The first part of this article is free to everyone in order to bring everyone up to date on how rapidly the world is collecting its citizens into a totally centralized cashless society. It also includes links and a password to give you access to some previously privileged content about the move toward cashless control that was originally for my Patrons only. I want to make sure everyone has access to the big picture that was once conspiracy theory but is now mainstream news starring major actors who are playing themselves.

The International Monetary Fund is making sure all digital currencies are global

First, a little refresher on what we’ve already seen in the news this month and covered in editorials in The Daily Doom:

The first big story was the push by the International Monetary Fund to make sure all central-bank digital currencies (CBDCs) work on a global platform right out of the gate. The IMF wants to makes sure digital currencies that are controlled by central banks as each nation’s legal tender don’t starts off with each nation doing its own thing to where they struggle to integrate globally over time. So, it is creating a global platform.

In an article titled “IMF Pushes Global Central Bank Digital Currency Platform as Cashless Trend Builds Steam,” we learned …

The International Monetary Fund (IMF) is working on a platform that would allow various central bank digital currencies (CDBCs) to interoperate on a global scale, which comes amid a broader push toward cashless societies and concerns about risks to freedoms….

IMF managing director Kristalina Georgieva told conference participants on Monday in Rabat, Morocco,… “CBDCs should not be fragmented national propositions … To have more efficient and fairer transactions, we need systems that connect countries—we need interoperability…. For this reason at the IMF, we are working on the concept of a global CBDC platform.”

In case you were concerned your nation’s first move into a digital currency changeover would not work globally, the IMF is letting you know they have this covered … or are hard at work on solving it. It is not there yet, and that may be what is holding up CBDCs’ large-scale rollout:

Georgieva said the IMF wants central banks to reach a consensus on a common global regulatory framework for digital currencies that would give global adoption a major boost.

The IMF believes that the absence of a global platform on which various countries’ CBDCs can interoperate would make a weaker case for their use and cryptocurrencies would step in to fill the void. CBDCs are controlled by central banks, while cryptocurrencies are generally decentralized.

It is vital to the globalists that we do not do anything in a decentralized way. God forbid cryptocurrencies should cut central banks out of central control of the currency in use. Then where would their power be?

“The last thing we want” is the emergence of “settlement blocks” where CBDC transactions are settled within separate ring-fenced regional frameworks.

So, global they are going to be … pretty much right out of the gate, though some are past “out of the gate” and have crossed the finish line:

She said that out of 114 central banks around the world that are exploring issuing national CBDCs, around 10 have already crossed the finish line.

This is a determined globalist move:

“We will pursue relentlessly together” the development of central bank digital currencies…. The agency sees the widespread adoption of CBDCs as a near given.

To accomplish Earth’s move to becoming a global cashless society, the IMF has increased the staffing it has working on digital currency.

We also learned just this month that the UN seeks to make sure you have a digital ID attached to your bank account. I wrote about this in an earlier editorial, so I won’t repeat it all here. (“Line Up for your Global/Interstellar ID Number”) I’ll quote just one paragraph of that as a refresher:

The UN Secretary-General Antonio Guterres states that the United Nations is planning to introduce a global digital ID system that is linked to individuals’ bank accounts. He wants to make sure every individual in the world can be directly tied to his/her/its bank accounts. You probably should be afraid: Why does the UN need to know my bank account number? And why do I need to have a globally recognized number to identify me? We’ve survived for thousands of years without one. The plan … is similar to the system developed by the World Economic Forum.

You can read all about Guterres’ initiative in that editorial, but the active integration here is the important point. The silence of global leaders expressing any concern about these global digital IDs is deafening. Bill Gates pushed for the same thing during the Covid pandemic (for everyone’s wellbeing of course). I wrote in detail about Gates’ push for global digital IDs clear back in the early Covid days for RT and on my past site here: “CASHLESS SOCIETY 2020: Bill Gates Goes Viral on Digital ID and Digital Currency.”

If anyone thinks this is not a globalist agenda, they should note the articles quoted here state that the UN is working in conjunction with the IMF. The UN is pushing the digital ID attached to your bank account, while the IMF is pushing the global integration of all digital currency. In a video at the end of this article, the head of the world’s largest central bank, the Bank for International Settlements, also pushes hard for the new CBDC system.

