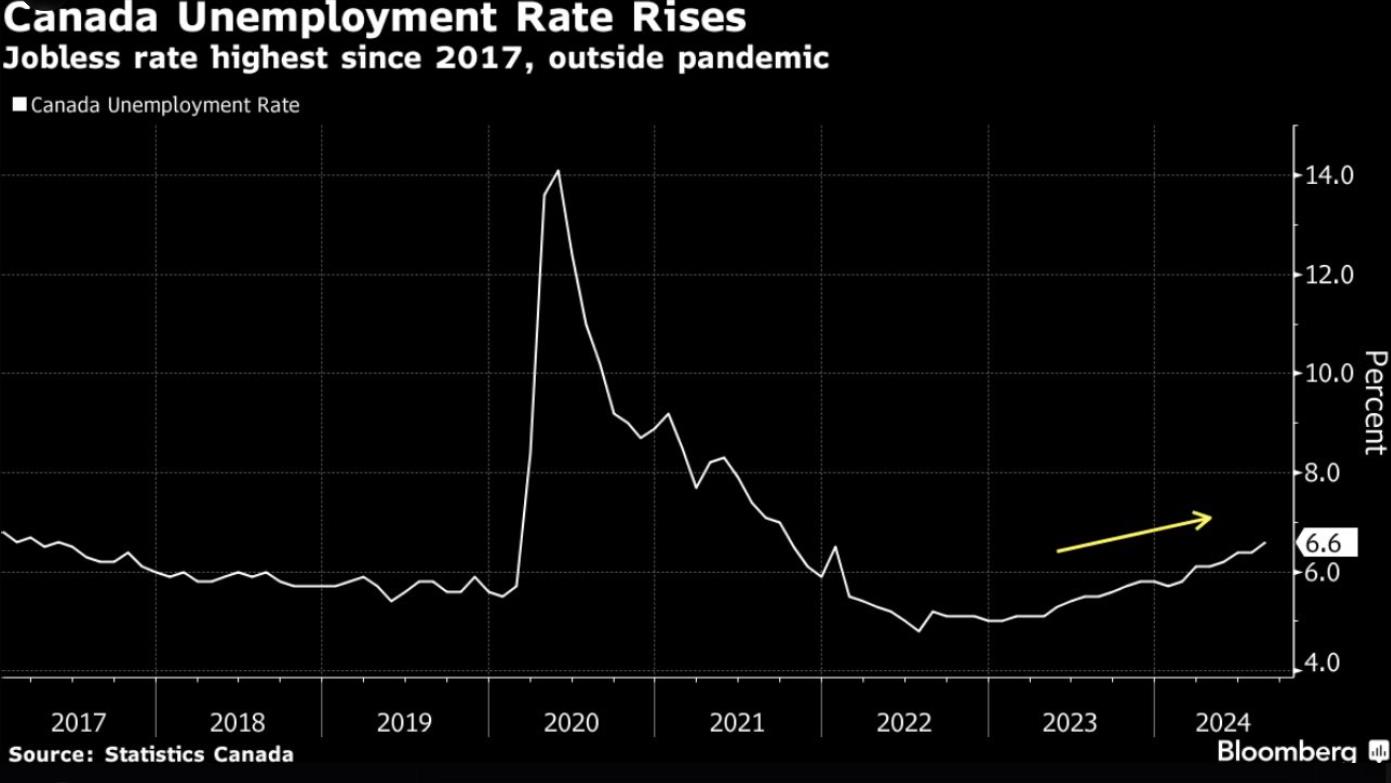

Canada is grappling with a stark reality as the unemployment rate jumps to 6.6%, the highest level since 2017, excluding the COVID pandemic. This is more than just a statistic; it’s a warning sign that cannot be ignored. The youth unemployment rate has reached a staggering 14.5%, with Ontario bearing the brunt at a chilling 17.5%. As Canada continues to add people to its population, the failure to generate corresponding job opportunities is reaching a crisis point.

Business confidence in Canada has plummeted, dropping to 48.20 points in August from 57.60 points in July 2024. This sharp decline signals growing unease among businesses about the economic landscape, a concern that is echoed in the U.S. with the U-6 unemployment rate rising to 7.9% from 7.8%. The latest jobs report was hardly a beacon of hope, especially with another revision cutting jobs by a staggering 100,000.

The risk of unemployment looms larger than ever, and the threat of increased layoffs is becoming a winter reality. The 6.6% unemployment rate may be a misleading figure—many believe it’s much higher. The truth is hidden behind the numbers, with countless individuals experiencing drastic reductions in their working hours. How many people have seen their weekly hours slashed from 40 to just 15 or 20?

This isn’t just about statistics; it’s about lives being affected and families facing uncertainty. As the data paints a grim picture, it becomes increasingly clear that urgent action is needed to address the deepening crisis.

Sources:

ca.finance.yahoo.com/news/canada-unemployment-rate-rises-6-125022406.html

Really not good: “Canada’s youth unemployment rate continued to surge in August, rising to 14.5%, the highest since 2012 outside the pandemic.”

— Genevieve Roch-Decter, CFA (@GRDecter) September 6, 2024

I still believe the 6.6 unemployment rate is BS.

It’s much higher but let’s cook the books.

Do U know how many ppl have had their hours cut from 40-30 hours down to 15-20 a week?!?

Silent Depression 🤫🇨🇦 pic.twitter.com/35jDRAwwWF

— EconomicWoes 🦁 (@ManyBeenRinsed) September 6, 2024

BREAKING NEWS

CANADA's YOUTH UNEMPLOYMENT RATE HITS 14.5%

ONTARIO's HITS 17.5%

AS CANADA CONTINUES TO ADD PEOPLE… BUT DOESNT ADD JOBS

THIS IS A CRISIS! pic.twitter.com/kCrIGDP4wS

— Tablesalt 🇨🇦🇺🇸 (@Tablesalt13) September 6, 2024

Business Confidence in Canada decreased to 48.20 points in August from 57.60 points in July of 2024.t.co/2cUAdiMkdy pic.twitter.com/2OwSLmSN41

— TRADING ECONOMICS (@tEconomics) September 6, 2024

The Canadian employment data shows us how far the Fed is behind with US U-6 rising to 7.9% from 7.8% – this was hardly a ‘positive’ jobs report on yet another -100K in revisions

Risk for unemployment is still much higher and layoffs will increase into the winter. #MacroEdge

— Don Johnson (@DonMiami3) September 6, 2024

The Canadian employment data shows us how far the Fed is behind with US U-6 rising to 7.9% from 7.8% – this was hardly a ‘positive’ jobs report on yet another -100K in revisions

Risk for unemployment is still much higher and layoffs will increase into the winter. #MacroEdge

— Don Johnson (@DonMiami3) September 6, 2024

Views: 199