by bitkogan

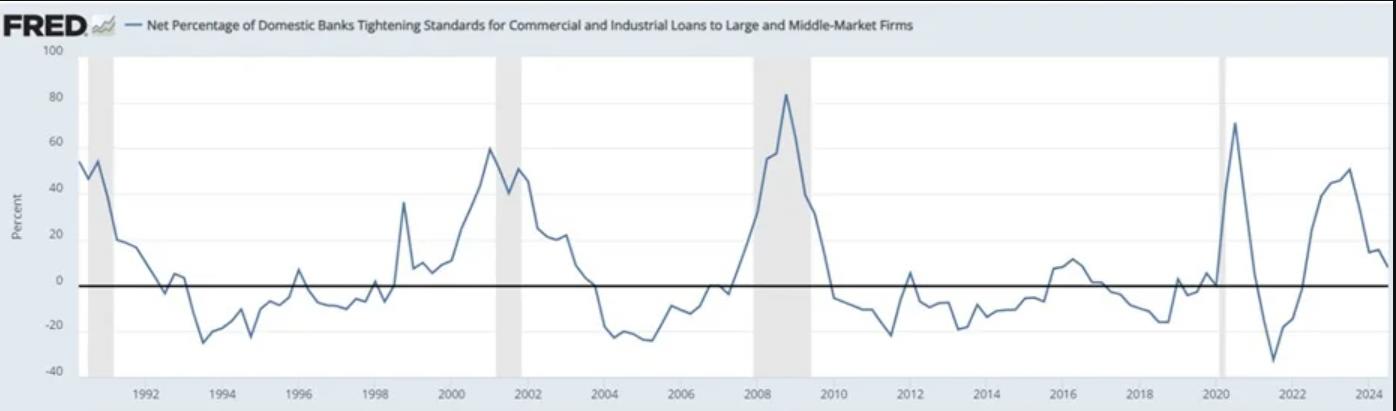

I’ve been watching this chart for a while.

It’s good that the percentage of Domestic Banks Tightening Standards is low. However, a year ago, it was over half, and things have only tightened further since then.

Historically, every time this indicator crossed the halfway mark, a recession followed—either during the peak or right after. In 2020, it even happened before the peak.

Perhaps we’ve been very lucky.

Or a recession is still on the way. In that case, the Fed shouldn’t delay rate cuts—25 basis points in September won’t make much of a difference.

So, today’s CPI could end up being bad news for stocks.

As for TMF and TLT, the key point is that rate cuts are inevitable, and long-term yields will continue to decline. Just as I mentioned on Monday.

Views: 19