So we have a global digital currency system being worked out openly now by numerous major players that will be attached to each person’s identity and bank account. The UN even titles its program “Our Common Agenda.” “Brief 5” of the common agenda is titled: “A Global Digital Compact — an Open, Free and Secure Digital Future for All.” They have no reservations in stating their agenda is a common globalist digital compact to create a digital future for everyone that includes (another title) “Reforms to the International Financial Architecture.”

We are clearly very deep into the process of the entire world switching to an integrated digital currency system tagged to you and your bank account.

Where is the US in all of this?

Digging a little further back for those who joined the conversation after I switched from writing on The Great Recession Blog to focusing on The Daily Doom, the US is not far behind on all of this. I wrote sometime around last June about how Biden ordered all government agencies to lay out clearly the ways in which a dollar-based CBDC would impact them and how they would integrate with it by that fall.

Then, in September, the Biden Administration issued a paper detailing the technical framework for a central-bank digital currency in America, and in October/November the Fed began beta-testing such a system with 100 chosen banks. Finally, the Federal Reserve planned to premier its centralized “distributed” ledger this June or early July, but for some reason that got delayed.

This week the announcement came out that banks are starting to use it to clear all transactions nearly instantaneously: (This is no longer the beta test. This is a decision by these banks to make permanent transition to this system.)

FedNow goes live with 35 early-adopter banks and 16 payment service providers

The Federal Reserve has announced that FedNow, its new system for instant payments, is live, allowing banks and credit unions “of all sizes” to sign up and utilize the tool “to instantly transfer money for their customers, any time of the day, on any day of the year.”

… said Federal Reserve Chair Jerome Powell … “Over time, as more banks choose to use this new tool, the benefits to individuals and businesses will include enabling a person to immediately receive a paycheck, or a company to instantly access funds when an invoice is paid.”

The central bank said the U.S. Department of the Treasury’s Bureau of the Fiscal Service and 35 early-adopting banks and credit unions are already prepared to utilize the system, and 16 service providers are ready to support payment processing….

The system has been designed so that bank and credit union customers will be able to sign up for the service through their financial institution’s mobile app, website, and other interfaces to send instant payments quickly and securely.

That system, I wrote not long ago, will likely become the backbone of the Fed’s own CBDC when the digital dollar is ready to roll out. I look at it as, first they are going to get all banks using this instant digital transaction system before switching all of society over to using it at stores before they switch to their CBDC replacement for cash, which is, therefore, likely still a little ways away. (And most likely their CBDC, when they do roll it out, will run concurrent with digital dollars as we already know and use them on this system before they just take our unprogrammable, anonymous cash away. The Fed is nothing if not patient:

While the Federal Reserve has not made any definitive plans to introduce a CBDC, it’s looking into the matter and has announced the imminent launch of the FedNow service, an “instant payment” platform that some say lays the groundwork for the future adoption of a CBDC.

I wrote about that in an earlier article exclusively for Patrons of The Great Recession Blog, but I will now make it available to all readers: “Will We be Force-Fed Fedbucks.” (To read the article, click the link, then enter the password frogs.)

While Chair Powell says otherwise, some now are agreeing with me:

“FedNow appears to be a prototype CBDC,” Jordan Schachtel, publisher of “The Dossier” on Substack, stated in a tweet….

The Fed has denied that FedNow is related to the adoption of a CBDC, insisting that it is a payment system that allows businesses and individuals receive instant payments in real time.

During congressional testimony in early March, Fed chair Jerome Powell was asked by a lawmaker whether there’s an advantage to the FedNow payment system over a CBDC or stablecoins that also tout faster payment services.

“A CBDC is going to be years in evaluation,” Powell replied. “And I think we can get this into the hands of the public very quickly, and we’ll have real-time payments in this country very very soon.”

So, maybe the Fed’s CBDC is a few years away still, but an instant payment transaction system that could easily become the backbone of a cashless system did come about “very, very soon.” The United States is already running on it, as of this week, and you probably didn’t even notice the difference. To consumers, the only observable difference is how almost rapidly your checks or debit transactions post to your account if your bank is on the system. This year, I’m sure, will focus on drawing as many banks into the net as possible.

I think the Fed’s denial that FedNow is related to adoption of a CBDC simply means the Fed was going to go to FedNow well before a CBDC was adopted and even should a CBDC never be adopted. And it did, even as the Fed continues to work out how its CBDC will integrate with the UN’s agenda and the platform already being developed by the IMF.

