by TonyLiberty

45-year mortgages are becoming more common in Canada as negative amortization rises — It’s a ticking time bomb.

Negative amortization happens when the monthly payments are not enough to cover the interest, so the principal amount of the loan actually increases over time.

This can happen when interest rates rise or when the borrower has a variable-rate mortgage and interest rates increase.

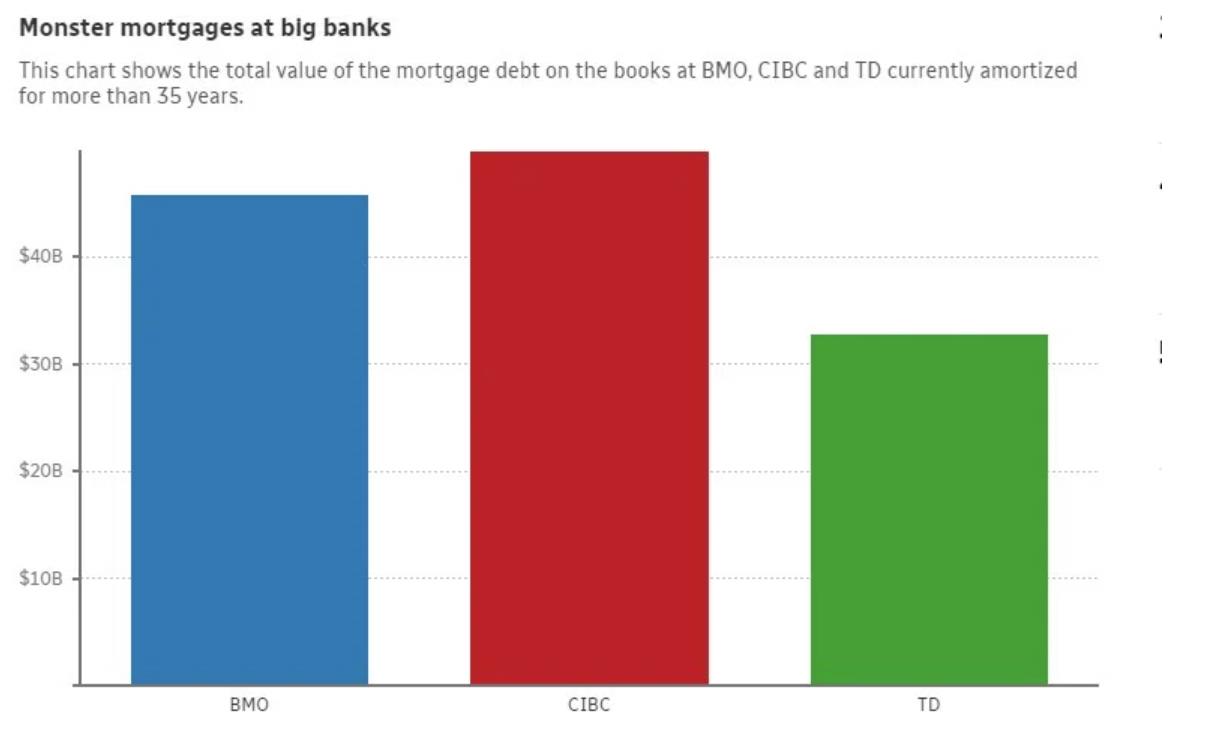

20% of mortgages at the big 3 Canadian banks are now negatively amortizing. This means that 12% of Canada’s total mortgage debt is amortized for 35 years or longer (instead of the standard 25 years).

Read more here: https://www.cbc.ca/news/business/mortgage-negative-amortization-1.6986214