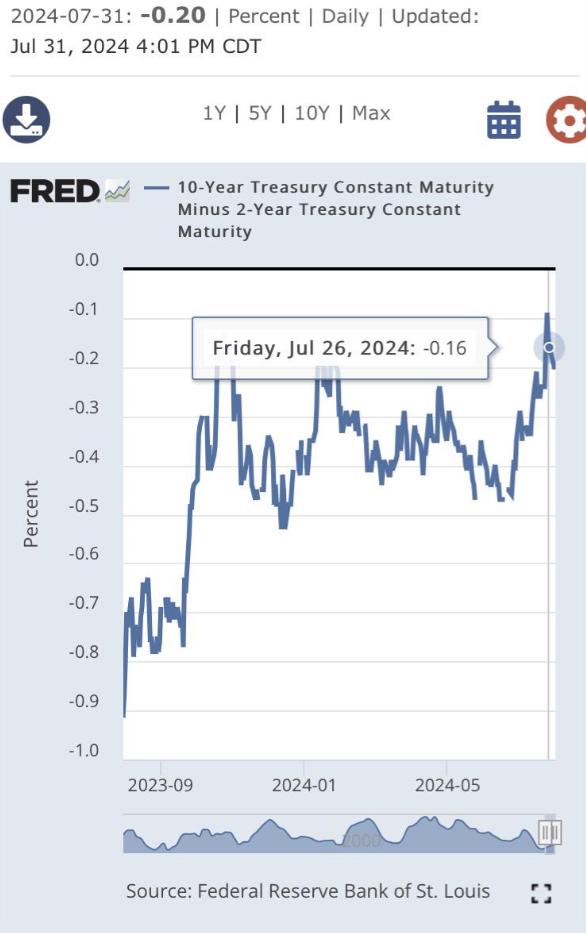

The yield on the 10-year Treasury note is about to surpass the yield on the 2-year Treasury note, reversing the previous condition where the 2-year yield was higher than the 10-year yield.

Implications:

- Economic Sentiment Shift: An inverted yield curve (where short-term yields are higher than long-term yields) often signals a lack of confidence in the economy’s short-term outlook and can be a precursor to a recession. An un-inversion suggests improving economic sentiment.

- Changing Interest Rate Expectations: The shift might indicate that investors expect interest rates to stabilize or fall in the future, reflecting changing expectations about the Federal Reserve’s monetary policy.

- Market Impact: An un-inverting yield curve can affect various financial markets, including stocks and bonds, potentially reducing the perceived risk of recession and leading to increased investor confidence.

h/t zulufux999