JUST IN 🚨: Warren Buffett Indicator hits 195%, the highest level in history, surpassing the Dot Com bubble, the Global Financial Crisis, and the 2022 Bear Market pic.twitter.com/SAE5MbHTlY

— Barchart (@Barchart) July 9, 2024

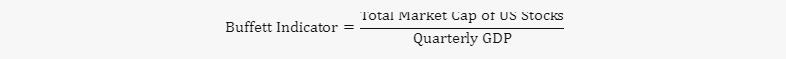

The Warren Buffett Indicator, a metric favored by the legendary investor Warren Buffett, has surged to a record high of 195%. This indicator compares the total market capitalization of publicly traded US stocks to the quarterly gross domestic product (GDP). When it exceeds 100%, it suggests that stocks are overvalued relative to the size of the economy.

Here’s how it’s calculated:

The market is in a precarious position. The low volatility and tight dispersion imply stability, but the high dealer gamma exposure indicates a potential for dramatic shifts.

x.com/AndrewThrasher/status/1810661235689427241

x.com/FinanceLancelot/status/1810637523359855096

- Compressed Period for the $VIX: The $VIX, often referred to as the “fear gauge,” measures market volatility. A compressed period means the $VIX is experiencing low volatility and tight trading ranges. It’s noted that this level of compression has been rare over the past decade.

- Dispersion: Dispersion here refers to the spread or range of returns of different assets. Lower dispersion means asset returns are moving in a more correlated manner with less variance.

- Dealer Gamma Exposure (GEX): Gamma exposure reflects how much dealers need to adjust their positions as the market moves. A 250% increase to $16 billion indicates that dealers have significantly increased their exposure to options, particularly being net long (holding more call options).

- Implications of High Gamma Exposure: When dealers are net long options, they must buy more underlying assets to hedge their positions as the price rises, which can create upward pressure on the market. Large spikes in gamma exposure often precede significant market movements.

- Potential for a Violent Reversal: The significant increase in gamma exposure can lead to heightened market sensitivity to price changes. This means that while the market may initially move upward due to buying pressure, it can also set the stage for a sharp reversal if conditions change, as the need for dealers to adjust their hedges could amplify market movements in the opposite direction.

x.com/SuburbanDrone/status/1810699656759791849

x.com/great_martis/status/1810472430764523582

Views: 207