2024 is not looking like a good time to retire. Today we consider 3 red flags that are enough to make you reconsider any plans you may have for the next year or two…

From Peter Reagan for Birch Gold Group

As you near retirement age, one of the decisions you get to make is when to file for Social Security benefits and officially retire from the workforce. By this point, you’ve saved as much for your future as can. Your savings priorities change from growth to preservation.

Before officially embarking on your retirement journey, it’s smart to consider both the current state of our economy as well as the current state of Social Security. While both will certainly change during the years ahead, we don’t know with certainty how they’ll change. What we DO know is what’s happening right now – and that may be extremely important.

We’re going to focus on three key “red flags” that signal tough economic times ahead, and how they play a part in the Social Security benefits you will be receiving after you file.

They are, in no particular order: The cost-of-living-adjustment or COLA, the inflation rate, and increasing piles of personal debt.

Let’s get started…

Social Security’s COLA isn’t a raise

According to the July 2024 official update, the rate of price inflation has finally eased below the 3% mark (it’s 2.9%).

With that in mind, you might be thinking that the 2.63% cost-of-living-adjustment that the Social Security Administration offered for 2025 would cover that.

Unfortunately, COLA isn’t a raise, and that means price inflation could rob you blind once you “make the leap” into retirement on a fixed income.

An article on Newsmax compared the current COLA offering with inflation:

The COLA for next year will be a 2.63% rise in Social Security benefits, substantially lower than 2024’s 3.2% and 2023’s 8.7% increases, according to The Senior Citizens League.

While the pace of year-over-year inflation increases has been decreasing, coming in at 3.0% in July, cumulative inflation since 2021 has jacked up prices for goods and services by an average of 22%. The problem for retirees is that between 2020 and 2023, average grocery prices rose 24%.

The 86% surge in the price of a dozen eggs and 72% spike in the cost of iceberg lettuce from 2020-2023 grabbed headlines, to be sure, but many other everyday items have become much more expensive, too.

See, the COLA raises future benefits payments based on past inflation rates – by the time you get your slightly bigger check, you’ve already paid the higher prices.

In other words, the horse is way behind the cart, unlikely to ever catch up.

On top of that, while the headline rate of inflation may have (finally) eased below 3% after 39 grueling months, according to Peter Schiff, things other than eggs and lettuce are still expensive too:

Electricity prices are up almost 5% year over year. Shelter (i.e. rent and housing costs) are up more than 5%. Medical costs are up 3.3%. Services in general, which include everything from childcare to tax preparation, are up almost 5%. Transportation is up nearly 9%. Motor vehicle insurance is up 18.6%!

Inflation, the tax that no one voted for and everyone pays, punishes those on a fixed income the most. Even when that fixed income is “indexed to inflation.”

We can’t forget that the source of this inflation adjustment is questionable, as well… When a COLA is calculated, it’s based on the headline rate of CPI inflation. Official CPI is problematic at best, considering it hasn’t factored in basic standards of living since it was “improved” in the 1990s.

All this to say, don’t make the mistake of relying on Social Security’s COLA to actually keep up with your personal cost of living.

So maybe consider delaying your retirement a little while? Unless you’ve already saved plenty and aren’t too worried about economic volatility.

