by Chris Black

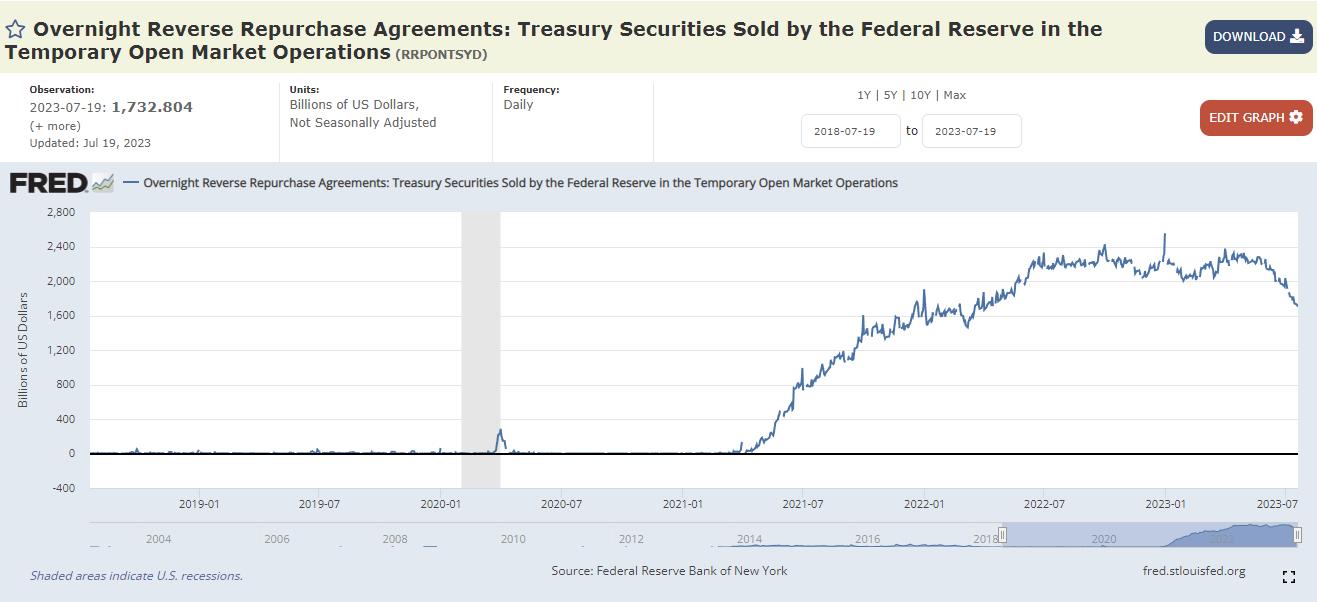

Use of the Fed’s liquidity-neutral reverse repo facility has hit above $2trn+ for most of H1 this year and, with the facility offering over 5% risk-free, options to drain it have been limited. On June 1, one day after the debt ceiling was resolved and the Treasury was given the all-clear to refill the US govt’s coffers, the RRP topped $2.2trn (t.me/marketfeed/413042).

In May we suspected that the TGA would be replenished through a drain on liquidity-boosting bank reserves , and said this would be a headwind on asset prices.

This risk was widely known (www.bloomberg.com/news/articles/2023-05-18/a-1-trillion-t-bill-deluge-is-painful-risk-of-a-debt-limit-deal?), particularly in the already-fragile banking sector, and posed a challenge for the Treasury.

Incredibly, they were able to avoid it:

On June 7, the Treasury announced its plan to refill the TGA by issuing short term (even one day) T-bills (www.treasurydirect.gov/instit/annceresult/press/preanre/2023/SPL_20230607_1.pdf).

This surge in bill supply cheapened short term bills and pushed short term yields above the expected path of the RRP (chart on right), enticing money market funds (MMFs) to rotate money out of the RRP and into higher-yielding T-bills.

MMFs are always able to invest in the RRP, so they are only interested in returns above the RRP offering rate (which has been 5.00% since early May ).

Another source of hesitation from MMFs arose from Fed policy uncertainty — if the Fed will raise the RRP offering rate at the June FOMC, why take money out of the RRP to invest in bills? This was likely the primary reason why the Fed decided to skip an interest rate hike in June .

Shorter-term bills also reduced this concern as they span fewer Fed meetings.

The rapid $500bln rise in the TGA post-debt ceiling resolution thus averted the potential market disruption had it been financed by bank reserves. SEC data (www.sec.gov/dera/data/form-nmfp-data-sets) indicate that the refill was almost entirely financed out of RRP balances, and drained the RRP down to levels not seen since April 2022 (t.me/marketfeed/425736).

The decline in RRP balances through July (fred.stlouisfed.org/series/RRPONTSYD) indicates that MMFs continue to rotate money out of Treasury reverse repo and into T-bills – which will serve as another tailwind for asset prices.

Lower rate volatility would encourage rotation out of RRP into bills.

So I think hikes and pauses have similar impact as long as they are well telegraphed so that the outcome is firmly in market prices.

I think June was well understood, so MMFs would not have had to worry about buying bills and then getting surprised by a hike.

So it’s possible that June pause was motivated by TGA refill via RRP.

Going forward there is less certainty, but that can still be avoided by buying very short dated bills (if the yields still make sense).

Views: 214