by Michael

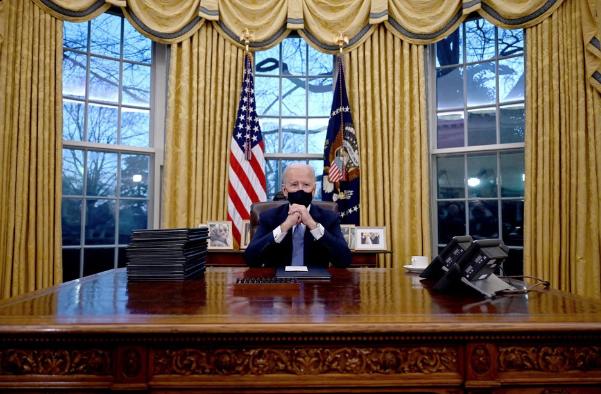

When you look at Joe Biden, you are also getting a visual picture of what is happening to our economy as a whole. Both have been getting artificially propped up for a long time, both are now sick once again, and both are starting to decline very rapidly at this point. There is lots of speculation that Joe Biden is not going to be able to make it much longer, and of course the exact same thing could be said about the U.S. economy. Sadly, the truth is that the clock won’t stop ticking and time is not on the side of either one of them.

On Wednesday, we learned that Joe Biden has once again tested positive for COVID…

President Joe Biden tested positive for COVID-19 following an event Wednesday in Las Vegas, the White House confirmed.

This is the third time the president has tested positive for the virus. And Biden is not alone: the positivity rates for COVID-19 have been increasing recently, as have visits to the emergency department and deaths.

Biden, 81, is vaccinated and boosted and is “experiencing mild symptoms,” White House press secretary Karine Jean-Pierre said in a statement.

The White House is trying to make it sound like this isn’t a big deal, but Biden certainly didn’t look like he was just “experiencing mild symptoms” when he arrived in Delaware on Wednesday night…

The 81-year-old – whose political future is in jeopardy due to his age – walked very slowly off Air Force One, pausing multiple times.

He then put on a mask on inside the black SUV that carted him off to his beach house in Rehoboth.

Biden also appeared to need some assistance as he slowly nudged himself into the car before the motorcade pulled away.

Of course this is happening at a time when speculation that Biden could drop out of the race has reached a fever pitch.

Axios is reporting that some “top Democrats” believe that Biden could make an announcement “as soon as this weekend”…

Several top Democrats privately tell us the rising pressure of party congressional leaders and close friends will persuade President Biden to decide to drop out of the presidential race, as soon as this weekend.

Personally, I don’t know if Biden is ready to throw in the towel quite yet.

But we shall see what happens.

Meanwhile, more bad economic news continues to pour in.

For example, we are being told that home eviction filings are way up all over the nation…

Home evictions are on the rise in several major cities nationwide as Americans continue to grapple with the ongoing cost-of-living crisis.

Eviction filings over the past year are up more than 15% compared with the period before the COVID-19 pandemic began in 10 cities across the country, according to the Eviction Lab, a research unit at Princeton University. The Eviction Lab tracks 10 states and 34 cities.

However, the problem is noticeably worse in five cities, where the eviction rate is at least 30% higher than it was before the pandemic started.

Whether someone is seeking to rent or buy, housing costs have soared into unprecedented territory.

And this is one of the biggest reasons why so many Americans are so deeply frustrated with the economy right now.

According to Fox Business, the “median monthly housing payment for homebuyers in swing states” has risen 92 percent since the last presidential election…

The cost of buying a house has surged in recent years, as high mortgage rates and rising home prices put ownership out of reach for many Americans.

The problem is even worse for the millions living in key battleground states that could determine the outcome of the 2024 presidential election.

New findings from Redfin show the combination of steep mortgage rates and elevated home prices has pushed the median monthly housing payment for homebuyers in swing states to an all-time high of $2,161 – a 92% increase from the 2020 election.

This is going to have an enormous impact on how people vote, and that is not good news for the Democrats at all.

At the same time, banking industry problems continue to mount and local branches continue to be shut down at a staggering pace…

US banks closed 28 branches across the country in just one week in July.

Wells Fargo, Bank of America and US Bank each closed eight locations in the last week.

The remaining locations were closed by Greenville Fed, Chase and Schaumberg Bank & Trust, who each closed one branch.

Watch the banking industry, because I believe that this will eventually become a huge story during the months ahead.

Retailers are permanently shutting down lots of locations too. In fact Stop & Shop just announced that they will be closing 32 grocery stores…

Stop & Shop is closing 32 underperforming grocery stores across the US northeast as part of the company’s efforts to improve its financial performance.

Shoppers are also being squeezed by higher prices at the grocery store, with food prices experiencing modest upticks last month, according to the newest inflation report.

“Stop & Shop has evaluated its overall store portfolio and made the difficult decision to close underperforming stores to create a healthy base for the future growth of our brand,” said the chain’s president Gordon Reid in a release.

Needless to say, that isn’t even worth comparing to what Walgreens is getting ready to do.

The plan is to shutter more than 2,000 Walgreens locations before it is all over, and that is really bad news for those that have come to depend upon that chain…

Shoppers, it may be time to find a new pharmacy. Walgreens is closing up to a quarter of its 8,600 stores within the United States.

Walgreens CEO Tim Wentworth recently explained to the Wall Street Journal on June 27 that the closures would focus on locations that aren’t profitable, too close to each other or stores struggling with theft.

Unfortunately, this is just the beginning, because vast hordes are businesses are likely to go belly up during the coming years.

According to one recent survey, almost half of our small businesses are convinced that they will not survive “the current economic climate, ongoing inflation or another four years of Biden administration policies”…

Nearly half of 80,000 small businesses surveyed say they won’t survive the current economic climate, ongoing inflation or another four years of Biden administration policies, according to the survey conducted by RedBalloon and Public Square.

Their May Freedom Economy Index found that small businesses “remain in survival mode,” with 40% delaying paying bills to manage cash flow and 70 percent putting staffing plans on hold, neither hiring nor reducing staff, “the highest reading … over the past year,” the report states.

We are in far more trouble than most people realize.

I have been documenting the ups and downs of our inevitable economic decline for more than a decade, and now we have reached a stage where that decline is threatening to become an avalanche.

So I would encourage you to brace yourself for very hard times, because it has become clear that this is a story that is not going to end well.

Views: 254