These buyers made a huge financial mistake and eventually they face a choice:

Either suck it up and keep paying the mortgage for 30 years, get foreclosed on, or just decide to walk away from the house.

People bought houses they couldn’t afford.

This is how we got here. https://t.co/7xxM0rEPPp

— QE Infinity (@StealthQE4) November 19, 2024

With mortgage delinquencies rising fast, 2025 looks like it's going to be a rough year for home prices

Analyst Melody Wright @m3_melody expects to see a big drop in avg national prices, followed by several more years of declines https://t.co/9xaIPpBRRs pic.twitter.com/WVoeUQFnr7

— Adam Taggart (@menlobear) November 19, 2024

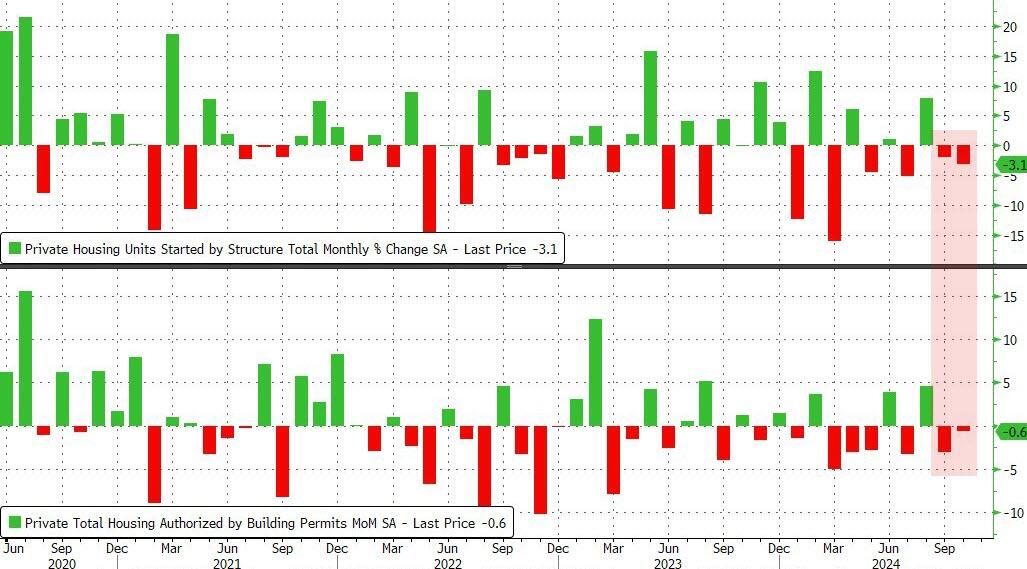

US Housing Starts & Building Permits Slump Back Near COVID Lockdown Levels

US Housing Starts and Building Permits disappointed in October with the former dropping 3.1% MoM (-1.5% exp) and -0.6% MoM (+0.7% exp) respectively. This is the second straight month of declines for both measures of housing activity…

Source: Bloomberg

Housing is on the precipice, while $LOW just reported a 13% decline in sales (YoY).

“Housing is the business cycle”

– Edward Leamer (2007)

Chart: @MacroEdgeRes pic.twitter.com/EEI3fh3J4V

— Kalani o Māui (@MauiBoyMacro) November 19, 2024

like 07 lol https://t.co/ZTgvZxGX7V

— Darth Powell (@VladTheInflator) November 19, 2024

#recession … #GFC2 US #Housing Bubble 2.0 edition https://t.co/wwSxBU8lSH

— Invariant Perspective (@InvariantPersp1) November 19, 2024

Looser financial conditions, The Fed cutting rates, and inflation on the move higher — I wonder what the future holds. #FiatAlternatives for the win!

— Charts and Parts (@chartsandparts) November 19, 2024

1,186 views