How much should you save for retirement? There are no perfect answers – and lots of wrong ones. Before deciding how much to save, ask these 4 questions …

From Peter Reagan for Birch Gold Group | Reading time: 6 minutes

It’s the eternal question for Americans who hope to stop working one day: “How much should I save before I retire?”

The problem with the question, there are so many different answers it’ll make your head spin.

Let’s take three (of many) examples to illustrate this:

First, you might consider the popular “4% rule,” which was summarized on Investopedia along standard assumptions:

For an income of $80,000, you would need a retirement nest egg of about $2 million ($80,000 /0.04). This strategy assumes a 5% return on investments, after taxes and inflation, no additional retirement income, such as Social Security, and a lifestyle similar to the one you would be living at the time you retire.

In general, the 4% rule assumes that you will live for 30 years in retirement.

That’s a lot of assumptions... For example, your life span could be longer or shorter, and inflation might eat up the returns that you’re getting.

Next, you might consider saving ten times your pre-retirement income by retirement age, like Fidelity suggests:

We estimate that saving 10x (times) your pre-retirement income by age 67, together with other steps, should help ensure that you have enough income to maintain your current lifestyle in retirement. That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60.

That’s it! What are the numbers based on? No idea!

Finally, you could just give up on planning and do your best:

“Because there are so many variables, even the retirement researchers can’t agree on a total dollar amount,” says Ben Storey, director of Retirement Research & Insights at Bank of America. “What each person needs will vary based on a number of factors.” These factors include your current age; the age at which you plan to retire or could be forced to retire due to health, the loss of a job or other circumstances beyond your control; how long you expect to live based on family history; how much you plan to spend in retirement; and what your sources of retirement income will be.

I’m not trying to intimidate you with all this. Rather, I’m trying to explain there aren’t any hard and fast rules.

How much to save for retirement is up to you. The decision is based on how you want to live after you stop working. Maybe you have modest dreams, or maybe you plan to travel the world? Either way, your needs will vary.

Maybe picking a “magic number” to work toward is thinking about retirement the wrong way.

You must account for these 4 unavoidable factors

Like Coach Mac always said, “Failing to plan is planning to fail.”

If we don’t consider these absolutely unavoidable factors in our retirement planning, we’re setting ourselves up for disappointment.

Factor #1 – Taxes

Various forms of taxes are the first factor that can slow (or even stop) the best retirement savings plans. According to Kiplinger, it’s getting harder to keep up with the tax situation in the United States:

The tax situation in our country is always changing, due in part to our national debt, which is more than $33 trillion, according to the Treasury Department. And when our country is in debt, the tax rate will change because the only way to increase revenue is to raise taxes.

So those saving for retirement might defer all their taxes now only to find out that they’ll pay more in taxes when they start pulling funds from their retirement accounts.

You can tell the article is more than a couple months old, because they say the debt is only $33 trillion!

Regardless, the point is taxes will likely be higher in the future than they are today. And it won’t matter much who you vote for, higher taxes are likely to be a problem for quite some time.

You might be paying them longer, too…

Factor #2 – Planning for a longer life

Even if you manage to keep a good grasp of the ever-changing tax laws, you could outlive your retirement nest egg if you’re not careful.

According to U.S. News, financial planners are penciling in 100 years as the typical lifespan:

A 65-year-old can expect to live another 19 to 21.5 years, on average, according to the Social Security Administration. What’s more, the government agency says a third of 65-year-olds will hit age 90, and 1 in 7 will live beyond age 95.

Those numbers show a significant improvement in life expectancy over time. In 1960, for instance, a 65-year-old man was only expected to live an average of 13 more years while a 65-year-old woman had an average remaining life expectancy of 17 years.

Financial planners have taken note of the trend and adjusted their guidance and savings plans accordingly. “It’s not odd in this day and age for someone to live to 100,” says Wendy Terrill, retirement planner and owner of financial firm Assurance & Guarantee in Burlington, North Carolina.

Let’s say you have a good grasp of the tax situation, and think you have saved enough to enjoy retirement until you’re 100 years old.

First, congratulations!

Second, I really hope you accounted for the next factor appropriately…

Factor #3 – Inflation

Inflation has always been considered the “tax that no one voted for.” That’s because it could have a severe impact on even the best financial plans, and it’s virtually impossible to avoid.

Here’s an extract that explains the importance of accounting for inflation:

The inflation rate affects how much your retirement savings will really be worth years from now. Over time, it can seriously devalue your savings and reduce your income. Factoring inflation into your retirement strategy is key to a workable financial plan for the future.

