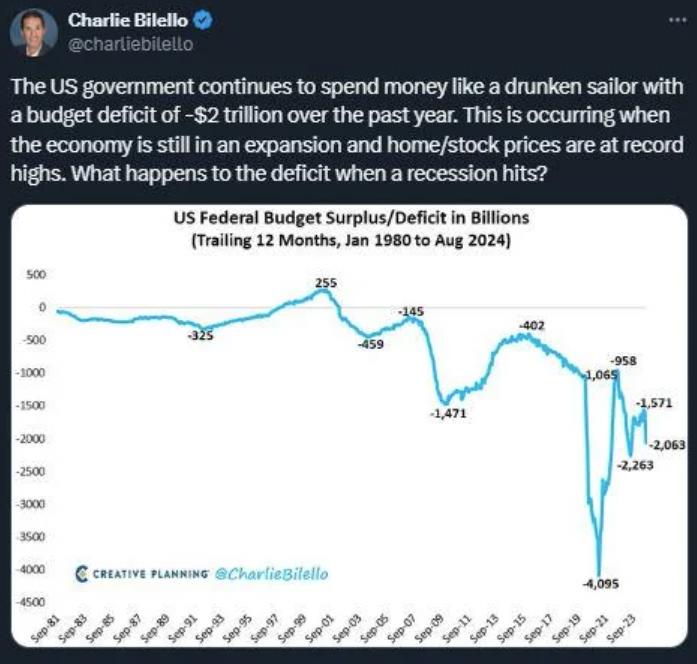

It’s a joke. The US took in less than $4.5T in income in 2023, yet serviced $33T in debt. The US debt was $5.6T 24 years ago (2000), but revenue was $2.025T. Interest payments were $660B in 2023 and $220B in 2000. Expected to be $890B in 2024.

Point being, the US is being financed because interest payments are still manageable. But, the debt is impossible to repaid anytime soon. The moment there is a recession, revenues will dip, and the debt will grow.

Eventually this will result in further monetization of the debt and higher interest rates.

The politicians don’t care because their constituents don’t care. The pols just want to be reelected. So this will continue until the US fails or we anarchy, or both.

This is how Rome eventually died.

h/t Perfect_Alarm_2141

Views: 326