Our nation’s debt has grown from a merely economic challenge to a national security threat. Here’s why this much debt makes America less safe…

From Peter Reagan for Birch Gold Group

We’ve published more than a few articles about how the national debt makes our lives more difficult and diminishes the dollar’s purchasing power.

But as we’ll cover in this article, the insane level of debt that the United States is carrying right now ($34.8 trillion) also poses a dangerous national security risk.

In fact, Congress approved a resolution back in March declaring exactly that, according to a report by Reason Magazine:

The Senate unanimously approved a resolution on Wednesday calling the debt “a threat to the national security of the United States” and calling expected future budget deficits “unsustainable, irresponsible, and dangerous.”

And the approval of that resolution was timely. Later on Wednesday, the Congressional Budget Office (CBO) published its latest long-term budget projections. The report shows that annual budget deficits are on pace to grow from an expected $1.6 trillion this year to $2.6 trillion in 2034, $4.4 trillion in 2044, and $7.3 trillion in 2054.

Then the same piece also gave a 30,000-foot overview of the danger that carrying such extreme amounts of national debt could pose:

The CBO does not account for the possibility of recessions, natural disasters, wars, or other unpredictable events that could cause the federal government to borrow more heavily than current law expects. The past 30 years have included 9/11, the war on terror, the Great Recession, and the COVID-19 pandemic, so it seems pretty likely that the next three decades will include at least a few emergencies that drive deficits higher.

Namely, that any emergency would necessitate even more spending, which according to the CBO, would pose an even higher national security risk now.

But it gets worse…

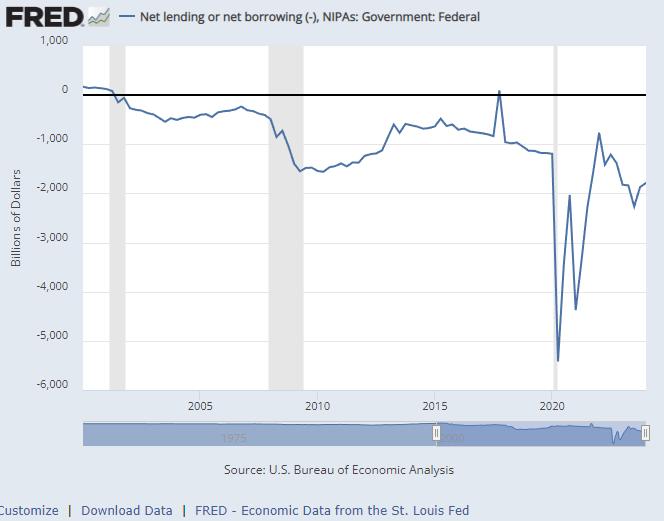

It appears like the United States has also been in a “net borrowing” situation for most of the last 22 years. This accounts for all government receipts, and subtracts all expenditures (including interest payments).

A picture is better than a thousand words in this case:

So in addition to piling up debt, the United States economy has been operating “in the red.” There is no economy in which this debt would reduce the national security risk.

It’s also quite odd that the corporate media and Chairman Jerome Powell haven’t addressed this net shortfall more often, especially in light of the CBO’s findings.

(Our 2021 piece actually covers the economic theory that underlies most of this inflationary debt spending spree, called Modern Monetary Theory.)

With all of the above in mind, let’s dive into the debt’s potential impact on national security in this country.

“Peace through strength” only works if you can afford it

Former Trump advisor Robert C. O’Brien recently took to Foreign Affairs to make the case for a global guiding philosophy called “peace through strength”:

U.S. President George Washington understood this well. “If we desire to secure peace, one of the most powerful instruments of our rising prosperity, it must be known that we are at all times ready for war,” he told Congress in 1793. The idea was echoed in President Theodore Roosevelt’s famous dictum: “Speak softly, and carry a big stick.”

In the same piece, O’Brien also briefly summarized a few of Trump’s foreign policy accomplishments during his first term:

In the Trump years, Russia did not press further forward after its 2014 invasion of Ukraine, Iran did not dare to directly attack Israel, and North Korea stopped testing nuclear weapons after a combination of diplomatic outreach and a U.S. military show of force.

But unfortunately for O’Brien, it’s not 2017 anymore.

Thanks to the trillions of dollars in national debt that have piled over the last few years, can we even afford Roosevelt’s “big stick”?

Regardless of who becomes the next president of the U.S. they’ll have a much more challenging struggle with foreign policy, thanks to those piles of debt.

For example, according to O’Brien, the next president would likely have to deal with China:

The Chinese Communist Party seeks to expand its power and security by supplanting the United States as the global leader in technological development and innovation in critical areas such as electric vehicles, solar power, artificial intelligence, and quantum computing.

But if spending isn’t brought under control, and the debt reduced, China could see an opportunity to keep “supplanting the United States” on the global stage.