Because the U.S. economy is looking pretty shaky right now, too…

Households buried in debt have given up on saving

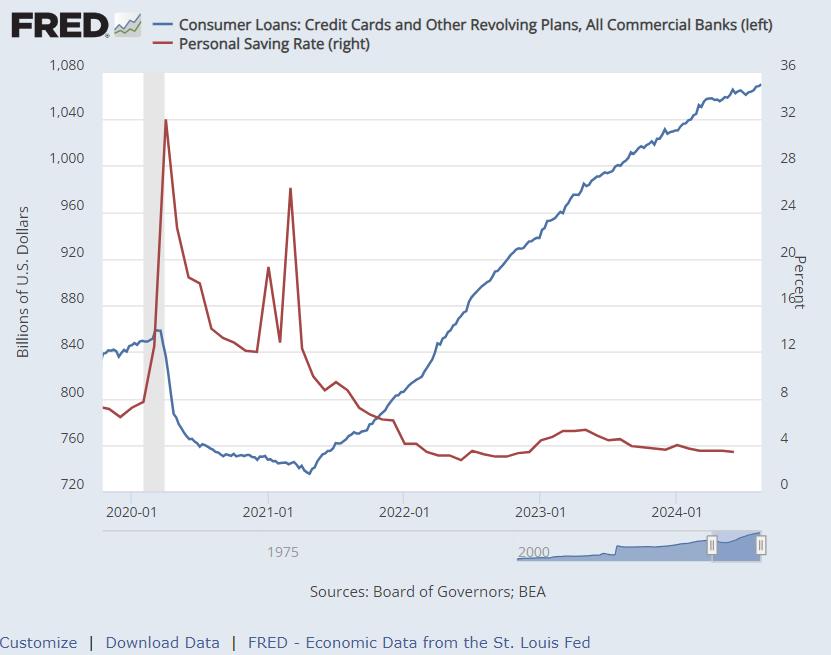

Those Americans who have already retired, and may be on a fixed income, are part of the same group of people who are saving less and burying themselves under piles of credit card debt to get by (see the graph below):

When prices go up – especially prices on food, fuel and housing – we pretty much HAVE to pay them. I don’t know about you, but for me, eating, keeping the lights on and driving are no more optional than having a home.

When those prices rise faster than our ability to pay for them, we whip out the plastic. Credit card balances are up an absolutely astonishing 40% in the last three years alone! News that credit card debt broke the $1 trillion mark earlier this year mostly went unnoticed. (Except for those desperate to maintain their standard of living…)

Which leads us to just one of the solutions that our elected leaders are proposing to help struggling Americans (it’s an election year, after all).

One solution that Vice President and presidential candidate Harris has proposed is a radical one. She appears to be proposing a form of government-enforced price controls:

Harris said that “building up the middle class will be a defining goal of my presidency” as she promoted her plan for a federal ban on price gouging by food producers and grocers…

Harris’ grocery pricing proposal would instruct the Federal Trade Commission to penalize “big corporations” that engage in price spikes and it singles out a lack of competition in the meat-packing industry for driving up meat prices.

Historically, government-enforced price controls have destroyed whole industries and even economies. For anyone who remembers Nixon’s disastrous flirtation with price controls in the 1970s, this is an insane proposal. For anyone familiar with the history of the former Soviet Union, or Cuba, or Venezuela, or Argentina (and so on and so on), we know where this road takes us.

This is a polite summary of the standard economic thinking on the subject – not even a radical position:

Over the long term, price controls have been known to lead to problems such as shortages, rationing, deterioration of product quality, and illegal markets that arise to supply the price-controlled goods through unofficial channels. Producers may experience losses, especially if prices are set too low. This can often lead to a drop in the quality of available goods and services.

Even the St. Louis Federal Reserve stated that price controls should “stay in the history books.”

To sum up, it’s a challenging time to consider retirement. There’s no guarantee Social Security will be able to meet your cost of living increases, the economy is on the brink of a recession and presidential candidates have some strange ideas about how to fix things.

That doesn’t mean you should give up on your golden years…

Your retirement savings need stability

Keep in mind, if you’re nearing retirement age, you’re probably in the “retirement red zone.” That means every decision you make could be a critical one.

One of those decisions is planning how your retirement assets are diversified amongst asset classes, vehicles, and types. (We cover more on proper diversification here).

For example, there are certain assets that are more inflation-resistant than others. In fact, they’re so important, we’ve devoted an entire education page to them.

There are also assets like physical precious metals, that have proven themselves historically to be a great store of value and financial stability.

But the main thing to consider right now is this: Whatever you decide to do, do it before it’s too late, because it appears like there are rough economic times ahead. That could mean any COLA you receive along with your Social Security benefits won’t be able to keep up.

It might also be a good idea to learn more about the wealth preserving benefits of precious metals in our free information kit (updated for this year).

Views: 416