I think it is also denying the connection to avoid controversy:

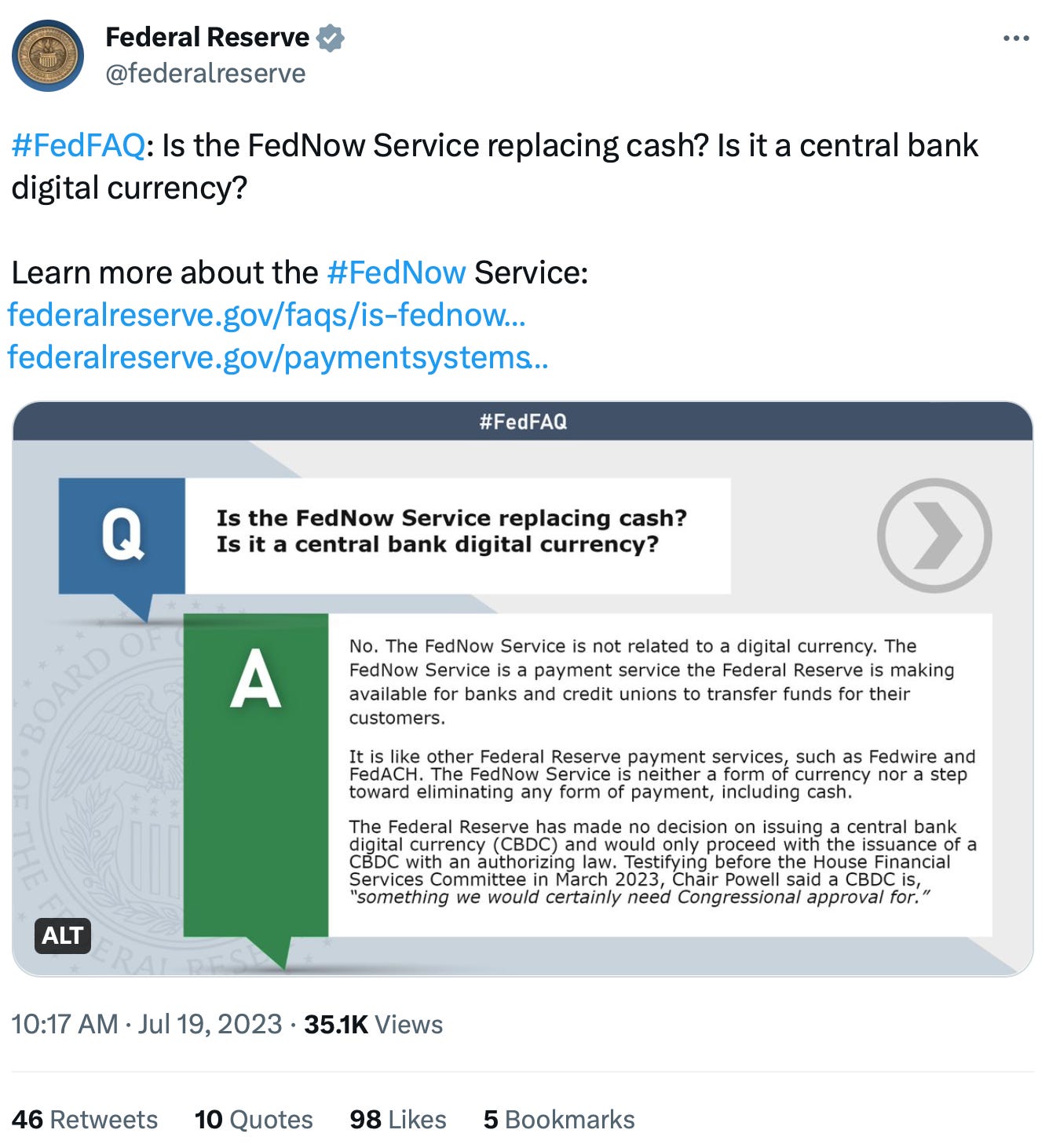

As part of the launch of the new service, and in an effort to avoid public backlash due to the contentious topic of central bank digital currencies (CBDCs), the Fed published a Twitter post clarifying that the FedNow Service has no relation with CBDCs.

Here is their full clarification statement:

Clearly, most banks are not up and running on FedNow yet, and certainly most retailers are not. However, the Fed has said, as mentioned in my article referenced above, it intends for private developers to use the platform to create all kinds of apps that will work wonderfully well for instantaneous digital transactions between banks, retailers, and their customers. It is a matter of gaining broad acceptance before going to a CBDC.

