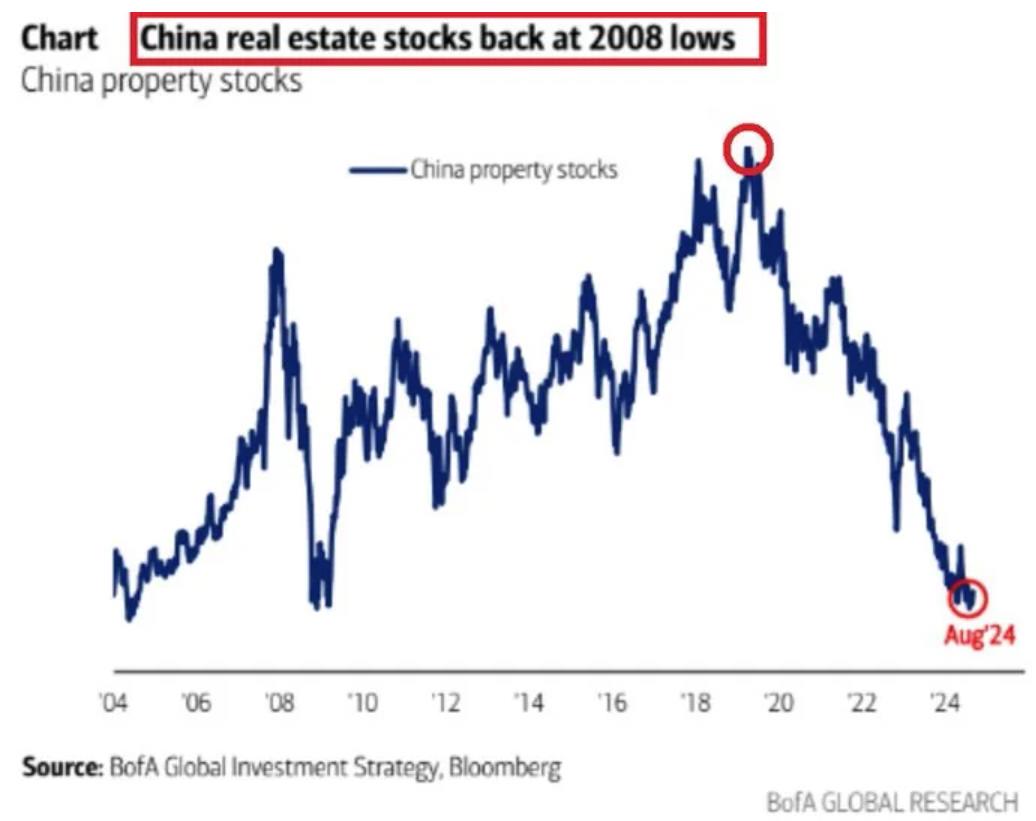

China’s real estate sector is facing significant challenges, with stocks performing worse than during the 2008 financial crisis. The ongoing downturn has been exacerbated by high levels of bad loans and defaults among major developers like Evergrande. This has led to a decline in property sales and new housing starts, dragging down the overall economy.

Sources:

https://www.visualcapitalist.com/china-real-estate-boom-and-crisis/

https://finance.yahoo.com/news/3-years-evergrande-crisis-chinas-093000590.html

https://finance.yahoo.com/news/2008-housing-bust-suggests-chinas-032107651.html

h/t IAmNotAnEconomist

Views: 90