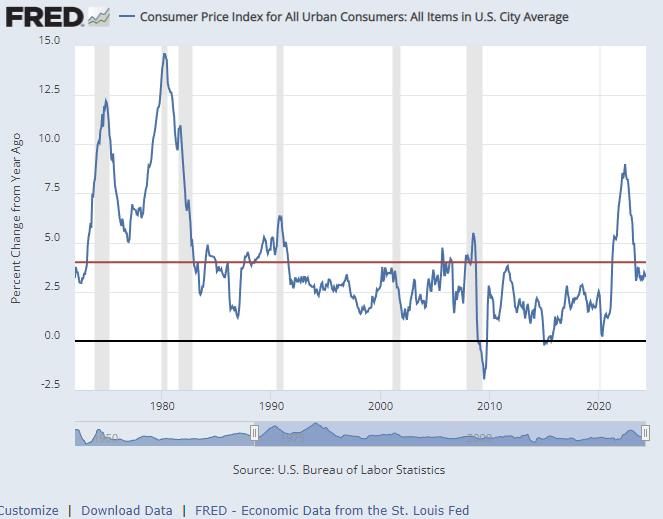

Let’s take a look at the official Consumer Price Index (CPI) chart:

Official U.S. inflation rates have been:

- An average of 4% over the last 50 years (the red line in the chart above)

- As high as 14.6%

- As low as -2%

Over the last 50-plus years (January 1972-May 2024) encompassing 629 months, inflation has been:

- Above the Fed’s 2% target for 488 months or 83% of the time

- Below the Fed’s target for 141 months or 22% of the time

- Negative (increasing the purchasing power of the dollar) for just 12 months (2% of the time)

That 2% target, as you can see from the data, is obviously a difficult target to hit. And the Fed does a much better job at destroying purchasing power than preserving it…

Put simply, no matter what investment vehicle you might choose, any dollars you’re saving are guaranteed to lose purchasing power!

That’s why I feel confident in saying your dollars are “guaranteed” to lose purchasing power. That’s a major part of the Federal Reserve’s mission! To destroy your purchasing power at a 2% annual rate.

Which makes planning for future prices a challenge. Maybe the best approach is to assume the average 3.3% inflation will hold true in the future? That’s at least a place to start.

Even if you have inflation accurately forecast in your plan, there’s another factor you’d be wise to consider…

Factor #4 – Economic volatility

Paul Kelash, vice president of Consumer Insights for Allianz Life Insurance Company of North America said the following about economic volatility:

While we see some increasing comfort with volatility, it is driving a simmering anxiety in many Americans – especially as it concerns their retirement savings. More than one third of respondents admit recent volatility is making them anxious about their nest egg [because] there is no way they could rebuild their savings in time for retirement.

A well-diversified retirement savings plan limits your exposure to volatility without sacrificing growth in good economic times – and also offering protection during recessions and crises.

Unfortunately, most financial assets perform best when the entire economy is booming. Only a very few assets truly offer protection from economic downturns.

The bottom line

The truth is, unless you’re already incredibly wealthy (if so why are you reading this?), no matter how much you save for retirement, any of these four factors could radically change your plans.

Now let’s discuss one potential solution…

Future-proof, tax-friendly assets with built-in inflation resistance and downside protection

Being aware of these factors is a good starting point.

So what are we going to do about it?

Let’s consider one asset class that meets those requirements: Physical precious metals.

- If you live to be 100: You know that investing fads come and go. Gold has always been considered money, so it’s reasonable to assume it won’t go out of style or drop to zero.

- Physical gold consistently outperforms inflation. The track record here is quite clear:

- Physical gold is countercyclical. That means it tends to outperform in the worst economic times. Think about it – in times of crisis, when the world’s on fire, what’s the one asset everyone wants? Gold. Thanks to diverse sources of demand, gold can do well under virtually every economic condition:

- You can also save on taxes. By diversifying your retirement savings between before-tax and after-tax accounts, you can decide whether you’d prefer to pay your taxes up-front at today’s rates – or roll the dice on future tax brackets and rates. (Learn more on our tax education page.)

Yes, planning for retirement is complicated. It’s like that old Japanese saying:

There’s only one path to wealth. But there are many, many roads to poverty.

…and nobody has a map.

The stakes are high! Like we discussed, there’s no one right answer for everyone. There are, unfortunately, an almost infinite number of wrong answers.

I encourage you to learn more about the benefits of diversification, what Nobel Prize-winning Harry Markowitz called “the only free lunch in investing.” That’s because diversification allows you to “limit your losses and reduce the fluctuations of investment returns without sacrificing too much potential gain.”

Diversifying with inflation-resistant, countercyclical and always-popular physical precious metals seems like a no-brainer to me. But is it right for you? Learn more here.