As the rollout spreads, all of the Fed’s conventional payment/transaction systems that run slower, such as FedWire, are, of course, still available because most banks are not yet part of the rollout, but the Fed is anticipating they will want to join quickly. For now, the banks need all the old forms so they can all keep talking with each other.

The U.S. Federal Reserve is due to imminently launch a long-awaited service which will aim to modernize the country’s payment system by eventually allowing everyday Americans to send and receive funds in seconds, 24 hours a day, seven days a week. The “FedNow” service, which has been in the works since 2019, will seek to eliminate the several-day lag it commonly takes cash transfers to settle, bringing the U.S. in line with countries including the United Kingdom, India, Brazil, as well as the European Union, where similar services have existed for years. FedNow is launching with 41 banks and 15 service providers certified to use the service, including community banks and large lenders like JPMorgan Chase, Bank of New York Mellon, and US Bancorp, but the Fed plans to onboard more banks and credit unions this year.

To give you a sense of how quickly that can happen, it appears the reason the rollout of FedNow did not happen in June or early July as some stories had indicated because major banks were holding out, but it did’t take long for them to see the benefits:

The service will compete with private sector real-time payments systems, including The Clearing House’s RTP network, and was initially opposed by big banks who said it was redundant. But many have since agreed to participate on the basis that FedNow will allow them to expand the services they can offer clients. “For us, FedNow really is a wonderful way of expanding reach,” said Anu Somani, head of global payables and embedded payments at U.S. Bank….

Unlike peer-to-peer payment services like Venmo or PayPal, which act as intermediaries between banks, payments made via FedNow will settle directly in central bank accounts.

The major banks are rapidly seeing how all those promised apps at the retail level will, as I laid out in those earlier articles of mine, cause lots of retailers to demand their banks provide full integration with this Fed service — so many apps for everything to lure the customer’s eyes with instant bank transactions at every site they shop from. (That idea is especially appealing for the retailers because they will get the cash flow from sales verified into their own bank account within seconds.) So the push is on!

The Fed also operates a real-time payments system called FedWire, but that’s reserved for large-scale, mostly corporate payments and is only operational during business hours. While the new FedNow system is for everyone, it’s likely to benefit consumers and small businesses the most, analysts have said.

So, the path to a full CBDC may be a little slower than I first thought it would be, though I have noted for a few years that the Fed is being very deliberative about the whole process. It’s just a little more deliberate than it sounded like it might be with all of Biden’s edicts last year. It is, however, picking up speed quickly.

Countervailing forces

One thing that always makes sure there are no straight lines to any goal in economics — even those of global central bankers — its that there are always counterforces that arise like that backlash concern the Fed just seemed to be trying to circumvent … even at or near the top. Not everyone running for president in the Democratic Party, for example, is in line with the globalist agenda and one candidate in particular is pressing against it to try to raise that backlash:

The U.S. government will use the current banking crisis to promote a central bank digital currency (CBDC), warned presidential hopeful Robert F. Kennedy, Jr. The candidate has come out in opposition to CBDCs in the United States, warning that its adoption would heighten financial surveillance and threaten basic freedoms.

“CBDCs grease the slippery slope to financial slavery and political tyranny. While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private financial affairs,” Kennedy wrote in a tweet on April 5. “The central bank will have the power to enforce dollar limits on our transactions, restricting where you can send money, where you can spend it, and when money expires.”

Those are the risks that many have now noted about CBDCs and that I have also been warning of for a few years. CBDCs are controllable (“programmable”). Your access, as I keep warning, can be turned on or turned off. As I said in a recent editorial, you may think you don’t need to worry about that because you haven’t anything illegal hide in your transactions. You need to worry about what new laws, like recent vaccine mandates, the government decides to impose that you decide to write against, protest against, or avoid. You need to worry about governments throughout the world that already clearly proved (as if it were a test run) they will lock you out of participation in social events and spaces (and soon out of your own bank account as happened briefly to Canadian truckers and to protestors in Pakistan) and even out of your livelihood (as they did to me) if you protest your government or simply don’t comply with the next emergency mandates.

(I also talk about the above stories in my recent interview on Rethinking the Dollar, if are interested and haven’t seen it yet.)

And that brings us, in the next section, to a look at the frightening details (in their own words) on …

How they are going to roll it all out…

The powers that be are not hesitant in saying outright that what they need in order to get cooperation is another pandemic or some other kind of global shock:

World Government Summit: ‘Shock’ Needed to Usher in ‘World Order Transformation’

During a panel discussion [at February’s World Government Summit in Dubai], Professor Arturo Bris from the IMD World Competitiveness Center argued that a “shock” is needed to shift global society away from the current “world order.”

