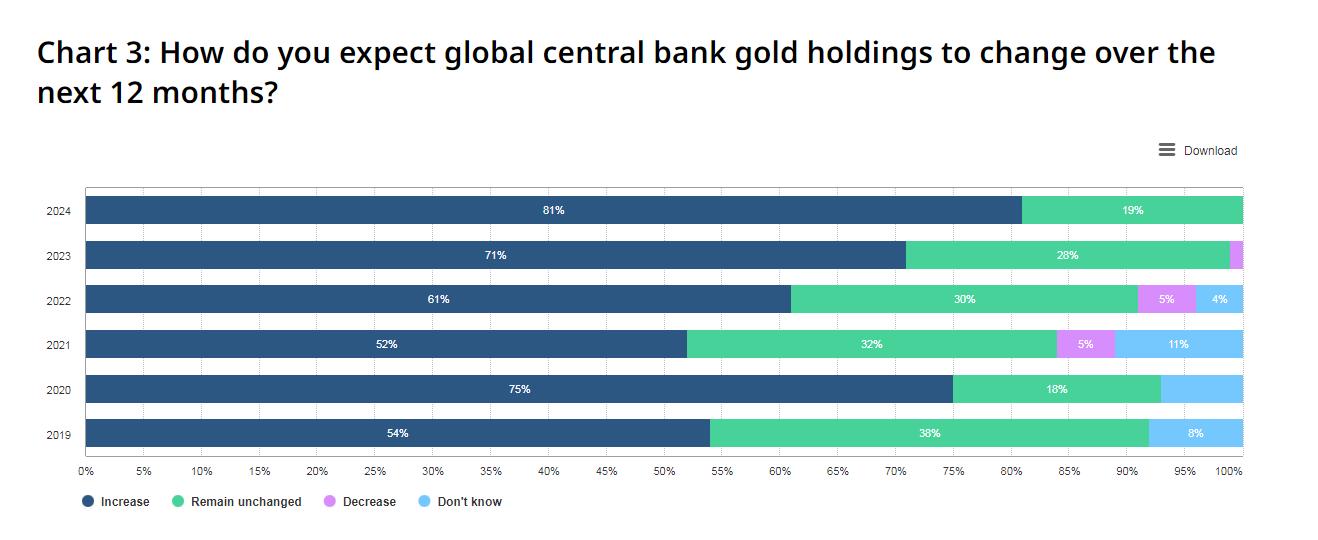

The 2024 Central Bank Gold Reserves (CBGR) survey conducted by the World Gold Council reveals that 29% of central bank respondents plan to increase their gold reserves in the next twelve months. This is the highest level observed since the survey began in 2018. The motivations behind these planned purchases include a desire to rebalance gold holdings, domestic gold production, and concerns related to financial markets, including higher crisis risks and rising inflation. It’s interesting to see how central banks continue to view gold favorably as a reserve asset in an increasingly complex geopolitical and financial environment.

“According to the 2024 Central Bank Gold Reserves (CBGR) survey, 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018.”https://t.co/MJHe8xocUz pic.twitter.com/zRkZPonIBL

— Jan Nieuwenhuijs (@JanGold_) June 18, 2024

183 views