In US BLS numbers for Q3 (published end April) should have been the wake-up call, but everyone still asleep at the wheel. 190k jobs destroyed over Q3 (600 k creations were expected from nfp surveys). Talking about hard data…

— Manu (@SolalM) June 11, 2024

Global labor market slowdown is underway

UK Claimant claims largest monthly jump since GFC (ex-COVID), unemployment up to 4.4%, -140K employment change

BoE likely to cut on this data. #MacroEdge pic.twitter.com/foE3yLCVNT

— Don Johnson (@DonMiami3) June 11, 2024

Look at the widening spread dislocation .

Something is about to break. pic.twitter.com/nUj6J95xO9

— The Great Martis (@great_martis) June 11, 2024

1) SLOWING GDP GROWTH AT 1.3% IN Q1

2) MEDIAN HOME PRICES AT ALL-TIME HIGH OF $434K

3) 37 MONTHS OF INFLATION ABOVE 3%

4) $2 trillion deficits

5) $34.6 trillion NATIONAL DEBT – record

6) 600k full-time jobs lost in the last 12 mths

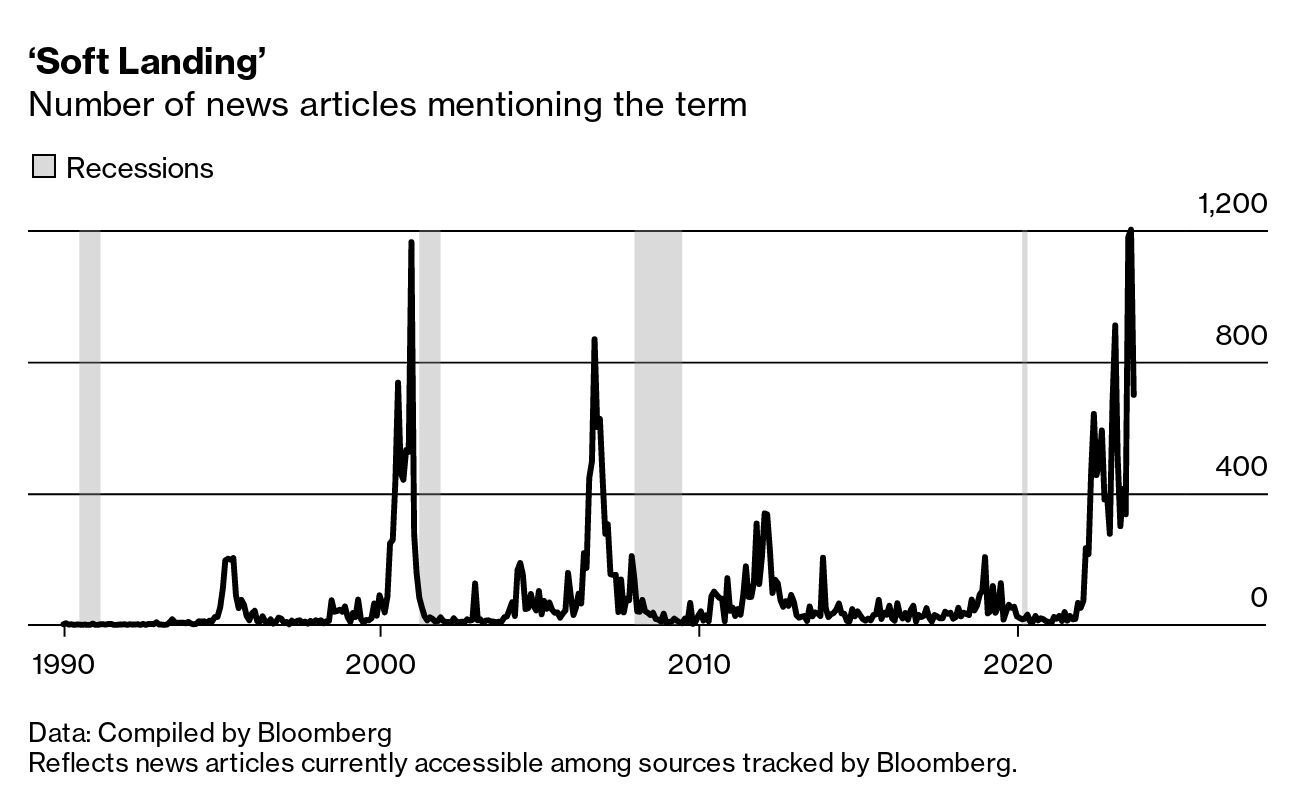

“Soft landing” is a term widely used in financial markets and economics meaning a period of rising interest rates and tightening financial conditions that does not end up with even a quarter of negative economic growth. In other words, an interest rates hiking cycle conducted by a central bank without causing a recession. Soft landing is an implicit goal of every central bank during each economic cycle. In the past, however, in the US, the Fed has not been successful in reaching such a goal. The chart below presents more than 40 years of quarterly GDP growth and the interest rate level in the country.

NEW: 🇺🇸 U.S. Senator Elizabeth Warren asks Fed Chair Jerome Powell to CUT rates 👀 pic.twitter.com/q0ihg8CoJm

— Win Smart, CFA (@WinfieldSmart) June 11, 2024