He insisted that the “transformation” of the “world order” “cannot be gradual.”

We, of course, all experienced how rapidly such shocks can work through the world when citizens across the world, without any direct representation, were stripped of their normal social rights to walk around freely, to write freely, in some cases to protest freely, and even to gather together for worship under former religious freedoms, and even to decide what drugs go into their own bodies or even to earn a living. The stripping of long-held basic rights were stripped away for the public good by legislatures, presidents/prime ministers and governors, even mayors.

I was one who was fired for refusing to become vaccinated. Yet, I got Covid and, in two weeks (at age 63 and overweight) got over it and recovered perfectly, while I know others vaccinated 2-4 times who came out far worse. And I did not — that I am aware of — infect anyone other than my fully vaccinated wife.

The WEF, the UN, the IMF and all these other non-government powerhouses learned from that experience that there is nothing like a frightening health crisis (whether it is fully real or fully imagined) to make the world compliant in losing its freedoms. In fact, they learned so much from it that some speculate (for example, in the video at the end of this article) the pandemic may have just been a beta run.

“The big question is how we are going to go through this transformation. It cannot be gradual,” he asserted. “It has to be, has to be, driven by … a certain shock that will happen.”

You can hear him in his own words here, which he ties to meetings and reports of the World Economic Forum: (He makes that particular point at the 7-minute mark.)

As you can hear, these globalists admit they have missed in all their forecasts, and the movement toward a world order has plenty of dissonant voices, even within it. In spite of all the centralized power these non-elected bodies managed to grab during the pandemic, forcing their plans on everyone, these speakers at this event do not see that as enough or even as a success.

There is no straight path to their future. They cannot even adequately see the future a year or two down the road, as they describe in this video; yet, they relentlessly believe they must push for the kind of global cashless society described above and for a global world order. The key phrase is the one used above by the IMF: relentlessly together. You also hear them talk about their need to control the conversation, particularly on social media, which has become the center of the world politic.

One of the key flaws they bring up over and over in their conversation about the new world order they would obvious like to see is the fragmentation between nations. Dr. Bris is, at least, wise enough to realize this is a real problem throughout the world that stands in the way of the “New World Order” and in the way of the global currency. He is, however, foolish enough to say Europe, fragmented as it is, is the answer — the path forward.

That is deluded because Europe has barely managed to hold the euro together as financial stresses grow between nations that naturally have very different economies; yet, Europeans have far more in common with each other than, say, Europe has with South America or India. This is always the downfall and danger of globalism. Centralized power and centralized economies or currencies cannot manage the disparate people of this world. So, they wind up destructively forcing surrounding nations to comply — just as Hitler and Stalin did.

What they should see is that the struggles of Europe to hold together (think of Brexit and the oft’-talked-about Grexit and Italeave) are compounded when you try to fold in Africa and China and Taiwan and India and South America. It absurd to think there can be “one ring to rule them all.”

That kind of system is like a statue made of iron and clay — the two do not form an alloy that binds together in unity with equity for all. It easily crumbles apart. Trying to force it with central control inevitably leads to austere and autocratic processes. If you cannot have a euro that holds together equitably for each country in Europe, how much less can you have a single currency for the world. Yet, that relentless push together is their clearly stated agenda … even if it takes another crisis to get it to happen. How diabolical … yet stated right out in the open. Though they do not state they intend to engineer such a crisis, one does not get the impression they would hesitate to do so.

Notice, too, how everyone wants to think they are going to lead the coming transformation. Bris believes Europe will lead it, but he knows the US wants to lead it. China wants to lead it, and Russia wants to break it if it can’t lead it. None of these major national entities is too inclined to give up their lead. So, they will work to make sure, if some kind of global currency develops, they, at least, have an edge over the others. That means there are always going to be designed fractures — control joints.

Crisis can bring diverse parties together for survival, including survival of their central plans, but when the crisis is over, the unity typically starts to fall back apart. Human history is replete with that. Close relationships that form out of crisis and immediate need usually do not endure beyond the crisis.

The need of a shock to reset the system was brought up by other powerful voices at another summit that was attended less than a month ago by the biggest of banksters and globalist leaders — “The Summit for a New Global Financing Pact”:

French President Emmanuel Macron has opened the Summit for a New Global Financial Pact in Paris that seeks to find financial solutions to the interlinked global goals of tackling poverty, curbing planet-heating emissions and protecting nature.