Especially since, according to O’Brien, the U.S. military appears to be coming up short, which would necessitate even more spending:

Meanwhile, O’Brien wrote, “the military increasingly lacks the tools it needs to defend the United States and its interests.” He pointed to the fact that the Navy now has fewer than 300 ships, compared with 592 at the end of the Reagan administration. O’Brien urges Congress and the administration to “recommit” to the goal of a 355-ship Navy by 2032 – a goal he played a role in setting during the Trump administration.

He also urged investing more in developing hypersonic missiles – which he specifically said a second Trump term would pursue – fixing the Pentagon’s clunky requirements and acquisition systems, and working more closely with “nimble newer defense suppliers” such as Anduril and Palantir.

In fairness, O’Brien has also acknowledged that more cautious spending would be needed in a recent quote:

“Thanks to unsustainable levels of borrowing, the federal budget will have to decline, and large increases to defense expenditures are unlikely regardless of which party controls the White House and Congress,” O’Brien wrote. “Spending smarter will have to substitute for spending more in a contemporary strategy of peace through strength.”

But in a May 2023 report published by the Foreign Policy Research Institute, it was discovered the proposed defense spending already might be coming up short:

The deal negotiated this past weekend includes a moderate defense spending increase, as proposed by President Joe Biden, leading to a projected $886.3 billion national security budget next year, marking a 3.3 percent increase from current levels. However, some Republicans, like Sen. Lindsey Graham, feel this increase is below inflation and insufficient.

The defense budget compromise may not adequately support modernization and maintenance of capabilities in the face of rising costs and global threats.

The article goes on to highlight the risks of the massive national debt:

If the United States were ever to hypothetically default on its debts, the consequences would extend beyond the economy, affecting U.S. military operations, the defense industry, and strategic alliances like NATO.

“Peace through bankruptcy” is not a winning strategy.

But “peace through strength” is not an affordable strategy.

The situation on the homefront isn’t looking much better

In a column published on The Hill website, you could already get the feeling that the cracks in the National Security dam were beginning to show:

When it comes to the entitlement black hole, unpaid-for promises America has made on entitlements, stretched out into the future, total up to $70 trillion.

Instead, America should focus on great-power competition, and building up our deterrence capabilities. We should refocus on domestic priorities. America’s current economic crisis demands such a refocus.

Here’s the problem: The United States can’t focus on “deterrence” or “domestic priorities” like Social Security entitlements very well, especially if the interest being paid to service the national debt ever takes up too much of the incoming revenue.

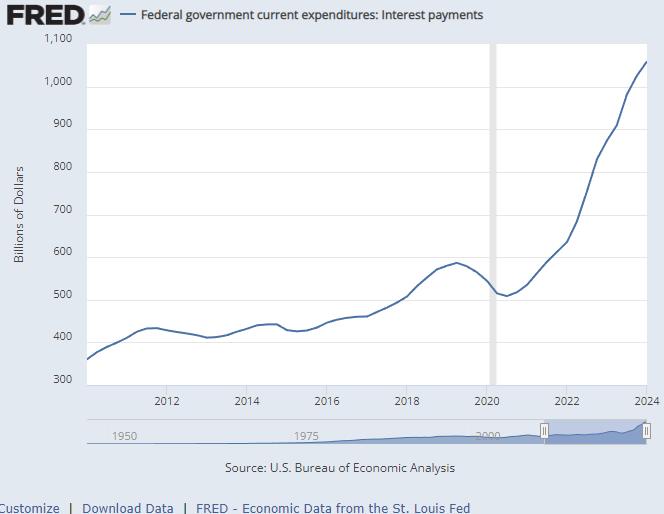

According to the official graph below, an incredible spike in debt service payments has already started to occur during the Biden administration:

According to the Committee for a Responsible Fiscal Budget in October 2023, interest payments on debt represented the fourth largest government spending. Only Social Security, Medicaid, and defense spending outranked it at the time.

That situation has probably gotten even more disproportionate since then, because according to that same CFRB report, interest payments were (and still are) the fastest-growing form of spending overall.

That puts United States defense in a weaker position domestically, which heightens the national security risk even further.

Other countries are probably paying close attention to this situation right now. So that means you should obviously keep an eye on it, too.

After all, it’s likely to get much worse before it gets better.

We can’t do much about national security, but we can improve our own financial security

Wartime brings more uncertainty and increased government spending, which as we just revealed, could threaten national security. The ongoing geopolitical turmoil, caused at least in part by the Russia and Gaza wars, are driving massive demand for safe-haven assets like gold.

With persistent demand from central banks and individual investors, gold’s price moves north. If the wars in Ukraine or the Middle East continue (or escalate further), we can only expect the demand to remain strong until the dust settles and turmoil is replaced by more stable times.

The good news is, you have an opportunity to consider physical precious metals before demand goes up, and the price rises again.

So go ahead and take a moment to learn about the benefits of owning precious metals like gold and silver. They both could provide some stability and a firm foundation for your savings, no matter how bad things get.

At the same time, you could also put yourself in a better financial position for the future through proper diversification of your hard-earned dollars.