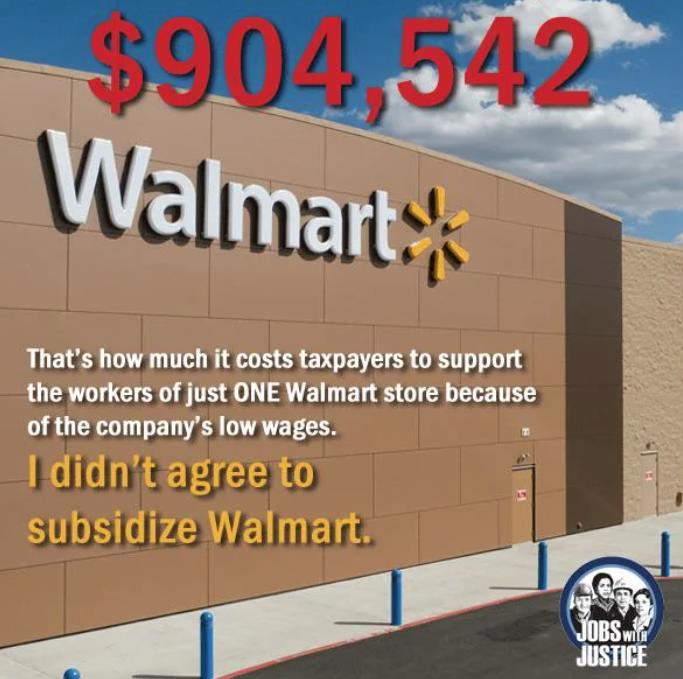

- Walmart and low wages: According to the Princeton study, Walmart pays wages that are low enough that many of their employees need to rely on government assistance (such as food stamps, Medicaid, etc.). Taxpayers indirectly subsidize this by covering the gap between what Walmart pays and what is needed for basic living expenses. The $6.2 billion figure represents the estimated annual cost to taxpayers for supporting Walmart employees who need public assistance due to low wages.

- McDonald’s stock buybacks: Despite making significant profits, McDonald’s—like Walmart—is criticized for paying its employees wages that are low enough to require public assistance. At the same time, the company engages in stock buybacks, which are seen as benefiting shareholders and corporate executives rather than employees. The argument is that the company could use that money to increase wages instead.

- “Welfare queen megacorporation”: This term is used to highlight the idea that, just like the stereotype of “welfare queens” relying on government assistance, these corporations are relying on taxpayers to indirectly support their underpaid workers. Instead of paying a living wage, the companies are accused of pushing the burden onto taxpayers, despite their large profits.

The study:

dataspace.princeton.edu/handle/88435/dsp019s161887r

h/t GobsDC

Views: 350