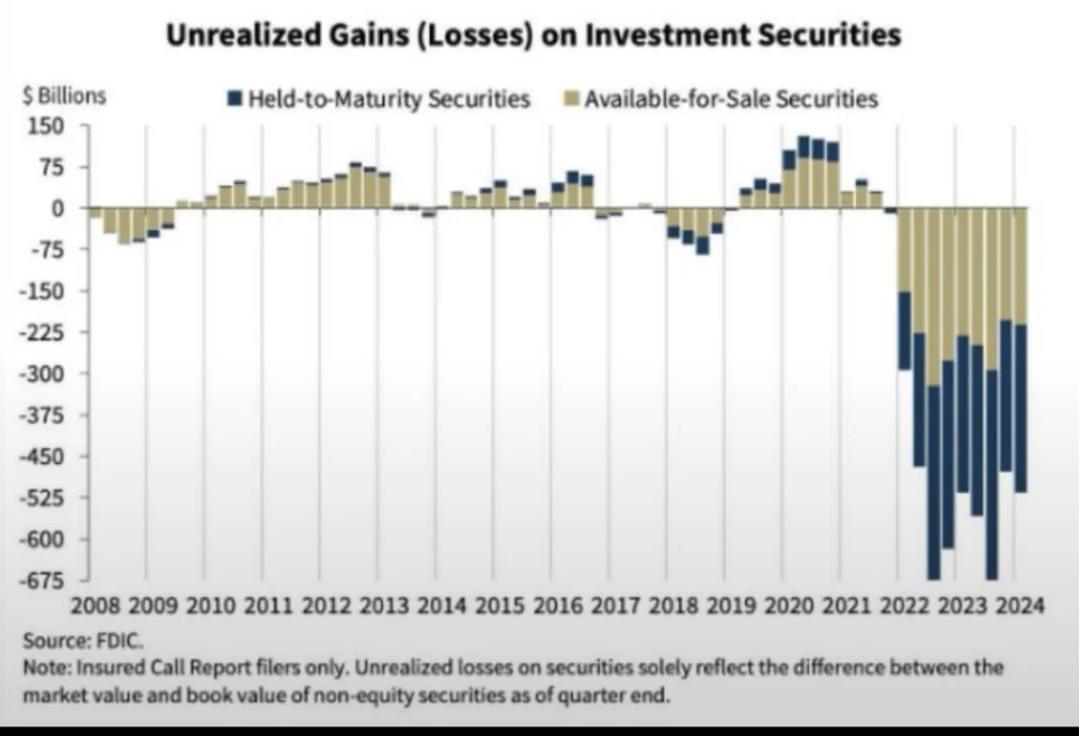

Banks hold bonds, and when interest rates rise, the value of those bonds in the secondary market decreases, leading to a reduction in their book value. This results in banks showing unrealized losses in their portfolios. However, unlike stocks, bonds, when held to maturity, recover their full value as the bond issuer returns the original investment, causing those unrealized losses to disappear.

Thus, if banks can hold these bonds until maturity, the situation is relatively benign. However, if there are bank runs or other circumstances that force banks to liquidate those bonds in the secondary market, the losses would become realized, putting the banks in a precarious position—similar to the regional bank crisis from last year.

h/t StuartMcNight

Views: 110