via jessefelder

It is far easier and more lucrative to hype “the future” than it is to actually build it.

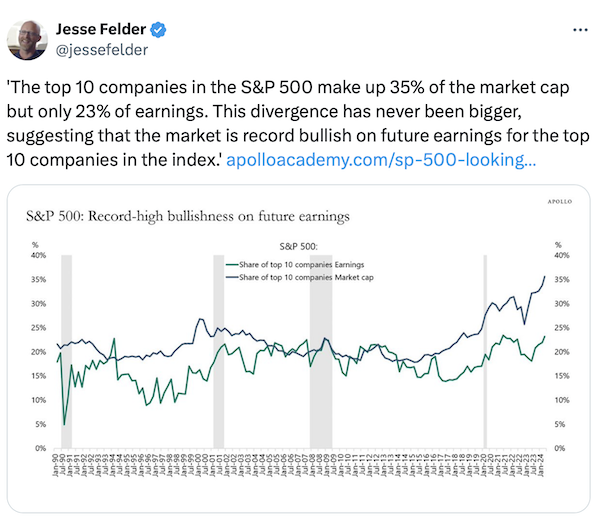

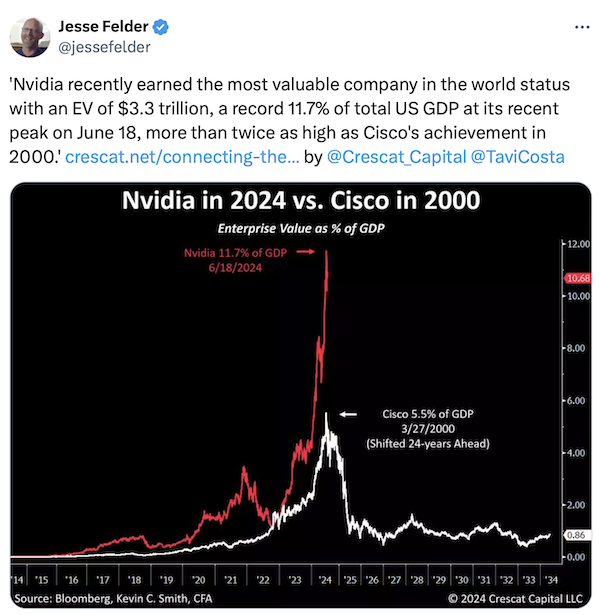

And there is now a record amount of hype built into the valuations of the biggest stocks in the market.

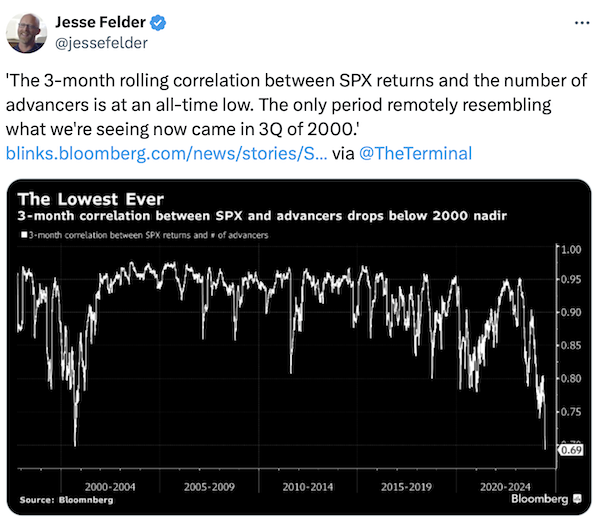

Meanwhile, the failure of the rest of the stock market to keep pace has led to unprecedented divergences in a variety of breadth measures.

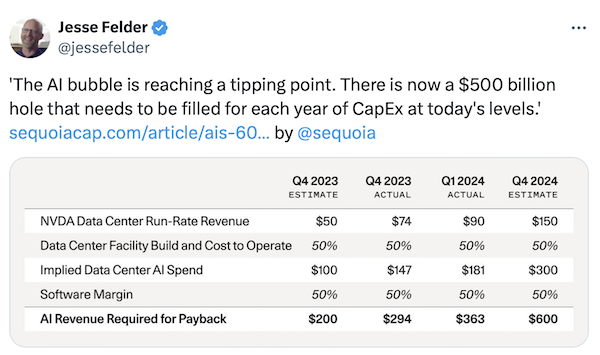

However, there is little fundamental evidence so far to suggest that reality will live up to the hype around Big Tech.

Given the size of the sheer size the bubble this time around, its aftermath could prove especially problematic.

Views: 261