Authored by Charles Hugh-Smith via oftwominds,

Rather than glory in success, we are better served by being extremely wary of success.

If success is a trap, isn’t that where we all want to be, trapped in success? Maybe not. In response to my recent essay for subscribers, China Adrift: Now Is the Winter of Our Discontent, several readers asked why China couldn’t just continue its astounding boost phase of growth without pause.

The short answer is success is a trap: the policies that generated the amazing growth of the boost phase are naturally viewed as the keys to everyone’s dream, permanent high growth. But those policies only worked like magic in a particular set of circumstances in a particular moment of history, and while no one is noticing, the great success changes the circumstances and the moment in history passes.

As a result of the great success of the policies, circumstances change such that the policies no longer work. It’s ironic, isn’t it? The policies that optimized the harvest of the all the low-hanging fruit generated rapid, sustained growth. But the very success of the policies changes the circumstances that enabled rapid growth by stripping the tree of fruit.

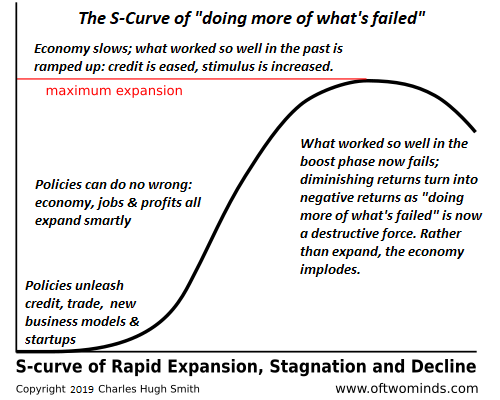

Now that circumstances have changed, the policies no longer generate growth, they generate systemic risk, risks that are ignored in the belief that the policies will restart growth if only we do more of what worked in the past.

In the exuberant boost phase, the low-hanging fruit seem endless, but nothing is limitless, and once the low-hanging fruit has been plucked, diminishing returns set in: all the easy windfalls have been exploited, and what’s left is barren soil that requires investing more capital and taking on more risk–risk that goes unrecognized, because everyone has become accustomed to assured gains.

Thanks to recency bias, we assume what worked in the recent past will keep working. As a result, there is no incentive to look for alternative policies. Rather, there are powerful financial and emotional incentives to paper over signs of diminishing returns as threats to an emboldened status quo that has boosted everyone’s prospects and hopes.

This is how the status quo ends up doing more of what’s now failing. If loosening credit greased the remarkable expansion, then the solution to a slowdown is to loosen credit even more. If subsidies and stimulus boosted growth, then the solution is to expand subsidies and stimulus.

The problem is that once the mighty machine has reaped all the easy gains, throwing gasoline on the embers no longer creates growth, it generates systemic risks, as loose credit and subsidies encourage the moral hazard of high-risk investments gushing into marginal projects that soon become tottering dominoes in the financial system.

Success is a trap is scale-invariant, meaning that it is true for individuals, households, small enterprises, global corporations, central banks and governments alike. The day trader who has booked astonishing gains by riding a meme stock higher with high-risk options bets will soon acquire a belief that they’ve discovered the Holy Grail of Trading, a system or approach that enables them to book immense gains like clockwork.

But circumstances change, and the meme stock rally fades, and attempting to replicate the grand success of the system that can’t lose ends up losing all the gains of the heady days of limitless success.

This is how former Intel CEO Andy Grove described the trap of success: “Success breeds complacency. Complacency breeds failure. Only the paranoid survive.” But there is another dynamic operating beneath the emotional appeal of success and doing more of what worked in the past, and that is the inherent difficulty of adapting to changing circumstances.

This is why the S-Curve tops out and declines: adaptation is not easy or assured, and decay leads to collapse more easily than it leads to successful adaptation

Successful adaptation requires experimentation and a series of failures as not all experiments yield productive adaptations. In Nature, this process of responding to the selective pressure of rapidly changing circumstances is automated: individuals in the species generate random mutations–experiments seeking improved performance in changing circumstances–or epigenetic changes that improve the individual’s chances for surviving the new conditions.

In the human experience, individuals and organizations must undertake this grueling adaptive process of experimentation and constant failure consciously. It is not automatic, nor is a positive result guaranteed. The odds favor decay and collapse, which is what we observe in human history.

Rather than glory in success, we are better served by being extremely wary of success. The ascent of the boost phase seems so effortless and forever, while the slide down the backside of the S-Curve is well-greased by our hubris and complacent confidence that doing more of what worked so well in the past will work its magic again.

Oh, right, there’s a Federal Reserve meeting coming up. How apropos.

New podcast: The Great Unwinding. (33 min)

Views: 104