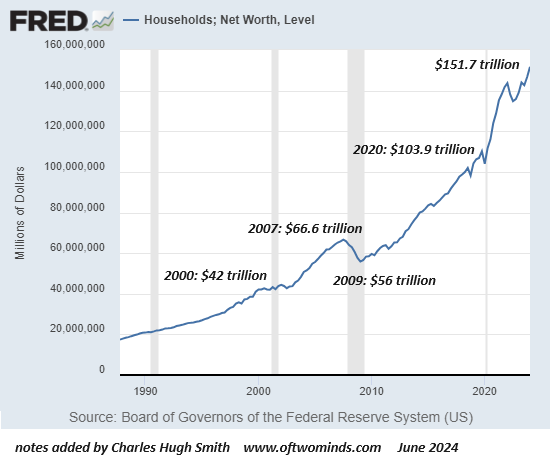

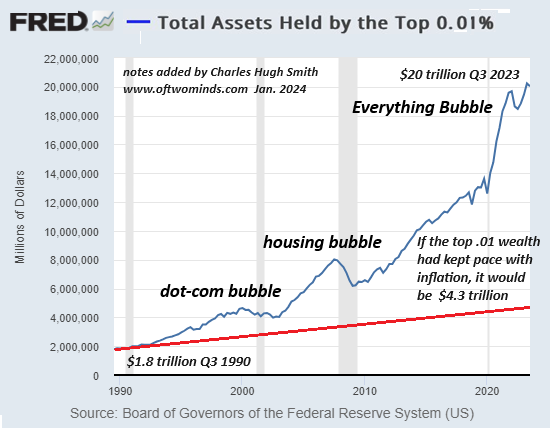

That the real-world economy–a neofeudal confection featuring a parasitic, predatory Nobility vacuuming up virtually all the gains of the Everything Bubble while the bottom 80% stumble along in debt-serfdom, resigned to serving the top 10% who own 90% of the assets bubbling higher–is teetering on the precipice, clinging to the wealth effect of soaring assets, courtesy of the Federal Reserve, for its lifeline is, well, insane.

Speaking of gaslighting–how many people do you know who call this arrangement by its real name, neofeudalism? No one? How many people are trembling with excitement because every time the Fed cut rates at or near the all-time highs in the stock market, stocks were higher the next year–20 times out of 20? Hundreds? Thousands? A great multitude to be sure.

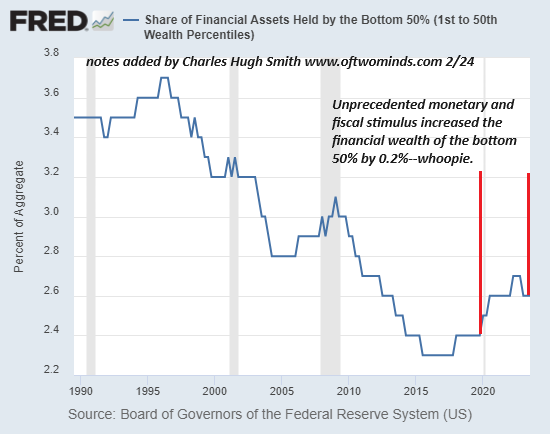

And this outstanding track record of the Fed stimulating the wealth effect is generating ecstatic euphoria in exactly which cohorts? The bottom 50% who own a single-noise 2.6% of the nation’s financial assets? Households paying half their net income in rent? No, the euphoria is limited to the cohort which stands to boost its already gargantuan gains from Fed stimulus–the top 10%.

Does anyone actually buy a stock or index based on the fundamentals? We all answer “yes” because that’s the acceptable cover story for the reality, which is Fed, Fed, Fed: the Fed is going to cut rates, so front-run the rate cut, and then front-run everyone front-running rate cuts, until the golden day the Fed finally does cut rates, then buy, buy, buy, as the statistics–20 out of 20!– guarantee a huge gain regardless of price-earning ratios, revenues, profit margins, or any of that fundamental-analysis nonsense.

Sure, the big research houses spew out reams of the stuff, but nobody actually pays any attention to it, despite their lip-service to the contrary: the only real trigger for pushing the “buy” button is the Fed. Everything else is just the cover story that gives an impression of serious analysis and “investing.”

The economy is dependent on the wealth effect fueling the incomes and spending of the top 10% who collect roughly half the income and account for almost half of all consumption–the high-end consumption that keeps the economy afloat. Should the Fed’s next round of financial fentanyl fail to boost housing and stocks even higher, then the income and spending of those reaping the gains of the asset bubble might stop spending, and the economy will promptly crater.

Let’s summarize: the US economy is completely dependent on one thing: the top 10% front-running everyone front-running Fed stimulus. So front-running the front-runners is the sole support of “growth.”

As for all those gleaming statistics promising fat returns to front-runners, they’re shiny but they’re not causation, or even correlation: if the causal conditions have changed, then the results will be different, regardless of what happened in the past under different conditions.

Have causal conditions changed? Well, how about China, which has transitioned from the engine that pulled the global economy uphill with its famed credit impulse, to the current stagnation caused by its monumental real estate bubble popping, deflating not just consumption but the entire wealth effect that’s fueled its economy for two decades.

If causal conditions have changed, the “guarantee” offered by statistics is empty.

Those holding index funds convinced that “stocks always go up 8% a year over time” will be bagholders because causal conditions have changed, and the smart money has been selling to retail punters enthralled by statistics–20 out of 20, we can’t lose!–and those buying and holding index funds because that’s worked so well since front-running the Fed became the entire market and economy, circa 2009.

Contrary to what stock market statisticians claim, the world is not a mechanical device that spits out rallies when the crank is turned. Though it has been largely forgotten, we inhabit a moral universe, where the absolute faith in greed as the wellspring of plenty, the prideful confidence that our winnings at the Fed’s casino were “earned” by our genius and hard work, while those who didn’t own the assets bubbling higher slip into the abyss–all this hubris generates feedback.

Hubris invites Nemesis. Nemesis offers a curative lesson to greed and prideful over-confidence. We just don’t know in what form or when, but the crank will turn and the results won’t be predictably euphoric.

Is an economy based on the wealth effect generated by front-running the front-runners really that stable? Is an economy based on enriching the already rich so their wealth increases by tens of trillions of dollars as assets bubble higher a sound economy? Or is it an exploitive, parasitic neofeudal economy of extremes awaiting Nemesis? Perhaps we’ll find out sooner than the front-running multitude expects.

New podcast: Is the Everything Bubble About to Pop? (37 min, 40 charts)

Views: 96