In his opening remarks, Macron on Thursday told delegates that the world needs a “public finance shock” – a global push of innovation and financing – to fight these challenges, adding the current system was not well suited to address the world’s challenges….

… “What is required of us now is absolute transformation and not reform of our institutions,” said Mottley, whose country has put forward a detailed plan for how to fix the global financial system to help developing countries invest in clean energy and boost resilience to climate impacts. “We come to Paris to identify the common humanity that we share and the absolute moral imperative to save our planet and to make it livable….”

Other participants include United Nations Secretary-General Antonio Guterres, US Treasury Secretary Janet Yellen, IMF Managing Director Kristalina Georgieva and World Bank President Ajay Banga.

Kind of makes one wonder whether that is why the always-complicit mainstream media has been running so many stories of calamity this month that always start out with “human caused climate change.” I’m not suggesting they could engineer the heat, and I’m not even sure they are lying about it being record-breaking; but they are certainly all using it to score major points about climate change as the intro to each story.

If you need a good reset crisis, it appears they have found one they might hope to attach to.

Presenters at the event noted that the international economic framework had been battered by a number of crises, including the pandemic and the war in Ukraine, but focused on “the spiraling cost of weather disasters intensified by global warming” as a reason for the ongoing destabilization of financial systems.

That does gain a new sense of meaning when we reflect back to what we just heard about needing a crisis to establish “the global reset” back in that February conference in Dubai. I personally have never witnessed any destabilizing of financial systems due to weather. I’ve only seen destabilization of financial systems due to the people who are operating them.

Now, if we will trust the control of our weather to these same people, everything will be made better; but how would bankers save the world from a climate crisis?

“We can take steps right now and take a giant leap towards global justice,” [Guterres] said, adding that he has proposed a stimulus of $500 billion a year for investments in sustainable development and climate action. There was also a plan presented to use the IMF’s Special Drawing Rights basket as a mechanism to boost global liquidity.

Ah, so use the taxes or credit of governments and dole out the money through the UN and its apparently affiliated banks. That is one path that might be easier to maintain control of with a central global currency system that has a digital ID tagged to each individual’s bank account.

Yet, here they are, trying to take control and institute a sweeping Reset plan for the calamity they created. But where is all of this leading?

Last year the UN suggested that developed and emerging economies like the US and China would have to pay a kind of wealth/emissions tax of at least $2.4 trillion a year into a fund for climate change developments, and this wealth would be redistributed to poorer nations. Redistributed by who? Well, the globalists, of course….

These all seem like disjointed plans to simply inflate prices through different forms of taxation and force the public to consume less goods, but there is a much bigger scheme at play here. It’s important to understand that climate change is nothing more than a vehicle to deliver a fully centralized global economic system, likely under the control of the IMF, BIS, World Bank and the UN….

I suspect that this is all culminating in a currency crisis which the globalists will use as an opportunity to finally introduce their CBDC (Central Bank Digital Currency) model. And once CBDCs are implemented their ability to dominate the populace will be complete. A cashless system with no privacy in transactions and the ability to shut down the buying power of individuals and groups at will? It’s a totalitarian’s dream scenario.

It’s no mistake that the public is being constantly bombarded with global warming propaganda these days – The powers that be need an existential crisis as a fear generator. When people are afraid they don’t think rationally and will often turn to the worst possible leaders for relief. And a global threat requires a global response, right?

Whether all the climate crisis news is being pumped and massaged toward that end or not, I have long suspected that, too, and long made that same argument that a global financial crisis would be the needed tipping point to get us to slide as quickly into a global currency as the answer to the crisis. After years of writing that, we saw how a global health crisis got the world to give up so many other long-held rights.

If the present “heat dome” crisis goes away at the end of the summer like so many of those other crises the UN, et. al. thought they could use to aggregate control, then why not a crisis they have proven quite capable of orchestrating and sustaining on their own … like a good financial crisis baked out of inflation — the very kind of heat bankers can directly control — as the banking expert in the video below describes? They have been making and sustaining those for years, and I have written for years that such a crisis would bring on the global cashless system.

If only we had a single global central bank digital currency the top bankers could use to help overcome the climate crisis or the next health crisis by collecting and “equitably redistributing” the wealth. If only….

The final two sections and video below lay out their scheming plans (in their own words) as to how they will now implement this global cashless system as quickly as possible. They might need some higher form of intelligence to guide them on this.

Views: 540